As a seasoned crypto investor with a decade of experience under my belt, witnessing BlackRock’s iShares Ethereum Trust ETF amass over 1 million tokens is nothing short of exhilarating. The institutional confidence in Ethereum, particularly at a time when Bitcoin is soaring past the $100,000 mark, speaks volumes about the potential growth of this digital asset.

The spot Ethereum exchange-traded fund (ETF) launched by the world’s largest asset manager earlier this year now holds a substantial trove of ETH, having recently surpassed one million tokens.

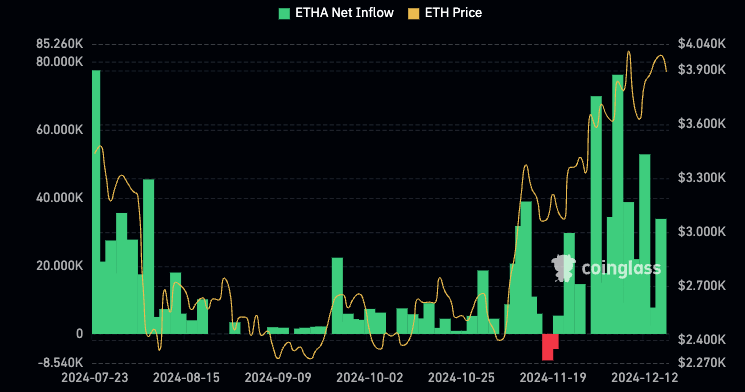

As per information from BlackRock’s website, the iShares Ethereum Trust ETF (ETHA) currently holds approximately 1.025 million Ether, which has a market value exceeding $4 billion. This increase is due to substantial inflows into the fund over the past few weeks, as indicated by data from CoinGlass.

This investment fund is constructed to mirror the value of Ether, giving users a simple way to invest in the cryptocurrency without needing to handle personal wallets themselves.

The increased amount of Ethereum (ETH) held by BlackRock’s ETF indicates that institutional confidence in Ethereum is increasing as they continue to acquire more tokens. This comes at a time when Ethereum is finding it difficult to exceed the 44,000 level, while Bitcoin has surged past $100,000 and maintains its position above this mark.

According to Juan Leon, senior investment strategist at Bitwise Asset Management, Ethereum is expected to experience a substantial increase in value by 2025. In a blog post published on December 17th, Leon suggested that Ethereum, though it may be eclipsed in 2024, holds the potential for massive growth due to the $100 trillion market for real-world assets.

Leon highlighted a significant change happening in the last couple of weeks. In his opinion, during the past 10 days, there has been approximately $2 billion poured into Ethereum ETFs as opposed to just $250 million over the previous four months. He believes this surge is due to increased investor faith in Ethereum.

As a crypto investor, I’m optimistic about Ethereum’s potential to rake in over $100 billion annually through tokenization, significantly surpassing its current income streams. I firmly believe that supportive regulations, especially from the SEC, could serve as a major growth driver for Ethereum in 2025.

Read More

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- All 6 ‘Final Destination’ Movies in Order

- ANDOR Recasts a Major STAR WARS Character for Season 2

- PENGU PREDICTION. PENGU cryptocurrency

- 30 Best Couple/Wife Swap Movies You Need to See

- Clair Obscur: Expedition 33 – All Act 3 optional bosses and where to find them

- Is a Season 2 of ‘Agatha All Along’ on the Horizon? Everything We Know So Far

- Apocalypse Hotel Original Anime Confirmed for 2025 with Teaser and Visual

2024-12-18 18:40