As a seasoned analyst with over two decades of experience in the financial markets, I’ve witnessed countless trends come and go. However, the growing trend of Bitcoin treasury adoption among corporations is one that has truly piqued my interest.

As an analyst, I am excited to share that our team at Bitwise is planning to debut a fresh Exchange-Traded Fund (ETF) called the “Bitcoin Standard Corporations ETF.

As a dedicated researcher, I’m keenly observing developments in the financial sector, and one such intriguing development is the filing by Strive, a company I have great interest in due to its co-founder Vivek Ramaswamy, for a new Exchange Traded Fund (ETF). This innovative ETF, christened the Bitcoin Bond ETF, promises to be another exciting addition to the financial landscape.

The Growing Trend of Bitcoin Treasury Adoption Among Corporations

December 27 saw Bitwise, a company specializing in asset management, submit a registration with the U.S. Securities and Exchange Commission (SEC) for a new exchange-traded fund (ETF). This ETF, titled “The Bitcoin Standard Corporate ETF,” is designed to invest in corporations that have significant amounts of Bitcoin as part of their financial reserves.

As per the submission to the SEC, Bitwise is set to oversee and possess the index known as Bitwise Index Services. The upcoming ETF will allocate its investments towards the stocks of companies that are part of this index.

Alongside the requirement that companies should possess at least 1,000 Bitcoins, Bitwise additionally assesses various financial aspects when selecting the companies for its index. These criteria encompass additional financial conditions as well.

- A minimum market capitalization of $100 million.

- Average daily liquidity of at least $1 million.

- A publicly traded free float of under 10%.

This action taken by Bitwise aligns with an expanding pattern where more corporations are managing Bitcoin reserves as part of their business strategies.

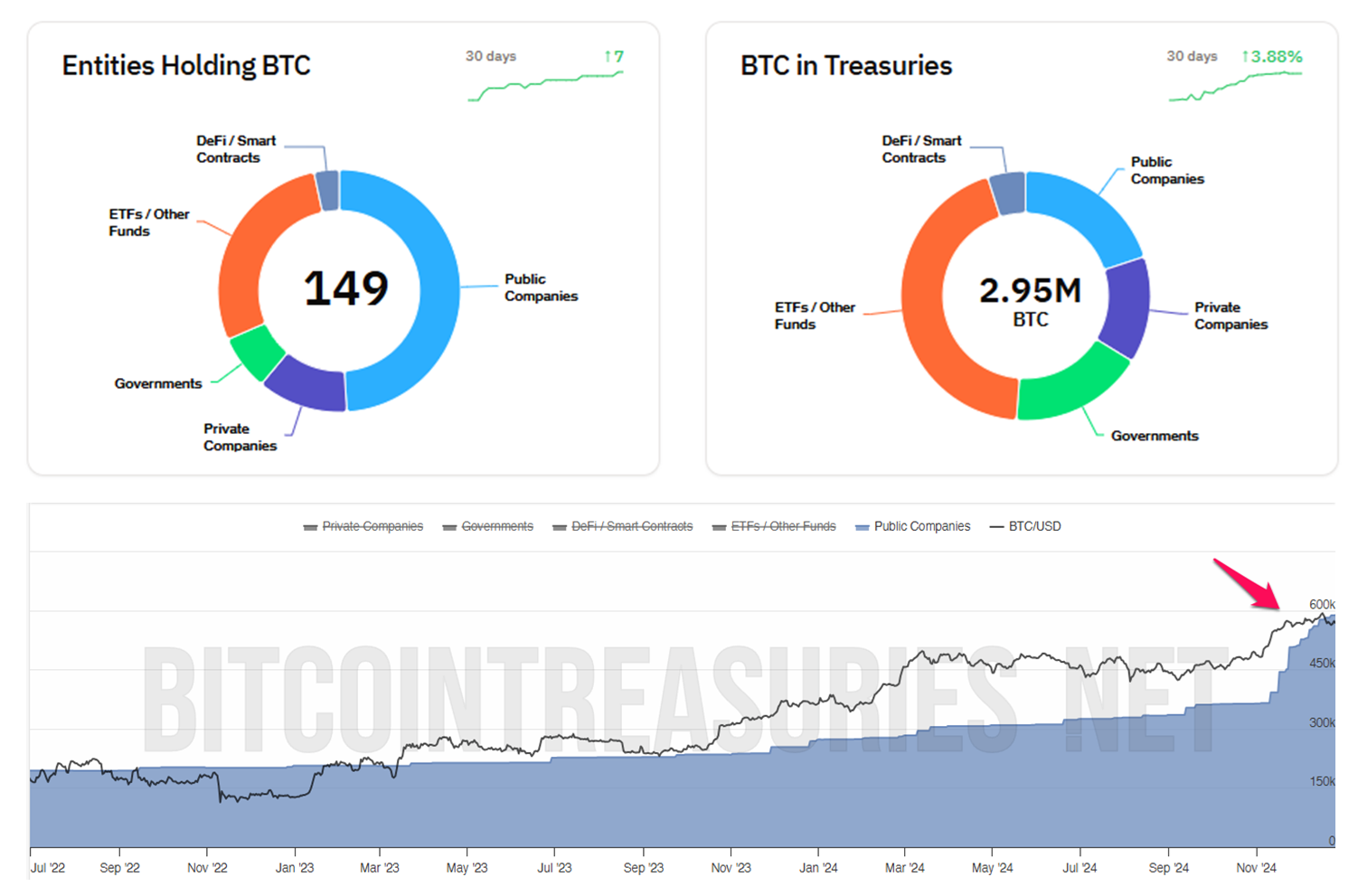

As a crypto investor, I’ve recently noticed an interesting trend: Nearly half (about 49%) of all Bitcoin entities are publicly listed companies, with 73 out of 149 falling into this category. Over just the past two months, this percentage has grown by a substantial 60%. This means that these companies now collectively hold approximately 587,687 Bitcoins, which equates to a significant 20% of the total Bitcoin supply held by all entities.

In recent times, various firms outside the crypto sector have been actively investing in Bitcoin. Companies spanning industries such as biotech, pharma, sports, cloud services, video sharing, and more – think Rumble, Anixa Biosciences, Interactive Strength, Hoth Therapeutics, Nano Labs, Solidion Technology, and Cosmos Health – have declared their Bitcoin purchases. Notably, the value of these companies’ stocks surged after such announcements.

Nate Geraci, President of The ETF Store, noted that the contagion of a virus affecting Bitcoin’s treasury functions is on the rise.

Furthermore, Vivek Ramaswamy’s asset management firm, Strive, has submitted an application for a Bitcoin Bond Exchange-Traded Fund (ETF). This ETF aims to invest in convertible bonds issued by companies that Strive anticipates will primarily or entirely use the funds from these bonds to acquire Bitcoin, which are known as “Bitcoin Bonds.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Summer Game Fest 2025 schedule and streams: all event start times

2024-12-27 11:27