On January 13th, it was officially disclosed that the new fund would be trading with the symbol IBIT, which corresponds to the company’s leading U.S. product, the iShares Bitcoin Trust (IBIT), in the stock market.

The iShares Bitcoin ETF is designed to provide Canadian investors with a hassle-free way to invest in Bitcoin, bypassing the complications that come with direct ownership. According to Helen Hayes, head of iShares Canada at BlackRock, this ETF serves to streamline Bitcoin investments and tackle the intricacies related to custody management.

Helen Hayes, head of iShares Canada at BlackRock, stated that the iShares Fund offers Canadian investors a simplified method to invest in bitcoin. This fund helps eliminate the operational and storage complications associated with owning bitcoin directly.

Cboe Canada, known for its innovative spirit, showed excitement about collaborating on this venture. The exchange emphasized its past accomplishments of introducing groundbreaking financial products, specifically spot cryptocurrency ETFs in the U.S., and expressed satisfaction in listing BlackRock Canada’s IBIT ETF.

Cboe, known for introducing unique financial products first, such as U.S. spot crypto ETFs, is excited to maintain its role as an innovator by listing BlackRock Canada’s IBIT ETF on Cboe Canada,” the platform stated.

BlackRock’s IBIT ETF Soars — $38 Billion Inflows

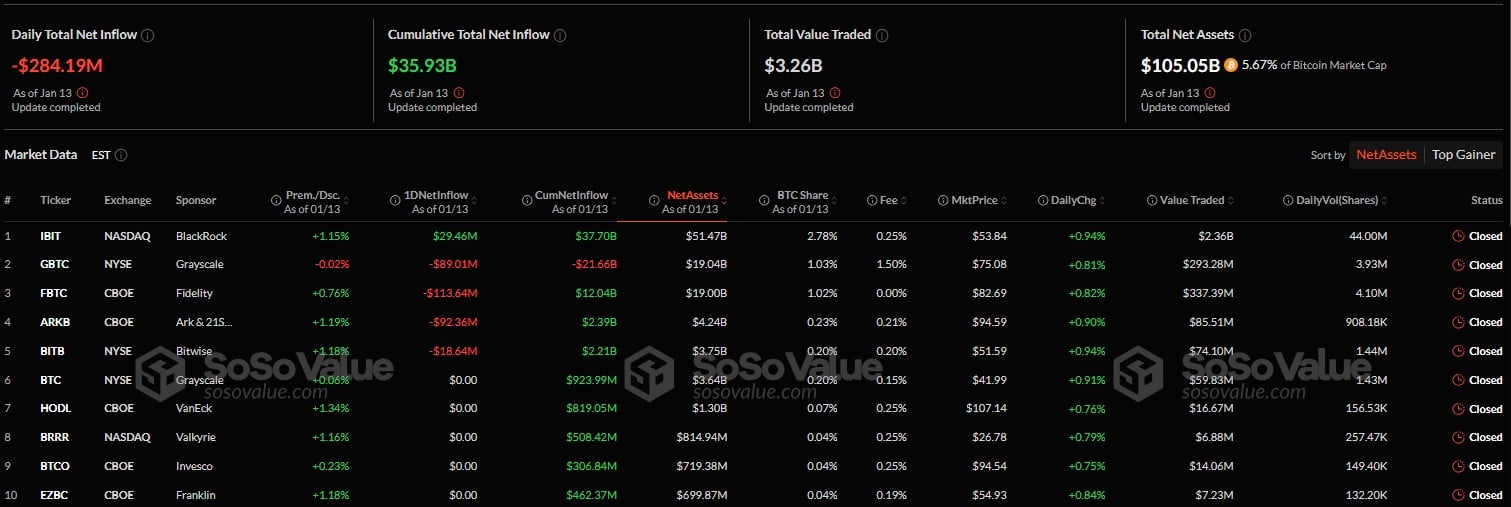

Since its debut in January 2024, BlackRock’s US-based IBIT ETF has rapidly become the leading Bitcoin fund globally, with a massive $37.70 billion in accumulated investments. This impressive expansion is a part of a larger trend in Bitcoin ETFs, which collectively attracted over $35 billion last year, translating to approximately $144 million daily inflows, as reported by SoSoValue.

The growth of Bitcoin ETFs in Canada has been nothing short of impressive. BlackRock’s latest product is set to join more than a dozen other Bitcoin ETFs already being traded on Canadian stock exchanges, as reported by Nasdaq. Nevertheless, analysts predict that BlackRock’s significant industry influence and the iShares brand will provide it with a strong competitive advantage.

$100 Billion Milestone Reached by US Bitcoin ETFs

In the wider financial market, US Bitcoin Exchange-Traded Funds (ETFs) hit a significant record in November 2024, exceeding $100 billion in total assets for the first time according to Bloomberg Intelligence statistics. As we move forward, experts from Steno Research anticipate an additional $48 billion in investments into Bitcoin ETFs in 2025, suggesting a growing interest among institutional investors in digital currencies.

Due to an increase in Bitcoin’s value and the expanding use of Bitcoin ETFs, these exchange-traded funds currently possess a greater quantity of Bitcoin than what was initially mined by Satoshi Nakamoto.

The allure of Bitcoin as a safeguard against inflation and geopolitical turmoil has sparked a surge of institutional attention. According to a report published in December by JPMorgan, this is the key point they highlighted:

(Alternatively) In recent times, Bitcoin’s function as a protective asset against inflation and global political instability has ignited a flurry of institutional investment. As stated in their December report, this was the main focus for JPMorgan.

Track the flow of funds into cryptocurrency markets, observing how Bitcoin is increasingly playing a significant and integral role within investment portfolios.

The sudden increase in interest is causing widespread effects. Experts at Sygnum Bank predict that the influx of institutional investments might spark unexpected increases in demand, possibly pushing Bitcoin prices to unprecedented peaks by 2025. At the same time, Cboe Canada’s strong foundation and dedication to building trust make it an excellent choice for hosting such innovative financial products.

BlackRock’s Global Impact on ETF Market

BlackRock’s influence reaches far beyond Bitcoin. Through iShares, they have been a significant player in the global Exchange Traded Fund (ETF) market. The company’s commitment to creating tailored investment opportunities is clear in their recent launches, such as ETFs focusing on mega-cap stocks and financial products based on blockchain technology.

In November 2024, BlackRock broadened the availability of its tokenized fund, the BlackRock USD Institutional Digital Liquidity Fund (BUIDL), across various blockchain networks. This action underscores the company’s dedication to innovation, offering investors sophisticated instruments for earning returns and maintaining liquidity within the realm of decentralized finance.

Cboe Canada, which hosts the newly launched Bitcoin ETF, plays a significant part in the ETF market landscape. This exchange provides a broad platform encompassing research and analysis on more than 1,200 Canadian ETFs. Its strong reputation for dependability and transparency has earned it the trust of issuers such as BlackRock.

Or:

Cboe Canada is essential in the ETF market. It’s where you’ll find the new Bitcoin ETF, and it offers a wide-ranging platform for research and analysis on over 1,200 Canadian ETFs. Its reputation for being trustworthy and transparent has made it a preferred partner for companies like BlackRock.

Read More

2025-01-16 17:19