Alright, settle in, folks. We’re talkin’ Bloom Energy (BE +7.42%). Now, these aren’t your grandma’s tulips, see? They build these… well, let’s call ’em giant, boxy power plants. They take fuel – natural gas, mostly, but they’re workin’ on biogas, bless their hearts – and turn it into electricity. No combustion, no fuss, just pure, electrochemical magic. Or, as the engineers say, “solid oxide fuel cells.” Sounds impressive, doesn’t it? Like somethin’ out of a Bond movie. The idea is businesses make their own juice on-site, rather than relyin’ on that rickety old grid. A grid, I might add, that’s older than my Aunt Mildred. And she remembers the invention of sliced bread.

Now, Bloom’s been fiddlin’ with these boxes for two decades, but the stock? Whew. It’s gone positively ballistic lately. Up 550% in the last year? That’s not a growth stock, that’s a rocket ship piloted by a caffeinated squirrel. And as of January 16th? Up 72% year-to-date. Folks, that’s enough to make a seasoned investor question reality. Which, naturally, is what I do for a livin’.

So, the question is, can this thing keep climbin’? Or are we lookin’ at a bubble bigger than a dirigible? Let’s dig in, shall we?

The Bull Case: Data Centers and a Really Old Grid

Here’s the deal: data centers. Those giant warehouses full of blinkin’ servers. They’re multiplyin’ like rabbits, and they gobble electricity. CNBC says over $60 billion went into buildin’ ’em in 2025 alone. And that old grid I mentioned? It’s about as equipped to handle that load as a horse-drawn carriage is to win the Indy 500. Frankly, it’s a disaster waitin’ to happen. Bloom Energy, naturally, wants to be the hero of this story. A sort of electrical knight in slightly boxy armor.

How? Well, Bloom’s servers generate power on-site. No reliance on the grid, no peak price gougin’, no blackouts. It’s modular, too. Need more power? Just add another box. Like buildin’ with Lego bricks, only much, much more expensive. And it’s fuel-flexible. Natural gas now, biogas later. Cleaner than burnin’ coal, which, let’s be honest, isn’t exactly settin’ the bar high.

They’re already gettin’ traction. Fortune 100 companies like Walmart, AT&T, and Verizon are customers. And data center giants like Equinix and Oracle are signin’ on. But the real kicker? A $5 billion partnership with Brookfield (BAM +1.42%) to power their “AI factories.” AI factories! It sounds like somethin’ out of a sci-fi movie. I expect robots to start demandin’ stock options any day now.

Bloom is Growin’, But Let’s Talk Valuation

2025 was a banner year for Bloom. Revenue up over 57% in the third quarter. Fourth straight quarter of record revenue. They even managed a gross margin of 29% and operating income of $7.8 million. That’s… progress. Slow, agonizing progress, but progress nonetheless.

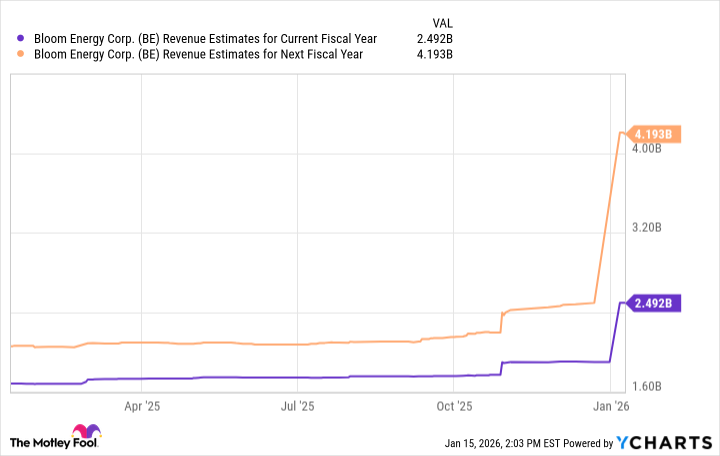

But here’s where things get tricky. The valuation. Oh, the valuation. A market cap of $31.5 billion. Trading at 153 times forward earnings and 48 times book value. Folks, that’s not a company, that’s a hope and a prayer. The average for the entire energy sector? About 17 times earnings and 2 times book value. Investors aren’t payin’ for what Bloom is today; they’re payin’ for what it might become. It’s like buyin’ a lottery ticket and expectin’ to win the jackpot.

Now, if data center construction stays strong and they keep landin’ big deals, that valuation could justify itself. The consensus estimates suggest revenue could nearly double next year. See the chart below. (Don’t stare at it too long, it might make your eyes cross.)

So, Does Bloom Energy Have Room to Run?

Bloom’s tradin’ at all-time highs. And while I think there’s still long-term potential, I expect growth to moderate in 2026. It’s not gonna keep goin’ up 550% a year. That’s just not sustainable. Unless they discover a way to power everything with rainbows and unicorn tears.

But Bloom does have somethin’ other novel energy companies lack: a deployable product. Customers can have these servers installed in under 50 days. That’s a big advantage over companies like Oklo and Nano Nuclear Energy, which are still years away from commercialization. Another big deal, and Bloom could hit even more record highs.

Just keep a long-term perspective. If you believe future electricity demand needs a novel solution, a small stake in Bloom could capture some upside over time. But remember: past performance is not indicative of future results. And always, always, do your own research. And maybe consult a psychic. Just in case.

Read More

- Gold Rate Forecast

- Top 15 Insanely Popular Android Games

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Silver Rate Forecast

- EUR UAH PREDICTION

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

2026-01-19 00:02