As a researcher with years of experience in the crypto market, I have seen my fair share of rollercoaster rides. While BNB‘s current position above $600 is commendable, the lack of significant price increase and reduced volatility has left me feeling like a kid on a merry-go-round that just keeps spinning without moving forward – fun but not exactly fulfilling the promise of progress.

Since the 8th of November, Binance Coin (BNB) has maintained a position above the $600 mark. However, it’s been finding it difficult to reach or even approach the $700 level, which is close to its record high.

The prolonged lack of growth has caused discontent among numerous Binance Coin (BNB) owners, leading one to wonder if BNB might attain a fresh high point.

Binance Coin Experiences Low Volatility, Falling Interest

As a crypto investor, I’ve noticed that BNB is currently trading at roughly $612, and the volatile nature around this price point seems to be preventing a significant upward trend. Despite staying above the $600 mark, I can see that it hasn’t yet made another substantial price jump.

Describing an asset as volatile implies that its value undergoes substantial changes in a brief period. Such instability suggests increased risk because of the unforeseen price fluctuations, yet it can potentially yield more significant returns.

In my analysis, when purchasing activity intensifies amid heightened market volatility, it’s likely that the asset’s value could experience a substantial rise. Conversely, if this volatility coincides with strong selling pressure, the price may dramatically decline.

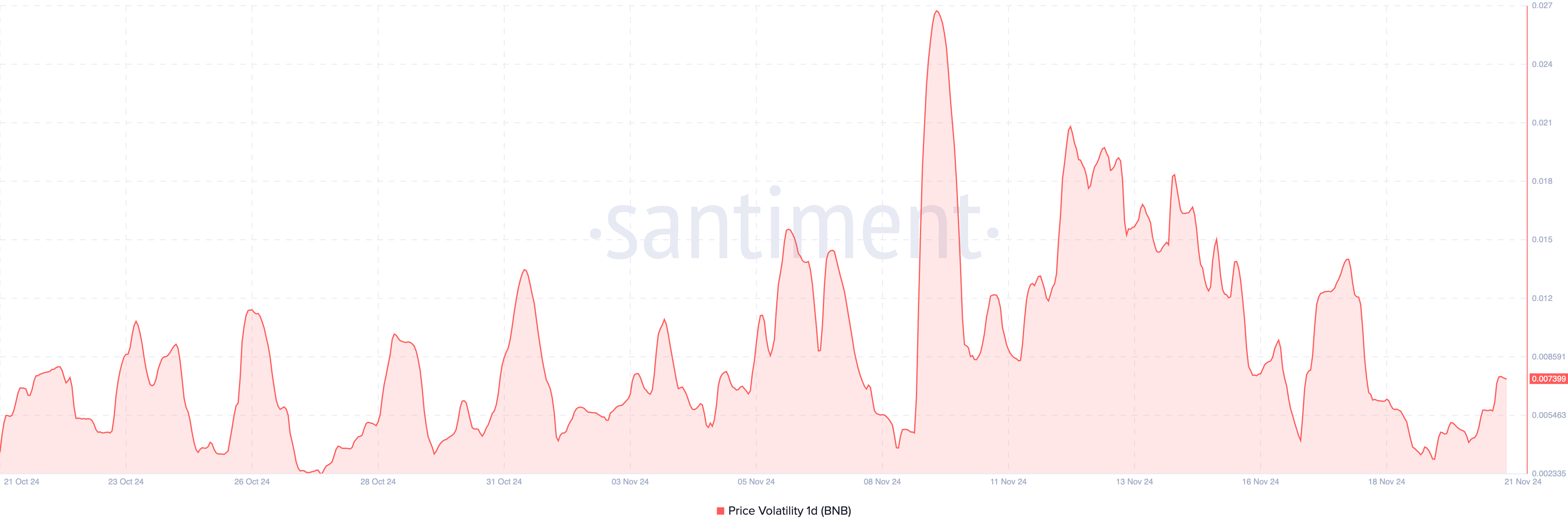

Based on Santiment’s analysis, the one-day volatility of BNB has lessened from its highest point, indicating potential decreased price swings. This decrease in volatility might make it challenging for BNB to surge past the $600 mark noticeably, as the market seems to be lacking the drive necessary for a substantial jump due to insufficient momentum.

Moreover, it’s worth noting that the Open Interest (OI), which measures the amount of ongoing speculation related to a particular cryptocurrency, has decreased. Typically, high levels of OI suggest substantial investments being poured into contracts, usually an indicator of significant buying pressure that can potentially boost prices.

From my perspective as an analyst, a decrease in Open Interest (OI) suggests less market liquidity, which can be linked to selling pressure and potentially forthcoming price drops. In the case of BNB, the OI has been fairly stable since November 19, implying that traders are reluctant to add more liquidity or engage in new contracts, suggesting a cautious approach towards this asset.

As a crypto investor, I’ve noticed that the Open Interest (OI) is significantly lower at around $532 million compared to November 14. This diminished speculative activity suggests a slowdown in market momentum. Consequently, it seems plausible that the price of BNB might find it challenging to surpass the $600 mark.

BNB Price Prediction: Drop to $551 Likely

Just like Open Interest, the price of BNB has been on a steady path since July, often encountering a barrier at roughly $612. This repeated resistance suggests that bears have consistently tried to impede the cryptocurrency from surpassing its previous record high of $724.

At present, since BNB trade is approaching a similar resistance point, a potential drop may occur. Looking at past trends, if the token cannot surpass this level, there’s a chance it might retreat back to around $551, a figure it has returned to before.

Just like Open Interest, BNB’s price has maintained a steady pattern since July, often encountering resistance near the $612 mark. This suggests repeated attempts by sellers (bears) to halt BNB from approaching its record high of $724.

As a crypto investor, I find myself cautiously optimistic about the current price trend of BNB. Despite the usual market volatility, I see a significant buying pressure emerging. If this persists, it could potentially overturn my current outlook and propel BNB beyond $600. In fact, it might even aim for $660 or challenge the previous high of $724.

Read More

- 30 Best Couple/Wife Swap Movies You Need to See

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- USD ILS PREDICTION

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- The Last Of Us Season 2 Drops New Trailer: Premiers April On Max

- PENGU PREDICTION. PENGU cryptocurrency

- Everything We Know About DOCTOR WHO Season 2

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Tyla’s New Breath Me Music Video Explores the Depths of Romantic Connection

- Save or Doom Solace Keep? The Shocking Choice in Avowed!

2024-11-21 16:10