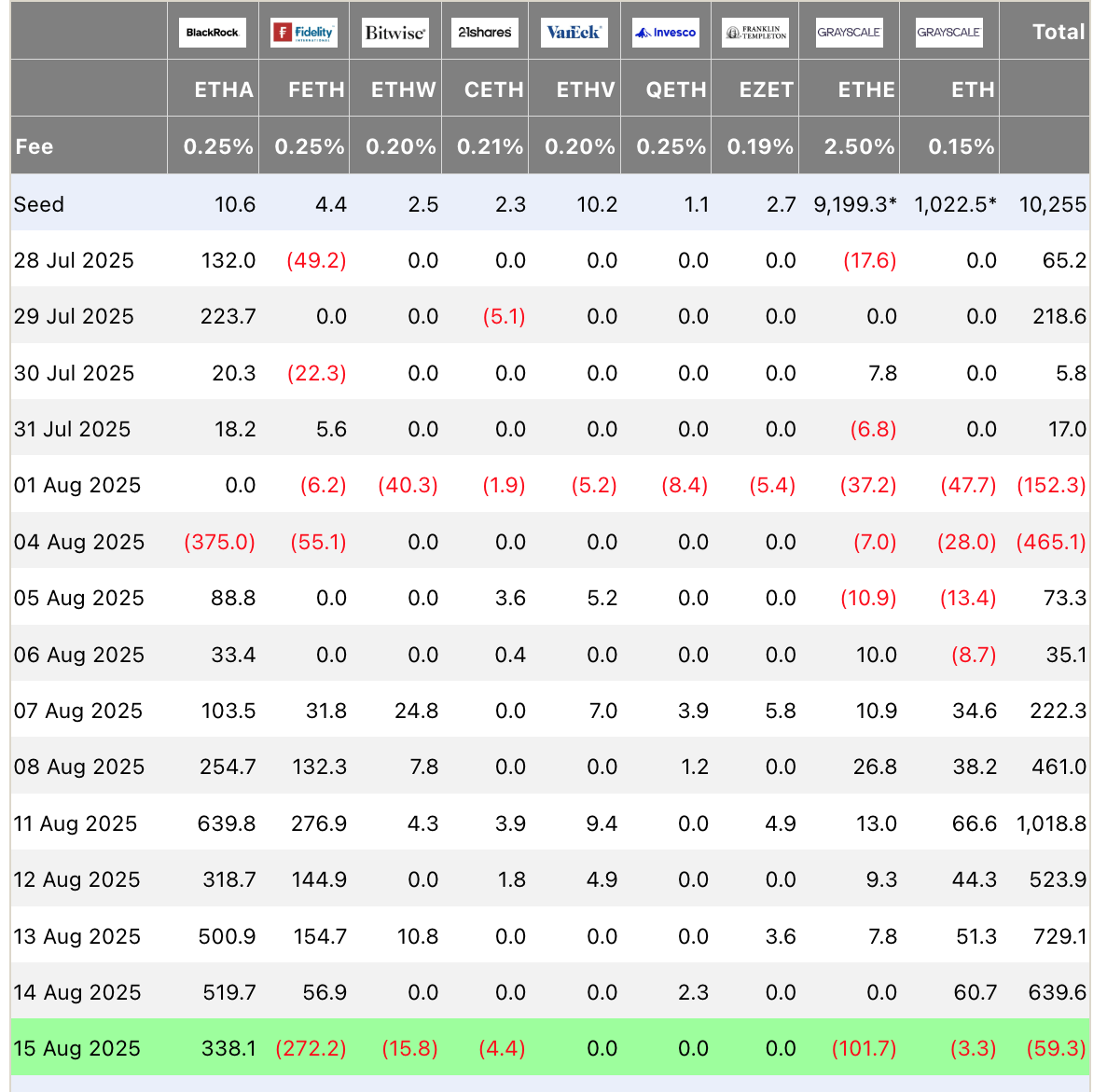

Ah, the eternal dance of numbers and greed! While the week ended with a modest net outflow across all funds (a mere $59 million-chump change in crypto land), BlackRock, that ever-hungry titan of finance, continued its Ethereum-buying spree like a maniacal dragon hoarding shiny gems. 🔥💎

According to data from Farside Investors (*insert dramatic pause here*), BlackRock’s iShares Ethereum ETF gobbled up a whopping $519 million on August 14. And if that wasn’t enough to make your wallet weep, they added another $338 million the very next day. Yes, dear reader, BlackRock doesn’t just dip its toes into Ethereum-it cannonballs straight into the deep end. 💸💦

By the end of July, this financial behemoth had already amassed $11.4 billion worth of Ethereum. Eleven. Point. Four. Billion. That’s more zeros than most of us see in a lifetime. Clearly, BlackRock is either extremely confident-or secretly plotting world domination through blockchain. 🌍✨

Ethereum ETFs are hotter than a Moscow summer, with inflows and trading activity reaching record-breaking levels. This week alone, net inflows totaled $2.85 billion, while trading volume soared past $17 billion. As Eric Balchunas so eloquently tweeted:

Spot Bitcoin + Ether ETFs did about $40b in volume this week, biggest week ever for them, thanks to Ether ETFs stepping up big. Massive number, equiv to a Top 5 ETF or Top 10 stock’s volume.

– Eric Balchunas (@EricBalchunas) August 15, 2025

Monday was a red-letter day for Ethereum enthusiasts, as spot Ethereum ETFs recorded their largest single-day net inflows ever: $1.01 billion. Over the first two weeks of August, inflows exceeded $3 billion, making it the second-best month on record. BlackRock’s iShares Ethereum ETF led the charge, raking in $519 million on August 14 alone. Truly, these folks don’t sleep-they just buy Ethereum instead. 😴📈

Meanwhile, Ethereum itself remains firmly in the limelight, basking in the glow of institutional demand and regulatory developments. On Thursday, the world’s second-largest cryptocurrency climbed 0.7% to hover above $4,700 per token, tantalizingly close to its all-time high of $4,891.70 set back in 2021. Close-but not quite there yet. Like a shy lover, it hesitates at the threshold of greatness. 🚀💔

The Securities and Exchange Commission’s “Project Crypto” initiative has added fuel to the fire, aiming to modernize regulations and provide clarity around digital assets. Ah, bureaucracy-the unsung hero of crypto adoption! Or perhaps the villain? Only time will tell. ⏳📜

Of course, no tale of triumph is complete without a dash of drama. Earlier this week, a major Ethereum ICO-era whale decided to cash out yet again, sending ripples of panic through the market. Sell pressure? Oh no! But fear not, dear reader, for demand from ETFs and corporate buyers seems to have absorbed the blow. For now. 😉🌊

And then, just when you thought things couldn’t get any wilder, Standard Chartered swooped in with revised price targets that read like science fiction. They now predict ETH will hit $7,500 by the end of 2025 and soar to an eye-watering $25,000 by 2028. Corporate accumulation plans may be the cherry on top, with companies targeting a combined $30.4 billion in ETH purchases. Bitmine alone plans to allocate $22 billion-nearly 5% of the total ETH supply. Imagine trying to explain *that* to your accountant. 📊🤯

So, will Ethereum conquer the world, or will it stumble at the last hurdle? Only the markets know for sure. Until then, we’ll keep watching, laughing, and occasionally crying over our portfolios. After all, in the world of crypto, nothing is certain except death, taxes, and BlackRock buying Ethereum. 🪙🎭

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- ETH PREDICTION. ETH cryptocurrency

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- Games That Faced Bans in Countries Over Political Themes

- ‘Zootopia+’ Tops Disney+’s Top 10 Most-Watched Shows List of the Week

- The Labyrinth of Leveraged ETFs: A Direxion Dilemma

2025-08-16 20:05