As a seasoned researcher with years of experience in the dynamic world of finance, I find the recent outflow of funds from BlackRock’s iShares Bitcoin Trust (IBIT) quite intriguing. The sheer volume of this exodus is unprecedented, surpassing even the previous record set just a day before New Year’s Eve in 2024.

The fact that IBIT has seen three consecutive days of outflows as of January 2 is particularly noteworthy. It’s like watching a Bitcoin whale swim away with a massive chunk of its holdings. The total outflow over the past week alone amounts to a staggering $391 million, which is no small change even in the world of institutional investing.

However, it’s not all doom and gloom for Bitcoin ETFs. Fidelity, Ark, and Bitwise BTC ETFs have managed to record net inflows on January 2, suggesting that some investors are still bullish on Bitcoin.

Interestingly, BlackRock, despite this recent outflow, has shown unwavering confidence in Bitcoin. They’ve made it clear that they don’t plan to diversify into altcoins and will instead focus on expanding their BTC and ETH offerings. This strategy could be a shrewd move considering the meteoric rise of Bitcoin and Ethereum over the past year.

On a lighter note, I can’t help but wonder if the person who cashed out $330.8 million worth of Bitcoin on January 2 regrets their decision now, given the price fluctuations since then. Maybe they should have held on to their Bitcoins and waited for the next ‘halvening’. After all, in the world of crypto, patience is a virtue!

The BlackRock’s iShares Bitcoin Trust (IBIT) ETF has experienced its greatest withdrawal of funds since it began operation a year ago, signifying a noteworthy event within the Bitcoin ETF sector.

On December 24, 2024, a new high was set, exceeding the previous record of $188.7 million in outflow that was recorded before.

Bitcoin ETF Outflows Hit $242 Million as IBIT Bleeds

Based on figures from SoSoValue, a fund achieved an unprecedented exit worth approximately 3,500 Bitcoins or $330.8 million on January 2nd. After IBIT’s significant outflow, Bitcoin ETFs collectively experienced daily net outflows amounting to about $242 million.

On January 2nd, IBIT saw its third straight day of withdrawals, establishing yet another record. As per Farside Investors’ data, BlackRock’s Bitcoin Trust recorded an outflow of approximately $391 million during the last seven days.

On January 2nd, I observed significant inflows into the Fidelity, Ark, and Bitwise Bitcoin ETFs, totaling approximately $36.2 million, $16.54 million, and $48.31 million respectively. These figures underscore the growing interest in crypto investments among investors.

According to Eric Balchunas, an analyst at Bloomberg ETF, the inflows into the IBIT ETF are significant because it has proven to be the most successful ETF ever launched. This assessment was made in December, following BlackRock’s rapid growth, outpacing any other ETFs across global markets.

James Seyffart, a renowned ETF analyst, stated that IBIT’s growth is exceptional and unparalleled. In fact, it surpasses other ETFs in reaching milestones at an astonishing pace, faster than any ETF across all asset classes. Given its current assets and an expense ratio of 0.25%, IBIT is projected to generate approximately $112 million annually.

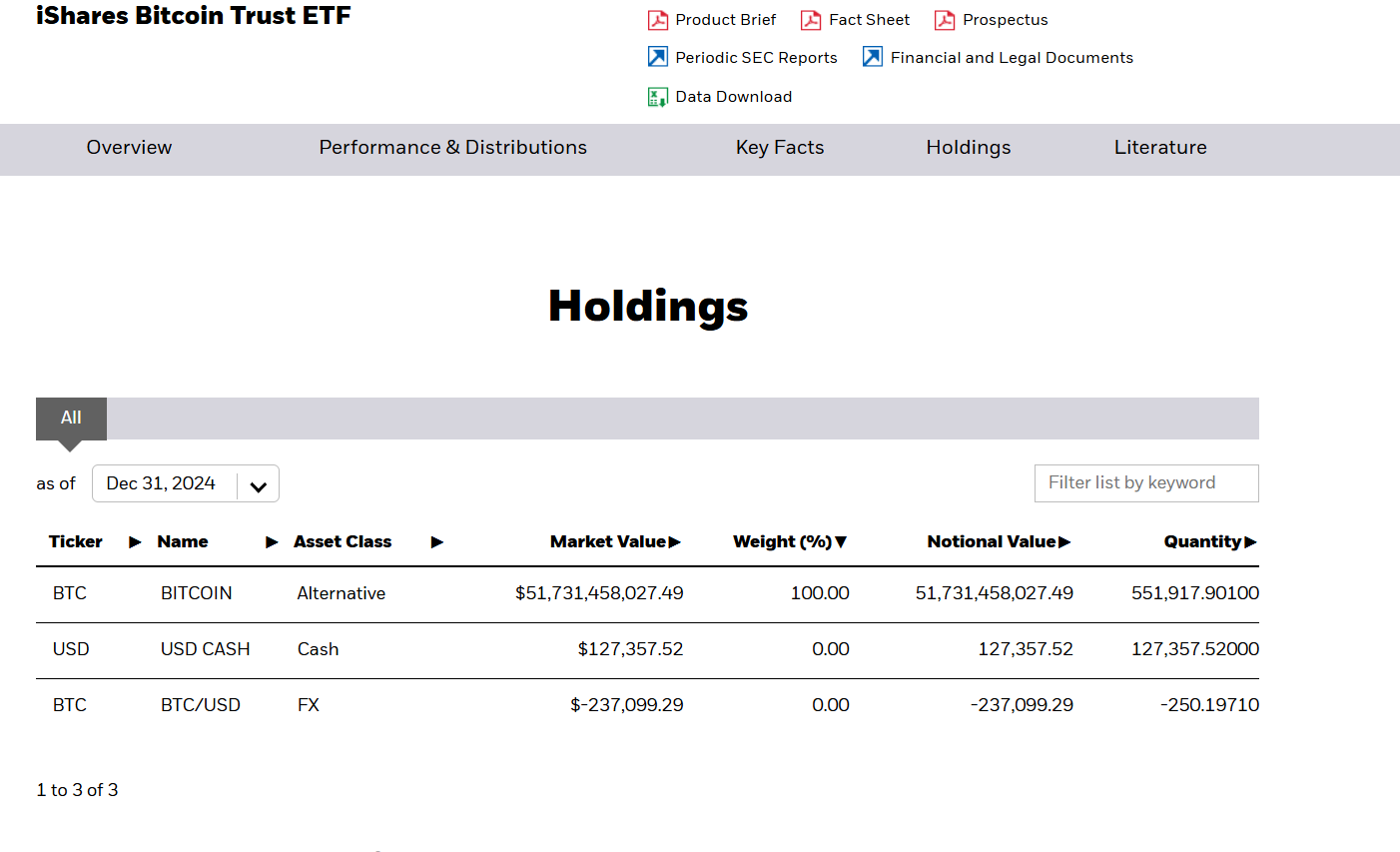

By the end of December 31st, IBIT owns more than half a million Bitcoins (551,000 to be exact). Since its inception, BlackRock has amassed approximately 2.38% of the total supply of Bitcoin that will ever be mined.

BlackRock’s belief in Bitcoin and Ethereum is clear as they stated their intention to concentrate solely on these two cryptocurrencies, rather than introducing new exchange-traded funds (ETFs) that focus on alternative altcoins.

In December, Jay Jacobs, head of BlackRock’s ETF division, underscored the company’s focus on broadening the scope of their current Bitcoin and Ethereum ETFs, which have demonstrated impressive results. Notably, BlackRock analysts have proposed that a percentage ranging from 1% to 2% of traditional 60/40 investment portfolios should be allocated to Bitcoin.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- PENGU PREDICTION. PENGU cryptocurrency

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- All 6 ‘Final Destination’ Movies in Order

- Clair Obscur: Expedition 33 – All Act 3 optional bosses and where to find them

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- 30 Best Couple/Wife Swap Movies You Need to See

- Persona 5: The Phantom X Navigator Tier List

- Clair Obscur: Expedition 33 – Every new area to explore in Act 3

2025-01-03 09:52