As a seasoned researcher with over two decades of experience in the crypto market, I have witnessed countless bull runs and corrections. The current situation with BNB is no exception. While it’s always exciting to see new all-time highs, the subsequent downtrend can be a bit disheartening.

On December 4, the price of BNB hit a record peak, but it’s currently showing signs of a downtrend according to various technical analysis tools. The significant increase in BNB’s ADX from 12 to 31 indicates that bearish momentum is growing stronger, possibly predicting further declines in the near future.

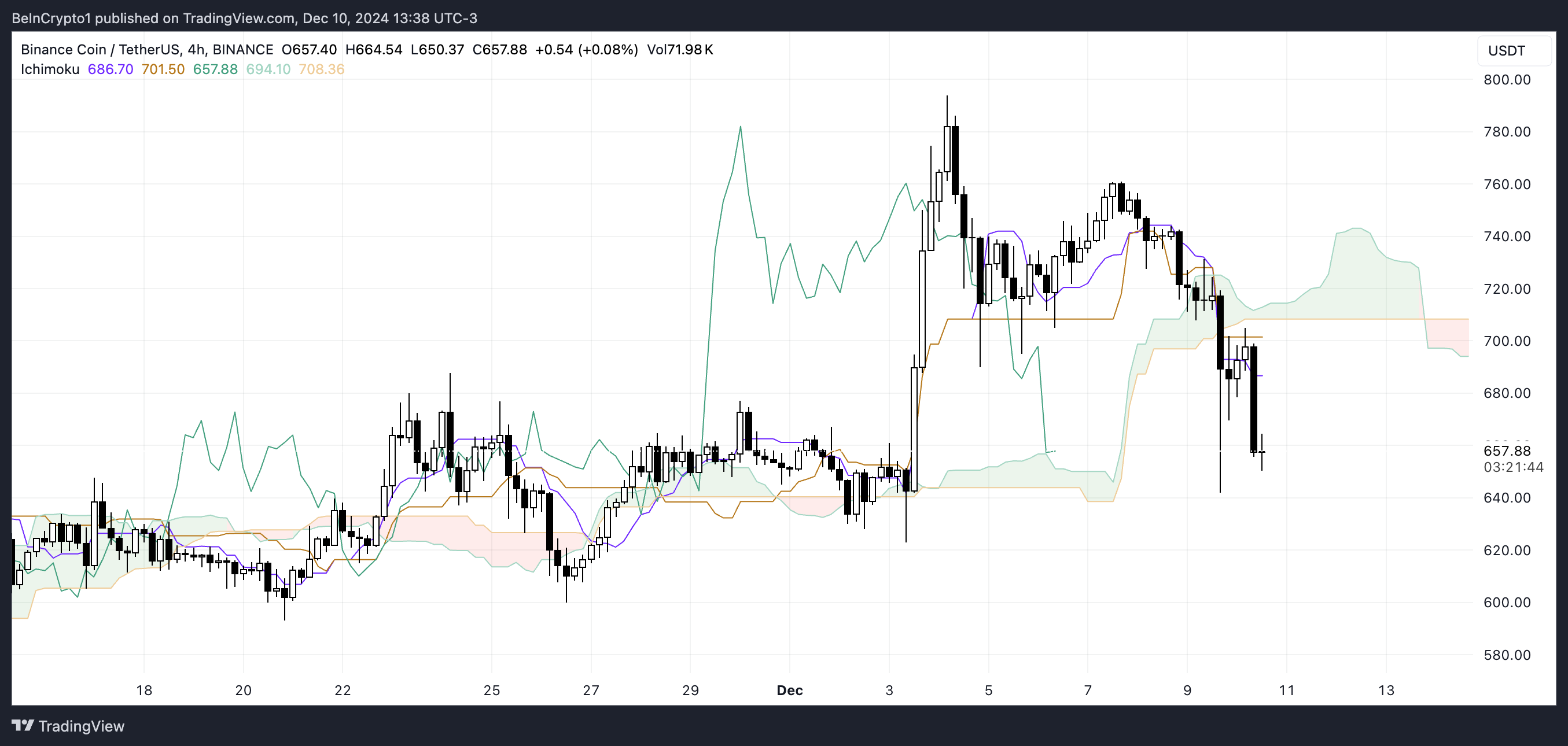

At present, the cost is under the Ichimoku Cloud, and there are signs of diminishing bullish momentum along with an increase in downward selling force. If this pattern persists, it’s possible that BNB could face additional adjustments, potentially reaching lower resistance points within the near future.

BNB Current Downtrend Indicates More Corrections Ahead

The ADX (a measure of trend strength) for BNB has significantly climbed to 31 from 12 within the past day, signaling an intensifying trend. This rise in ADX implies that the direction of the trend is growing clearer, and values above 25 usually suggest a robust trend.

Given that BNB’s current price pattern shows a decline, an increasing ADX suggests that the negative momentum is growing stronger. If this trend persists, the price may face additional downward movement.

As a dedicated researcher, I find that the Average Directional Index (ADX) serves as an invaluable tool for assessing the strength of a market trend, whether it’s moving upwards (bullish) or downwards (bearish). When the ADX value surpasses 25, it points towards a robust trend, while figures below 20 imply weak or undefined trends.

With the ADX of BNB standing at 31, it suggests that the current downward trend is becoming more pronounced. In the absence of a turnaround, there’s a high likelihood of persistent selling force in the near future.

BNB Ichimoku Cloud Shows Bearish Signals

right now, the price of BNB is sitting beneath the Ichimoku Cloud, which indicates a potential downtrend or bear market. Additionally, the green span line within the cloud seems to be narrowing and losing energy, while the base span lines seem to be leveling off.

This situation suggests a potential downturn in the upward trend, as any recovery attempt might encounter resistance as it attempts to break through the ceiling. Moreover, a drop beneath the ceiling indicates escalating selling activity that may drive the price lower for a brief period.

Based on the chart’s indicator lines, it appears that the blue line (Tenkan-sen) is situated below the red line (Kijun-sen). This implies a prevailing bearish trend since the faster moving Tenkan-sen is under the slower Kijun-sen. The distance between them indicates that the downward momentum is intensifying as the quicker line remains lower than the slower one, suggesting a strengthening downtrend.

The reddish hue of the cloud suggests a pessimistic trend, as it reflects a bearish outlook on the market’s mood. If BNB cannot surpass this cloud, it might encounter more selling, potentially causing its value to approach nearby resistance zones in the coming days.

BNB Price Prediction: Can BNB Fall Below $600 In December?

When the BNB Exponential Moving Averages (EMA) form what’s known as a “death cross,” it typically signals a bearish trend. This happens when the short-term EMA line moves below the longer-term EMA lines. This technical pattern is often interpreted as a sign of decreasing bullish power, suggesting that Binance Coin (BNB) might experience additional price drops.

As an analyst, I’m observing a potential persistence in the current downtrend for BNB. If the $647 support doesn’t withstand the pressure, we could witness a more substantial drop. This descent might lead us to test the resistance-turned-support levels at $622 and even $593. These points are crucial as they represent strong areas where the market may find temporary stability, offering insights into the resilience of the downtrend and the likelihood of additional price decreases.

Should the prevailing market mood change and a uptrend ensues instead, the BNB price might find a supportive base at approximately $647. From there, it may attempt to break through the resistance at around $687.

If BNB manages to surpass its current level, it might indicate a shift from the ongoing downtrend, potentially allowing BNB to challenge higher prices, including the $761 resistance barrier.

Read More

- 30 Best Couple/Wife Swap Movies You Need to See

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- PENGU PREDICTION. PENGU cryptocurrency

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- The Last Of Us Season 2 Drops New Trailer: Premiers April On Max

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- ANDOR Recasts a Major STAR WARS Character for Season 2

- In Conversation With The Weeknd and Jenna Ortega

- Scarlett Johansson’s Directorial Debut Eleanor The Great to Premiere at 2025 Cannes Film Festival; All We Know About Film

- All Hidden Achievements in Atomfall: How to Unlock Every Secret Milestone

2024-12-11 02:13