So, here we are. BLAST, launched in November 2023, showing up like the hot new restaurant in town. All that buzz, all that promise, and now? It’s like a bad breakup: full of memories but ultimately just a lot of regret. 😬 Let’s talk about this so-called “yield-bearing blockchain,” shall we?

What Makes BLAST Special – And Why That’s Both Fantastic and Completely Bonkers

Oh, look at BLAST! The first Layer 2 network that dangles automatic native yield in your face like a carrot. You don’t have to lock anything up, which sounds great until you realize it might just be a trap. Sure, you’re getting around 4% for ETH and 5% for stablecoins. But let’s not kid ourselves—a flashy marketing spiel doesn’t change the fact that it sometimes feels like a pyramid scheme with a fancy name. Who knew passive income could feel so… judgmental? 🏰

Sure, the sources are legit: Ethereum staking rewards and on-chain Treasury bills. But “too good to be true”? There’s a danger sign blazing with this one, folks.

skyrocketing, then plummeting like a lead balloon

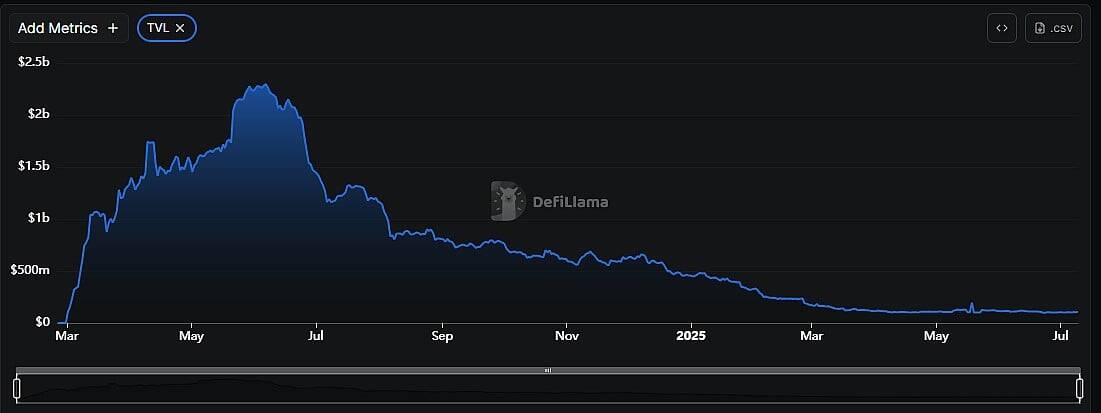

BLAST kicked things off with a bang, raking in more than $2.7 billion in Total Value Locked (TVL) in just six months. A real show-off move—like bringing a yacht to a beach party. But now? It’s down to $105 million. That’s a whopping 96% drop! Talk about losing the party favors.

This was once a crypto powerhouse…and now it’s having an identity crisis in the corner.

Daily users? They’ve vanished faster than a magician’s rabbit, dropping from 180,000 to a measly 3,800. While other chains like Base and Arbitrum are thriving, BLAST is somewhere in the depths of obscurity, licking its wounds after a disastrous token airdrop that left everyone feeling cheated.

Technical Brilliance vs. Trust Issues

And don’t get me wrong, the tech is impressive! 100,000 transactions per second? That’s great—if you’re trying to impress someone at a tech conference. But right now, all this engineering marvel can’t mask the governance issues lurking in the shadows. They’re relying on a 3-of-5 multi-signature wallet, making it feel as secure as a beach umbrella in a hurricane. 🎪

Even Dan Robinson from Paradigm—one of the guys who put money in—publicly tossed BLAST under the bus! “Problematic messaging,” he says. At least you can count on your friends to be honest… right? 🙄

The Bright Spot: Fantasy.top ➡️ Then a Big Cloud of Doubt

Now, let’s turn to the glimmer of hope: Fantasy.top! This little social trading card game raked in $11 million in ten days. Can you believe that? It’s like finding a $20 bill in your old jeans. 🔥 But, here’s the kicker: BLAST is getting pigeonholed into being all about gaming and “degen” culture. So much for serious DeFi, right? Maybe the founder just wanted to build a community of crypto gamers rather than actual investors. Take that, mainstream! 🙈

Problems Galore: Scams, Scandals, and General Shenanigans

The ecosystem’s not exactly winning any awards either. We’ve seen scams that would make a third-rate magician blush:

- RiskOnBlast pulled a rug and stole 500 ETH. Poof! 💸

- Super Sushi Samurai? Yeah, they got hit with $4.6 million in losses. Yikes!

- And let’s not forget ZachXBT, the blockchain investigator, who exposed organized fraud targeting this whole network. No thank you!

These incidents might not be about the core tech, but they certainly showcase a governance problem that’ll scare off any serious developers faster than a cockroach in a light bulb. 🚨

Wrap-Up: Innovation With a Side of Uncertainty

In the end, BLAST is the poster child for why hot tech alone won’t cut it. Sustainability needs more than just clever features and dazzling graphics; it needs governance, utility, and actual engagement. Sure, they’ve done some cool things, like the native yield and impressive tech, but with all these glaring issues and plummeting numbers? It feels like a panic sale at the local department store. Time will tell if they can turn it around, or if they’re destined for the crypto graveyard. 😅

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- ETH PREDICTION. ETH cryptocurrency

- 9 Video Games That Reshaped Our Moral Lens

- Games That Faced Bans in Countries Over Political Themes

- Gay Actors Who Are Notoriously Private About Their Lives

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

- USD PHP PREDICTION

2025-07-09 12:54