Cryptocurrency is increasingly becoming a part of everyday economics, moving past specialized groups. The latest report from financial company Bitwise supports this trend.

The survey provides valuable information about the methods American financial advisors are using to incorporate cryptocurrencies into their clients’ investment portfolios, as well as their strategies for the future.

Crypto Becomes Mainstream: 56% of Advisors More Likely to Invest

Between November 14 and December 20, 2024, the survey we carried out shows a notable change in how financial advisors view and handle cryptocurrencies.

The 2024 U.S. elections have sparked a notable surge in financial advisors’ interest in cryptocurrencies, with approximately 56% of those polled indicating that the election results made them more inclined to invest in digital currencies by the year 2025.

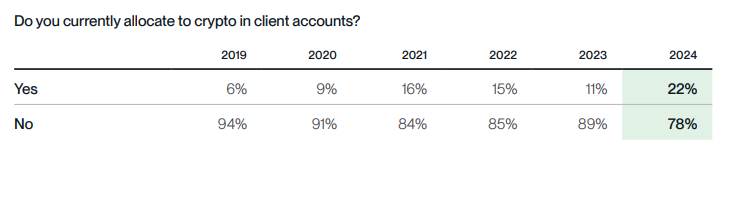

There’s been a significant rise in financial advisors adding cryptocurrencies to their clients’ investment portfolios. In the year 2024, as many as 22% of these advisors admitted to including crypto in client accounts, marking a substantial jump from only 11% the previous year.

Based on a recent poll, client interest in cryptocurrencies has reached an all-time high. Moreover, an astounding 96% of financial advisors mentioned fielding queries regarding cryptocurrency from their clients in the year 2024.

Almost all financial advisors who are currently invested in cryptocurrencies anticipate keeping or growing their crypto investments by the year 2025.

If there was any uncertainty about 2024 being a significant turning point for cryptocurrency, this year’s survey has cleared it up. Financial advisors are recognizing the potential of cryptocurrency more than ever before and are investing in it at unprecedented levels. What’s even more astounding is that there’s still plenty of room for growth, as two-thirds of all financial advisors – who guide millions of Americans and manage trillions of dollars in assets – have yet to be able to invest in cryptocurrency on behalf of their clients, according to Bitwise CIO Matt Hougan.

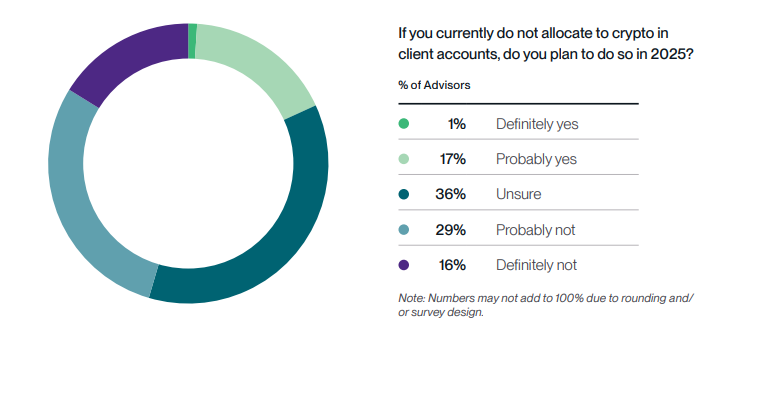

Additionally, approximately one out of five financial advisors who initially shied away from cryptocurrency investment have expressed a strong intention or likelihood of investing in digital assets for their clients, representing a significant jump from the 8% reported in 2024.

Although cryptocurrency is becoming more popular, acquiring it still presents difficulties. In fact, just 35% of financial advisors are able to buy crypto directly within their clients’ accounts, indicating an obstacle that could slow down broader acceptance.

By the year 2025, it’s expected that Crypto Equity ETFs will continue to be the preferred method for investors to gain access to the crypto market. This trend is driven by a rising curiosity towards investment tools that offer exposure to the overall crypto market, rather than single cryptocurrencies.

As a researcher, I’ve noticed a noticeable decrease in the level of apprehension surrounding regulatory uncertainties, compared to past years. In 2024, for instance, half of the advisors identified regulatory hurdles as a significant impediment, which is a drop from approximately 60-65% in earlier surveys. This trend indicates that we might be moving towards greater clarity.

Furthermore, we conducted a study on 400 financial consultants, encompassing independent registered investment advisors, broker-dealer agents, financial planners, and wirehouse representatives spread throughout the United States.

Read More

- Gold Rate Forecast

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Are Billie Eilish and Nat Wolff Dating? Duo Flames Romance Rumors With Sizzling Kiss in Italy

- Tom Hiddleston and Wife Zawe Ashton Announce Second Pregnancy, Know Couple’s Relationship Timeline

- Is Justin Bieber Tired of ‘Transactional Relationship’ with Wife Hailey Bieber? Singer Goes on Another Rant Raising Concerns

- Justin Bieber Tells People to ‘Point at My Flaws’ Going on Another Rant, Raises Alarm With Concerning Behavior

- Resident Evil 9: Requiem Announced: Release Date, Trailer, and New Heroine Revealed

- Summer Game Fest 2025 schedule and streams: all event start times

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

2025-01-10 08:41