As a seasoned crypto investor with over two decades of experience in traditional finance and technology, I must admit that watching institutions like BlackRock and MicroStrategy dive headfirst into Bitcoin is nothing short of exhilarating.

BlackRock, known as the world’s biggest asset manager, has rapidly expanded its presence in the cryptocurrency market following the U.S. Securities and Exchange Commission’s (SEC) approval of several Bitcoin spot exchange-traded funds in January. Today, they control more than half a million Bitcoins.

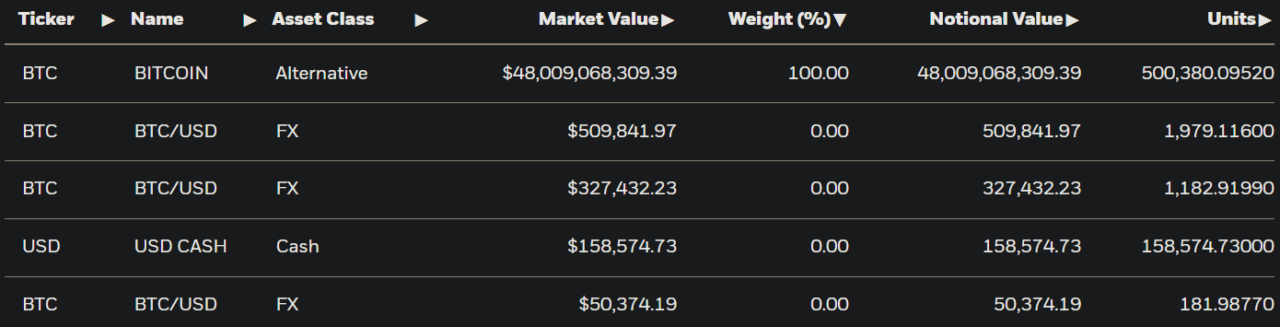

Based on information from their website, their Bitcoin ETF, iShares Bitcoin Trust ETF (IBIT), currently possesses approximately 500,380.09 Bitcoins. With a market value surpassing $48 billion, this makes IBIT one of the major cryptocurrency holders.

As a crypto investor, I find it noteworthy to point out that within barely a year, BlackRock has accumulated around 2.38% of all existing Bitcoins, marking a significant change in their perspective on this digital currency. Previously, CEO Larry Fink was known for his critical views, but now, he sees Bitcoin as an independent investment class with the potential to bring about transformative changes.

It’s worth noting that BlackRock’s IBIT doesn’t hold BTC for the firm directly, but rather for investors leveraging its fund to gain exposure to the flagship cryptocurrency. Some of these investors include clients of Wall Street giants, including Goldman Sachs.

According to a report by CryptoGlobe, MicroStrategy – the company with the most Bitcoin in its corporate holdings – just added another 15,400 Bitcoins to its stash at a cost of $1.5 billion, averaging approximately $96,000 per coin. This latest purchase pushes their total Bitcoin holdings above 402,000 coins.

As a crypto investor, I’m excited to share some impressive numbers from MicroStrategy’s Bitcoin journey this year. According to Michael Saylor, the co-founder and chairman of the company, we’ve seen a staggering 38.7% BTC yield so far in 2021, with a whopping 63.3% return year-to-date! This is based on the 402,100 BTC that MicroStrategy has amassed, which were purchased for a staggering $23.4 billion. Impressive, isn’t it?

The business has purchased Bitcoin on average for around $58,263 per coin, and its total Bitcoin holdings currently have a value of approximately $37.4 billion.

At this point, significant investors (Bitcoin whales) have seized the opportunity presented by Bitcoin’s recent price drop to continue amassing more BTC. This is because short-term holders have transferred approximately $4 billion worth of Bitcoin to exchanges.

Based on insights from CryptoQuant analyst Cauê Oliveira, large Bitcoin investors (or “whales”) seized the opportunity presented by widespread selling due to fear (referred to as “panic selling”), amassing approximately 16,000 Bitcoins valued at around $1.5 billion within a day. These additions were deposited into their holding reserves, following significant sales made by short-term holders.

In the post, the analyst pointed out that the given data could be observed in institutional wallets connected to the network. However, they implied that there might have been additional Bitcoin accumulation because the coins left in individual user accounts on cryptocurrency exchanges were not included in the count.

According to what he said, the number of whales (large investors) buying during market dips hasn’t been large enough yet to suggest a common trend across the market. He noted that this behavior seems to be mainly confined to institutional investors at the moment.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- Elder Scrolls Oblivion: Best Battlemage Build

- To Be Hero X: Everything You Need To Know About The Upcoming Anime

- When Johnny Depp Revealed Reason Behind Daughter Lily-Rose Depp Skipping His Wedding With Amber Heard

- ALEO PREDICTION. ALEO cryptocurrency

- Jennifer Aniston Shows How Her Life Has Been Lately with Rare Snaps Ft Sandra Bullock, Courteney Cox, and More

- 30 Best Couple/Wife Swap Movies You Need to See

- Revisiting The Final Moments Of Princess Diana’s Life On Her Death Anniversary: From Tragic Paparazzi Chase To Fatal Car Crash

- Who Is Emily Armstrong? Learn as Linkin Park Announces New Co-Vocalist Along With One Ok Rock’s Colin Brittain as New Drummer

2024-12-03 23:56