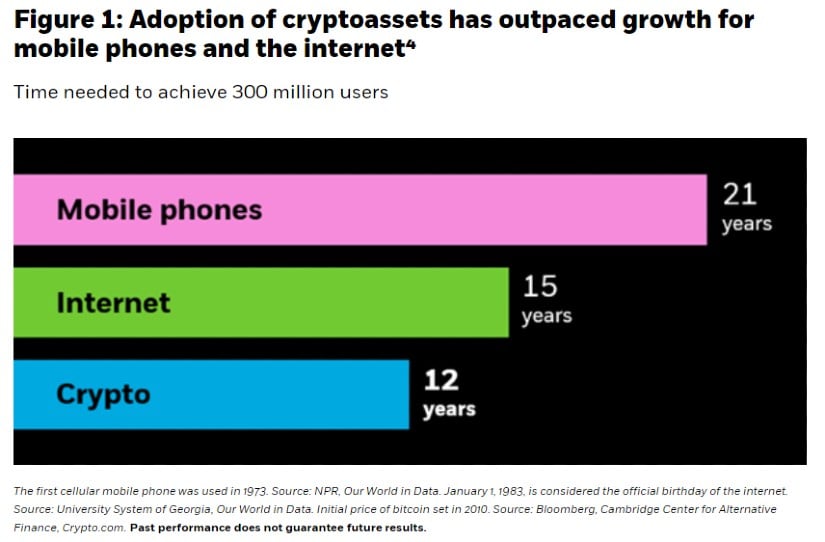

In a study conducted by BlackRock, it’s been found that digital currencies, such as cryptocurrencies, amassed approximately 300 million users within only 12 years of their existence. Interestingly, mobile phones took twice as long, requiring 21 years to reach the same number of users, and the internet needed even more time, 15 years, to accomplish this significant milestone.

Or, more concisely:

In a BlackRock report, it’s shown that cryptocurrencies garnered around 300 million users in just 12 years, compared to mobile phones, which took 21 years and the internet, which needed 15 years.

The remarkable surge suggests a change in worldwide financial trends. Cryptocurrencies, fueled by decentralized finance and blockchain technology, facilitate borderless transactions and continue to discover new applications. As innovation continually evolves, BlackRock underscores how change drives progress and reshapes the global market landscape.

Bitcoin, the leading cryptocurrency on a global scale, is at the helm of financial revolution. Its market value approaching USD 2 trillion positions it as a potential global monetary substitute. It garners interest due to worries about inflation, lack of faith in institutions, and dwindling trust in conventional currencies backed by governments.

Gen Z Leads the Bitcoin Adoption

The report underscores the fact that bitcoin has surpassed the adoption speed of numerous significant inventions. This rapid growth can be attributed to factors such as a tech-savvy younger demographic, increasing concerns about inflation, and global political instability. Furthermore, the ongoing digital transition in our economy is breaking down barriers, placing Bitcoin at the center of mainstream financial debates.

As a researcher, I found that younger generations are often referred to as digital natives due to their familiarity with technology. This propensity towards digital tools makes them more inclined towards adopting cryptocurrencies like Bitcoin, in contrast to GenX and Baby Boomers.

Adopting quickly often comes with hurdles. Historically, purchasing Bitcoin involved dealing with intricate procedures such as setting up new accounts, addressing security concerns, and enduring hefty fees on cryptocurrency platforms. Yet, as the system evolves, offerings like Bitcoin ETFs are emerging to streamline the investment process.

How IBIT Could Reshape Bitcoin Investment

The recently launched iShares Bitcoin ETF by BlackRock, named IBIT, seeks to simplify access to Bitcoin for a wider group of investors. This ETF makes it possible to hold Bitcoin within conventional brokerage accounts, thereby removing the complexity associated with Bitcoin storage or using dedicated cryptocurrency platforms.

The report states that IBIT, being an Exchange-Traded Fund (ETF), offers investment exposure to bitcoin. However, it behaves like a stock, allowing it to be bought and sold on standard brokerage platforms alongside traditional investments such as stocks, bonds, and other ETFs.

BlackRock’s IBIT offers simplicity and access for investors, enabling them to invest in Bitcoin similarly to purchasing stocks or bonds. This ETF can be traded within both taxable and tax-exempt accounts, such as the TFSA, making it a hassle-free choice for diversifying investment portfolios. The company stated:

As an analyst, I can express this statement as follows: “By leveraging the ETF structure, IBIT aims to mitigate some of the distinctive challenges associated with cryptocurrencies, offering a more familiar and widely-traded investment option.

At IBIT, security and dependability are fundamental components of our service, as it’s been observed that more money is lost in conventional finance compared to cryptocurrency. Notably, this ETF is managed by a globally recognized asset manager, linking up with Coinbase Prime – a reputable institutional digital asset custodian. This partnership signifies BlackRock’s dedication towards making it easier for both institutional and retail investors to invest in digital assets.

The introduction of Bitcoin ETFs such as IBIT marks a fresh chapter for the accessibility of cryptocurrency. By utilizing a well-known investment tool, IBIT makes Bitcoin easier to understand, making it less daunting for investors in the complex world of crypto. As Bitcoin’s value increases and more people adopt ETFs, Bitcoin ETFs now control more Bitcoin than was originally mined by Satoshi (the creator of Bitcoin).

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- PENGU PREDICTION. PENGU cryptocurrency

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- All 6 ‘Final Destination’ Movies in Order

- Clair Obscur: Expedition 33 – All Act 3 optional bosses and where to find them

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- Clair Obscur: Expedition 33 – Every new area to explore in Act 3

- 30 Best Couple/Wife Swap Movies You Need to See

- Persona 5: The Phantom X Navigator Tier List

2025-01-15 15:38