As a seasoned researcher with over two decades of experience in the financial markets, I have witnessed countless trends and shifts, but the rapid growth of BlackRock’s Bitcoin ETF (IBIT) is nothing short of extraordinary. Having closely monitored the European market for many years, I can attest to the fact that this achievement is indeed historic.

The BlackRock Bitcoin ETF (IBIT) currently manages more funds (assets under management or AUM) than all the regional ETFs in Europe, numbering over 50, combined. Some of these European ETFs have been around for 20 years, underscoring the rapid growth and unprecedented rise of IBIT.

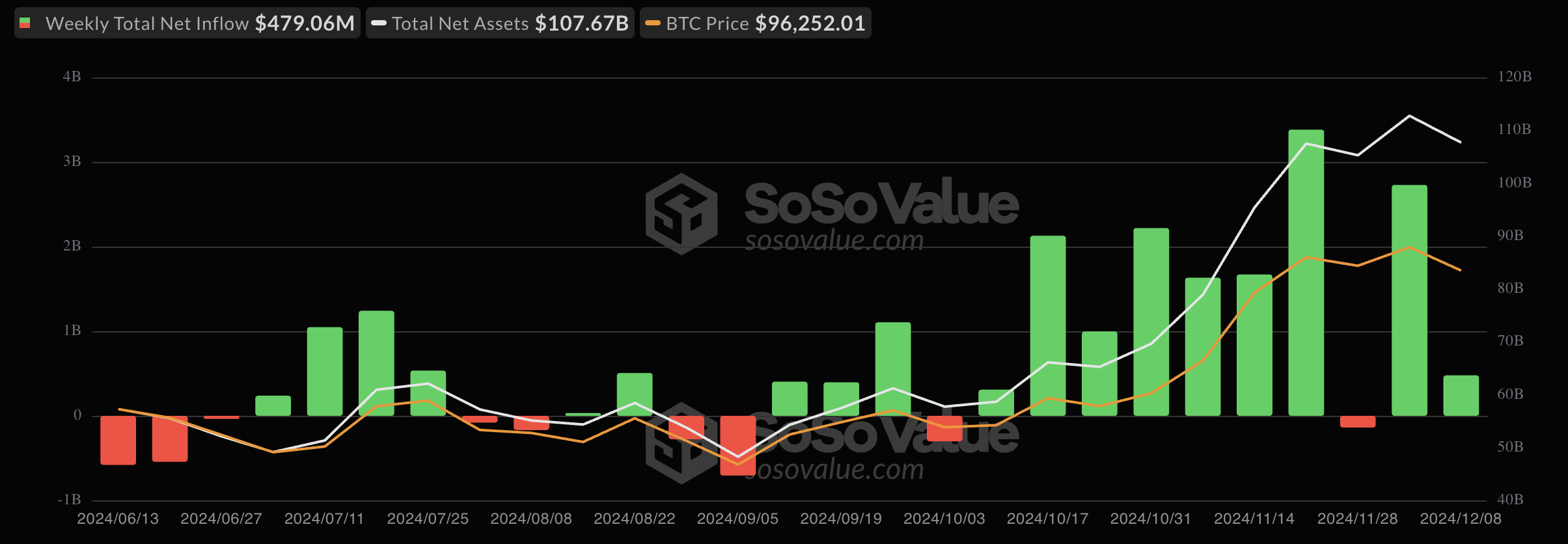

As an analyst, I’ve noticed a significant surge in inflows for Bitcoin Exchange-Traded Funds (ETFs) over the past month, with BlackRock taking the lead among its peers.

BlackRock’s IBIT: A Historic Success

Today, ETF analyst Todd Sohn disclosed an intriguing finding, focusing on the potential durability of these regional ETFs in relation to the unprecedented triumph of Bitcoin-related investment products.

According to Bloomberg analyst Eric Balchunas, IBIT’s asset value is equivalent to that of the combined total of about 50 European-focused ETFs (which include both regional and single country ETFs), and this fund has been in existence for the past two decades.

Referring to the poor performance of European-focused ETFs, Sohn pondered aloud, “With low returns, no fresh offerings, and a pattern of underperformance across generations – one has to question if it’s viable.

Since its debut in January, BlackRock’s IBIT has been dominating the expanding Bitcoin ETF market. Not long after Donald Trump’s election, IBIT exceeded its prior record value and surpassed BlackRock’s gold-backed ETF in worth.

The pace has largely remained steady. In November, Bitcoin ETFs experienced their highest monthly net influx, totaling a record $6.1 billion, with the majority coming from BlackRock’s IBIT. During the first week of December, Bitcoin ETFs recorded the second-largest weekly inflow, again primarily driven by IBIT.

As an analyst, I find myself in a position where I can articulate that the BlackRock fund under my purview boasts a staggering net asset value exceeding $51 billion. This figure accounts for almost half of the total market capitalization of all Bitcoin Spot Exchange-Traded Funds (ETFs) currently available in the United States.

The company has shown strong influence in various areas beyond weekly investments. For instance, last week, all 12 spot ETFs together held more Bitcoin than Satoshi Nakamoto did at one point. Notably, over half of these Bitcoin holdings are owned by BlackRock itself, and the firm has been consistently buying large amounts.

Essentially, these Exchange-Traded Funds (ETFs) symbolize the increasing institutional endorsement of Bitcoin and cryptocurrencies as a whole. For those institutions hesitant to embrace change, it could potentially lead to their marginalization. Notably, economists from the European Central Bank have proposed regulating Bitcoin’s price. The EU has been relatively strict towards crypto recently, and this strictness is evident in the underperformance of its ETFs.

Read More

- 30 Best Couple/Wife Swap Movies You Need to See

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- PENGU PREDICTION. PENGU cryptocurrency

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- The Last Of Us Season 2 Drops New Trailer: Premiers April On Max

- Save or Doom Solace Keep? The Shocking Choice in Avowed!

- In Conversation With The Weeknd and Jenna Ortega

- Tyla’s New Breath Me Music Video Explores the Depths of Romantic Connection

- Scarlett Johansson’s Directorial Debut Eleanor The Great to Premiere at 2025 Cannes Film Festival; All We Know About Film

- USD ILS PREDICTION

2024-12-11 02:12