As a researcher, I am excited to announce that our new fund has officially launched on January 13th, trading under the symbol IBIT. This ticker represents our leading US product, the iShares Bitcoin Trust, reflecting our commitment to closely follow its performance.

The iShares Bitcoin ETF is designed to provide a straightforward approach for Canadian investors to invest in Bitcoin, bypassing the complications associated with direct ownership. Helen Hayes, leader of iShares Canada at BlackRock, highlighted its role in streamlining Bitcoin investment processes and tackling custody intricacies.

Helen Hayes, the head of iShares Canada at BlackRock, stated that the iShares Fund offers Canadian investors an indirect method to invest in bitcoin, simplifying the operational and custody complications associated with owning bitcoin directly.

Cboe Canada, known for its innovative spirit, showed great interest in collaborating on this venture. The exchange emphasized its past achievements of introducing revolutionary financial products, such as U.S. spot cryptocurrency ETFs, and proudly announced the listing of BlackRock Canada’s IBIT ETF on their platform.

Cboe is known for introducing unique financial products first, such as U.S. spot crypto ETFs, and we’re excited to maintain our innovative stance by listing BlackRock Canada’s IBIT ETF on Cboe Canada,” the exchange announced.

BlackRock’s IBIT ETF Soars — $38 Billion Inflows

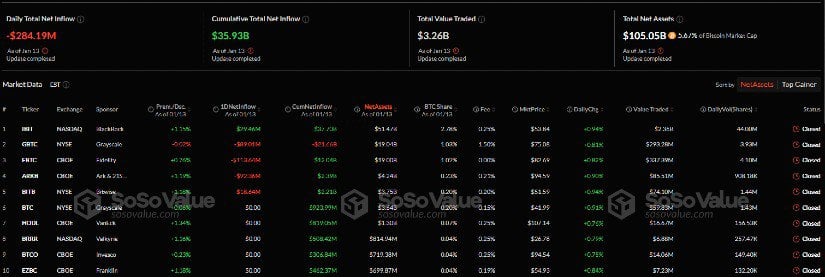

Starting in January 2024, BlackRock’s US-based IBIT ETF has rapidly become the world’s leading Bitcoin investment fund, boasting a massive $37.70 billion in total investments accumulated so far. This rapid expansion is part of a larger trend in Bitcoin ETFs, as a combined total of approximately $35 billion was invested last year, averaging around $144 million daily, according to SoSoValue’s data.

The increase in Bitcoin ETFs in Canada has been nothing short of impressive. BlackRock’s latest product is set to join more than a dozen other Bitcoin ETFs already being traded on Canadian stock exchanges, as reported by Nasdaq. Yet, analysts predict that BlackRock’s industry influence and the iShares label may provide it with a significant advantage.

$100 Billion Milestone Reached by US Bitcoin ETFs

In November 2024, US Bitcoin Exchange Traded Funds (ETFs) made a significant breakthrough in the larger market by accumulating over $100 billion in assets for the first time, as reported by Bloomberg Intelligence. Looking forward, analysts at Steno Research anticipate an additional $48 billion worth of investments flowing into Bitcoin ETFs in 2025, highlighting the increasing interest among institutional investors towards digital currencies.

As a crypto investor, I’m thrilled to witness the surge in Bitcoin’s value and the increasing acceptance of ETFs (Exchange Traded Funds). Today, it’s mind-blowing to realize that these Bitcoin ETFs now possess more Bitcoins than the legendary creator Satoshi Nakamoto ever mined! This is a testament to Bitcoin’s growing influence and adoption.

The surge in Bitcoin’s popularity is largely due to its potential as a safeguard against rising prices and political instability, drawing an influx of attention from major financial institutions. As outlined in a December analysis by JPMorgan, this aspect is particularly noteworthy.

Track the flow of funds entering the cryptocurrency market, recognizing that Bitcoin now plays a significant and increasingly structural role within investor’s diversified portfolios.

The sudden increase in interest is causing significant effects across various aspects. Experts at Sygnum Bank propose that large-scale investments might lead to unexpected increases in demand, possibly pushing Bitcoin prices to unprecedented levels by 2025. On the other hand, Cboe Canada’s robust system and dedication to building trust make it an excellent choice for launching innovative financial products like these.

BlackRock’s Global Impact on ETF Market

BlackRock’s impact reaches beyond just Bitcoin. In fact, through iShares, it has been a significant player in the worldwide Exchange Traded Fund (ETF) market. The company’s focus on creating custom investment opportunities is clear in its recent introductions, such as ETFs focusing on mega-cap stocks and financial products based on blockchain technology.

In November 2024, BlackRock broadened the availability of its tokenized investment fund, the BlackRock USD Institutional Digital Liquidity Fund (BUIDL), across various blockchain platforms. This action underscores the company’s dedication to innovation, empowering investors with sophisticated instruments for generating returns and liquidity within the realm of decentralized finance.

Cboe Canada serves as a key player in the ETF market, as it is where the Bitcoin ETF is traded. This exchange provides a broad platform for research and analysis on more than 1,200 Canadian ETFs. Its strong reputation for being reliable and transparent has made it a trusted ally for issuers like BlackRock.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- PENGU PREDICTION. PENGU cryptocurrency

- All 6 ‘Final Destination’ Movies in Order

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- 30 Best Couple/Wife Swap Movies You Need to See

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- Clair Obscur: Expedition 33 – Every new area to explore in Act 3

- All Hidden Achievements in Atomfall: How to Unlock Every Secret Milestone

- The Last Of Us Season 2 Drops New Trailer: Premiers April On Max

- ANDOR Recasts a Major STAR WARS Character for Season 2

2025-01-15 17:06