As a seasoned researcher with over two decades of experience in the financial industry, I’ve witnessed the evolution of traditional finance (TradFi) and its gradual encroachment into cryptocurrencies. The recent news about BlackRock’s aggressive Bitcoin accumulation is a testament to this trend.

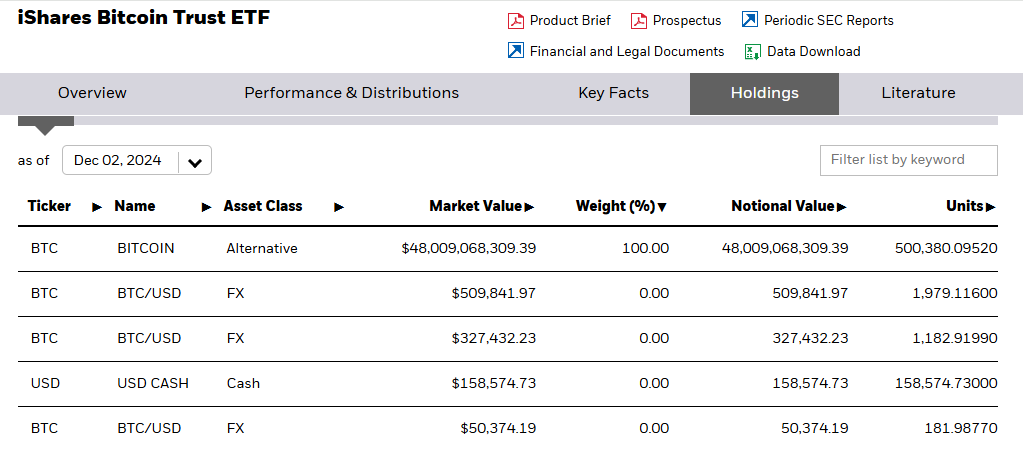

Based on blockchain information, it’s been found that BlackRock’s iShares Bitcoin Trust (IBIT) now possesses more than half a million Bitcoins. This makes BlackRock the third-largest Bitcoin holder worldwide, with only Satoshi Nakamoto, the creator of Bitcoin, and Binance, a prominent cryptocurrency exchange, holding more.

BlackRock’s dominance in the cryptocurrency sector is rapidly increasing, given its assets valued around $48 billion.

BlackRock’s Aggressive Bitcoin Accumulation

Over the course of approximately 233 trading days since IBIT’s debut, BlackRock has amassed around 2.38% of the total Bitcoin supply that will ever be in circulation. This significant acquisition underscores their belief in Bitcoin as a valuable financial asset. This belief is evident in their ongoing series of purchases, which have led to BlackRock owning a total of 500,380 Bitcoin units by December 2nd.

Lately, the company has been drawing attention by investing $680 million in Bitcoin, a move that strengthens its position in the market. This investment strategy follows a collective approach and BlackRock’s CEO, Larry Fink, is now embracing this shift. Previously, Fink was critical of Bitcoin, labeling it as speculative, but he now sees it as an innovative asset with the power to transform the financial landscape.

This transition has led BlackRock to significantly increase its participation in the crypto market. In fact, as reported by BeInCrypto, their US Head of Thematics and Active ETFs, Jay Jacobs, recently suggested that Bitcoin could potentially grow into a $30 trillion market, indicating further potential for its adoption.

BlackRock’s main product, the iShares Bitcoin Trust (IBIT), plays a crucial role in their strategy to amass Bitcoin. This year, IBIT surpassed $40 billion in assets it manages, setting new pace records within the ETF sector. On its debut day for options trading, the fund saw transactions worth more than $425 million, indicating strong institutional investor interest.

About a month ago, IBIT outperformed BlackRock’s gold ETF, showing Bitcoin’s growing influence within conventional finance. As reported by SoSoValue, IBIT remains at the forefront of the Bitcoin spot ETF sector.

On Monday, the financial tool saw almost $340 million in incoming funds. By December 2nd, its total net inflow had reached a staggering $32.08 billion, with Fidelity’s FBTC accounting for approximately $11.48 billion of that amount.

BTC Institutional Adoption Stirs Decentralization Concerns

BlackRock’s approach towards Bitcoin involves more than just ETFs. The company has also amplified its stake in Bitcoin by investing in MicroStrategy, a significant corporate owner of Bitcoin. This action signifies BlackRock’s belief in Bitcoin’s lasting value and their ambition to lead the institutional Bitcoin market.

Bitcoin’s status as a legitimate financial asset class has been solidified by the company’s actions, much like other traditional finance (TradFi) players. Yet, not everyone is rejoicing over this development.

Within the cryptocurrency sphere, critics say that the growing influence of large institutions like BlackRock contradicts Bitcoin’s original philosophy of decentralization. By accumulating substantial assets, this institution could potentially concentrate power in a system meant to put individual control above institutional authority.

“There once was a dream that was Bitcoin… this is not it,” one user on X lamented.

Critics argue that as more institutions buy Bitcoin, it undermines the very essence of decentralization since entities like BlackRock are increasingly becoming the largest holders.

Nonetheless, BlackRock’s emergence as a significant Bitcoin owner signifies a crucial turning point within the cryptocurrency marketplace. While this development underscores Bitcoin’s growing acceptance as a viable global investment option, it also brings into focus the influence of big financial institutions in an arena that has historically been linked to decentralized financial freedom.

Under IBIT’s guidance and innovative strides, the company stands ready to continue its significant role within the cryptocurrency sector. Yet, the ongoing discussion about whether their actions support or contradict Bitcoin’s fundamental values is not likely to cease.

Read More

- Gold Rate Forecast

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

- Are Billie Eilish and Nat Wolff Dating? Duo Flames Romance Rumors With Sizzling Kiss in Italy

- Tom Hiddleston and Wife Zawe Ashton Announce Second Pregnancy, Know Couple’s Relationship Timeline

- Is Justin Bieber Tired of ‘Transactional Relationship’ with Wife Hailey Bieber? Singer Goes on Another Rant Raising Concerns

- Justin Bieber Tells People to ‘Point at My Flaws’ Going on Another Rant, Raises Alarm With Concerning Behavior

- Resident Evil 9: Requiem Announced: Release Date, Trailer, and New Heroine Revealed

- Summer Game Fest 2025 schedule and streams: all event start times

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

2024-12-03 18:04