As a seasoned crypto investor with over a decade of experience navigating this volatile market, I find myself intrigued by the recent moves made by institutional giants like BlackRock and Grayscale. The contrast between these two heavyweights is as stark as night and day, with BlackRock’s strategic buy-in serving as a bullish indicator for Bitcoin’s future, while Grayscale’s sell-off seems to be a bearish signal.

On December 6th, the world’s largest asset manager, BlackRock, boosted its Bitcoin (BTC) investments substantially. This move followed swiftly after another investment firm, Grayscale, offloaded BTC amounting to $150 million.

BlackRock’s significant purchase indicates a growing faith in the leading cryptocurrency from their side. Given that institutional investors have been consistently purchasing Bitcoin after it surpassed the $100,000 mark, let’s explore potential future developments for this digital currency.

Bitcoin Continues to Get BlackRock’s Backing

On December 5th, the value of Bitcoin reached an all-time high of $100,000 for the first time ever. This significant milestone led Grayscale, a company that deals with Bitcoin exchange-traded funds (ETFs), to offload approximately $150 million worth of Bitcoin.

On the opposite side of things, BlackRock – reportedly possessing 500,000 Bitcoins – opted for a distinct strategy. The financial titan boosted its Bitcoin reserves by $750 million just a day later, demonstrating faith in the digital asset’s long-term potential, even amidst fluctuating prices in the recent market.

Based on BeInCrypto’s research, the significant increase in BlackRock’s Bitcoin holdings played a key role in allowing the cryptocurrency to reevaluate around $100,000 following a brief dip to $97,000. However, an important question arises: Could Bitcoin continue to climb further?

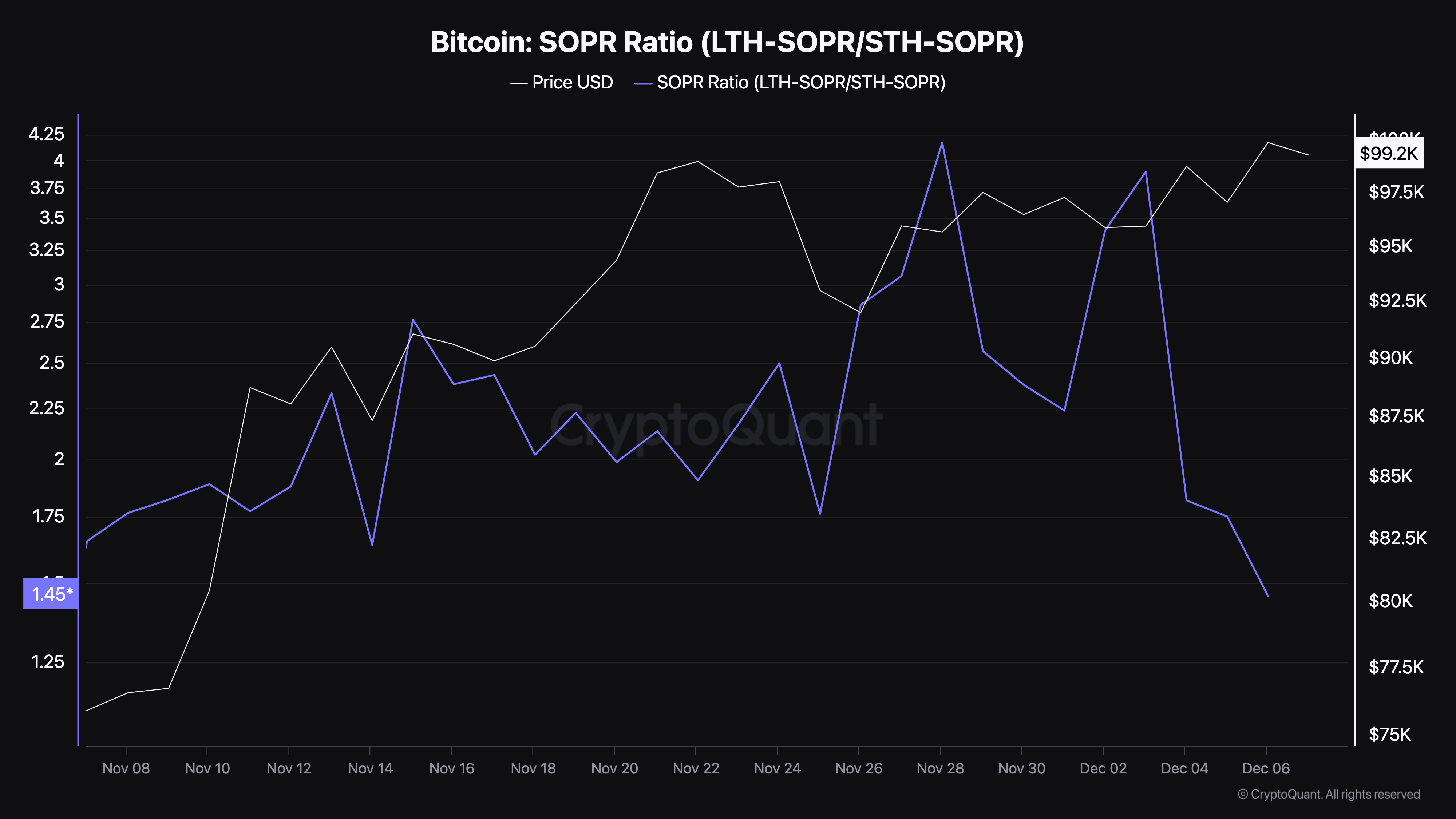

A method for predicting if Bitcoin’s value will keep rising could involve examining the SOPR, which stands for Spent Output Profit Ratio. This ratio is calculated by dividing the profits accrued by Long-Term Holders (LTH) by those held by Short-Term Holders (STH).

When the ratio is greater, it suggests that Long-Term Holders (LTHs) are earning more in returns compared to Short-Term Holders (STHs). In other words, this situation often indicates that the price is approaching a local or market peak. Interestingly, CryptoQuant reports that Bitcoin’s Spent Output Profit Ratio (SOPR) has decreased to 1.45, which implies that Short-Term Holders currently have an advantage. This suggests that the price might be moving closer to its bottom rather than reaching a top.

Should this trajectory persist, there’s a possibility that Bitcoin’s value could climb above $100,000 in the upcoming weeks.

BTC Price Prediction: $100,000 Could Just Be the Start?

Looking at it technically, Bitcoin’s price is currently moving inside a symmetrical triangle over a 4-hour timeframe. This triangle shape indicates a phase of consolidation, during which the price fluctuates between lines that are gradually converging. After this period, a breakout (an upward movement) or breakdown (a downward movement) may occur.

A dip beneath the lower boundary usually signals the commencement of a downward trend (bear market), whereas crossing over the upper boundary usually initiates an upward trend (bull market).

Additionally, the Chaikin Money Flow (CMF) currently indicates a strong buying trend, suggesting significant buying activity. If BlackRock’s Bitcoin holdings continue to grow and this buying pressure persists, the Bitcoin price may potentially reach $103,649.

Under an optimistic outlook, it’s possible that the value of Bitcoin may reach as high as $110,000. But if major players like Grayscale keep offloading large amounts, this bullish projection might not materialize. Instead, we could see Bitcoin’s price dipping to approximately $93,378.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- 30 Best Couple/Wife Swap Movies You Need to See

- PENGU PREDICTION. PENGU cryptocurrency

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- The Last Of Us Season 2 Drops New Trailer: Premiers April On Max

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- ANDOR Recasts a Major STAR WARS Character for Season 2

- In Conversation With The Weeknd and Jenna Ortega

- Scarlett Johansson’s Directorial Debut Eleanor The Great to Premiere at 2025 Cannes Film Festival; All We Know About Film

- All Hidden Achievements in Atomfall: How to Unlock Every Secret Milestone

2024-12-08 00:59