As a seasoned investor with over two decades of experience in traditional markets, I must admit that I was initially skeptical about Bitcoin and cryptocurrencies in general. However, the unprecedented growth and success of the iShares Bitcoin Trust (IBIT) has left me genuinely impressed and intrigued. In my entire career, I have never witnessed an ETF amass such a colossal amount of assets under management (AUM) within just 11 months – eclipsing the combined AUM of over 50 long-established European market-focused ETFs and even outperforming BlackRock’s own gold ETF.

The fact that a giant like BlackRock, with its more than $11 trillion in assets under management, has entered the Bitcoin fray not only legitimizes this digital asset but also underscores its potential as a viable investment option for both institutional and retail investors. The endorsement by BlackRock’s CEO Larry Fink, who once described Bitcoin as a tool for global money laundering, further cements my conviction that cryptocurrencies are here to stay.

Moreover, the impressive performance of IBIT has paved the way for other spot-Bitcoin ETFs in the United States, which is a testament to the growing interest and acceptance of Bitcoin as an asset class. However, I remain cautious about some players’ stance on cryptocurrency, such as Vanguard, which has chosen not to offer a spot-Bitcoin ETF or allow trading in similar products on its platform. I believe that ignoring this growing trend could potentially alienate younger investors who view digital assets as core portfolio holdings.

All in all, the success of IBIT and the broader acceptance of Bitcoin by traditional asset managers like BlackRock have opened my eyes to the potential of cryptocurrencies. And to think, just a few years ago, I was still scratching my head over Bitcoin’s whitepaper! Now, I can’t help but chuckle at the irony – it seems that even old dogs can learn new tricks!

11 months after its launch in January 2024, IBIT managed to build an impressive portfolio of over $50 billion in assets, making it the biggest Bitcoin spot-ETF available today. Bloomberg’s recent analysis underscores this achievement as unprecedented, pointing out that no other ETF has ever experienced such rapid and significant growth.

As a crypto investor, I’m excited to share that IBIT, a cryptocurrency investment product, has made quite an impact. Todd Sohn, Managing Director of ETF and Technical Strategy at Strategas Securities, points out that its asset size is now equivalent to the combined assets of more than 50 long-standing European market-focused ETFs. Nate Geraci, President of The ETF Store, even goes as far as calling it “the greatest launch in ETF history.” This kind of recognition certainly adds to my confidence in this investment.

As a research analyst at Bloomberg Intelligence, I’ve observed the extraordinary growth trajectory of IBIT, a trust that has outpaced significant milestones faster than any other ETF across all asset classes, earning it the description of “unprecedented.” Given an expense ratio of 0.25%, this rapid expansion is projected to generate approximately $112 million in annual fees. In a recent X-based conversation, I highlighted that BlackRock might be fielding numerous client queries regarding how best to allocate Bitcoin/IBIT within a diversified portfolio, with their suggested range being 1-2% of total Bitcoin exposure.

Blackrock Credibility Legitimizes Bitcoin

The remarkable climb of IBIT seems to have sparked a significant transformation within the broader Bitcoin market. BlackRock’s widespread reputation, anchored in its management of over $11 trillion in assets, has played a crucial role in making Bitcoin appealing to both institutional and retail investors. This shift was reinforced by Larry Fink, CEO of BlackRock, who initially viewed Bitcoin as a tool for global money laundering but later referred to it as “digital gold.” The backing of Bitcoin by one of the world’s largest asset managers helped push its price above $100,000 for the first time, igniting a 118% price surge this year.

The initial success of IBIT marked a significant milestone, opening doors for more Bitcoin Spot ETFs to gain approval and launch in the U.S. Notably, BlackRock, Fidelity, VanEck, Grayscale, and other firms have introduced these pioneering ETFs, with a total of 12 funds now managing approximately $107 billion in assets. Despite some industry critics arguing that the Securities and Exchange Commission (SEC) may not have followed its traditional “first come, first served” approach, IBIT’s leading position remains undeniable.

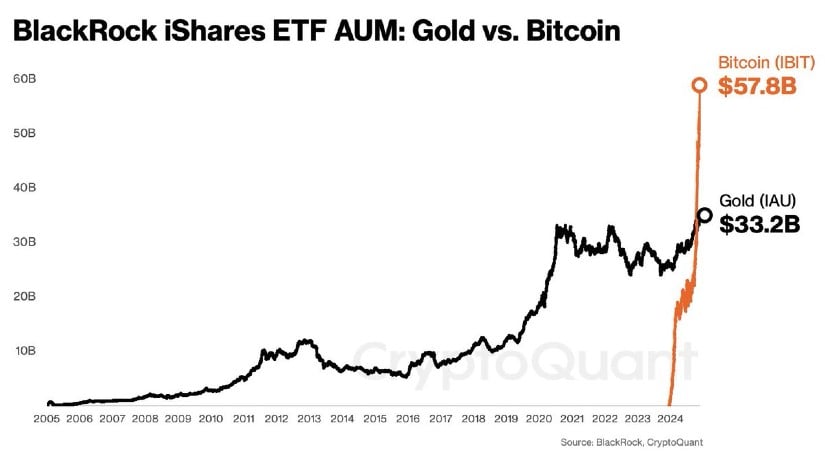

As a seasoned investor with decades of experience in the financial markets, I have witnessed numerous trends come and go. However, the meteoric rise of Bitcoin (IBIT) has left me genuinely intrigued. The fact that IBIT now manages more assets than BlackRock’s gold ETF, which is the second-largest gold fund globally, is a testament to its growing influence.

Geraci’s prediction that IBIT could potentially surpass SPDR Gold Shares, the largest gold ETF, by 2025 unless Bitcoin experiences a steep decline, is an interesting perspective. It underscores the potential for further growth in this digital asset class. However, it also serves as a reminder of the inherent volatility and risk associated with such investments.

The market data revealing that IBIT has seen only nine days of net outflows since its inception, typically accounting for over half of the daily trading volume within its peer group, is quite impressive. This resilience suggests a strong investor base and a robust interest in this digital asset.

That being said, I would advise caution to those considering investing in Bitcoin or any other digital assets. While the potential rewards can be substantial, so too are the risks. Always do your due diligence and make informed decisions based on your risk tolerance and financial goals.

The growth of this investment fund has spilled over into the market for options. Since their introduction on November 19th, these options have become some of the most frequently traded ETF-derived derivatives, with an average daily notional volume of $1.7 billion. Competing funds like Fidelity’s and Grayscale’s Bitcoin spot funds each account for less than 1% of the daily trading volume of these options, demonstrating the clear advantage of the iShares fund in this market.

In a different approach, some other asset managers have made opposing decisions regarding cryptocurrency. For example, Vanguard has opted out of providing a Bitcoin ETF or enabling trading of similar products on their platform. Some analysts speculate that this decision could potentially disenchant younger investors who consider digital assets as essential components of their investment portfolios.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- PENGU PREDICTION. PENGU cryptocurrency

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- 30 Best Couple/Wife Swap Movies You Need to See

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- All 6 ‘Final Destination’ Movies in Order

- Clair Obscur: Expedition 33 – Every new area to explore in Act 3

- All Hidden Achievements in Atomfall: How to Unlock Every Secret Milestone

- The Last Of Us Season 2 Drops New Trailer: Premiers April On Max

- ANDOR Recasts a Major STAR WARS Character for Season 2

2024-12-31 13:03