Bitcoin exchange-traded funds (ETFs) continue their unstoppable rise, with a jaw-dropping $321 million pouring in, thanks to the ever-mighty Blackrock and Fidelity. Meanwhile, ether ETFs finally shake off their gloomy streak with a modest $18 million inflow, courtesy of Blackrock’s lone efforts. The power of Blackrock: truly unmatchable. 🙄

Bitcoin ETFs Keep on Raking in Cash, Ether ETFs Try Not to Fall Behind

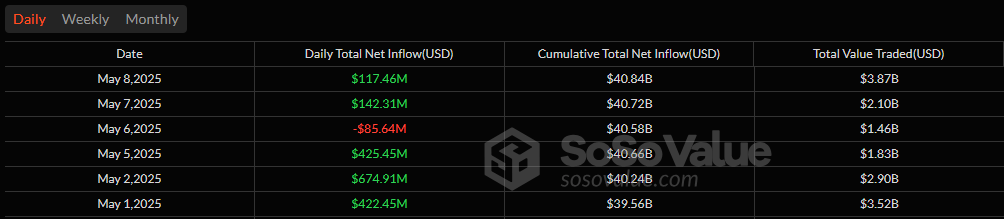

It’s another fine day in the land of ETFs, where Bitcoin remains king and ether…well, it’s trying its best. On May 9, the Bitcoin ETF market remained steadfast, with $321.46 million rolling in as though there were no tomorrow. The last day of the trading week? A record. Institutional confidence continues to run high like a runaway train, and no one’s stopping it. Not even Grayscale or Bitwise. 😏

Once again, Blackrock’s IBIT led the charge, sucking in an impressive $356.20 million, while Fidelity’s FBTC casually added another $45 million to the pot. The green wasn’t universal, of course. Grayscale’s GBTC saw a somewhat dramatic $65.16 million exit, while Bitwise’s BITB said farewell to $14.59 million. But hey, the gains still held firm. Who’s counting those outflows, anyway? 💸

Total trading volume hit $2.67 billion, because, why not? Net assets for bitcoin ETFs surged to a delightful $121.19 billion, marking the continued ascent of this digital asset class. It’s like a rocket shooting for the stars—no turbulence in sight. 🚀

As for ether ETFs, well, Blackrock’s ETHA added a humble $17.61 million to the mix, making it the lone savior of the ether world. After three straight days of outflows, this tiny inflow was enough to break the streak of losses. There were no other ether ETFs stepping up to the plate, but one is better than none, right? 🙄

Ether ETF volume surged to $620.39 million, and net assets climbed to $8.02 billion. It’s a decent rebound—though whether it’s enough to keep up with Bitcoin’s sky-high momentum is another story. 🤔

Bitcoin ETFs continue their relentless advance, while ether ETFs… well, they’re giving it their best shot. The digital asset ETF market seems to be rediscovering its footing. Will it last? Stay tuned! 👀

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Summer Game Fest 2025 schedule and streams: all event start times

2025-05-12 15:24