Right-o!

₿ goes BOOM! 🚀 $200K by ’25?! 🤯

The root of the matter, you see, is that Uncle Sam’s coffers are emptier than a politician’s promises, and that bounder Trump seems intent on making matters worse by chucking a petrol bomb into the proceedings. 💸🔥

According to the chaps at Bitwise, in their latest crypto gazette, the fiscal shenanigans in the U.S. – what with the national debt looking like an over-inflated soufflé and Trump’s latest wheeze, the “One Big Beautiful Bill Act,” threatening to bankrupt the Treasury – are just the ticket to send Bitcoin off to the races. A bull run, they call it, fit to make one’s monocle pop! 😮

Bitcoin as the Anti-Dollar

If Trump’s tax jiggery-pokery actually comes to pass (and let’s face it, there’s a chance he’ll be back in the Oval Office, dusting off the furniture in 2025), the government will be splashing out more cash than it’s raking in. The number-crunchers at the Congressional Budget Office reckon that interest payments on the national debt will triple to a staggering $3 trillion by 2030, turning America’s debt situation into a swirling vortex of doom. 🌀

And that, my friends, is precisely the sort of pickle that Bitcoin was invented to deal with. Like a soothing cup of tea in a world gone mad. ☕

“Bitcoin’s scarcity and resilience position it uniquely to benefit from both fiscal instability and improving market sentiment,” scribbled the Bitwise boffins. Translation: Bitcoin is Plan ₿. 🧐

Musk vs Trump = BTC Dip Buying Opportunity

Recent market antics rather confirm Bitcoin’s tendency to react to political dramas like a cat to a cucumber. When Elon Musk took a swipe at Trump’s “One Big Beautiful Bill” the other day, a social media dust-up ensued, Bitcoin took a temporary tumble of 6% to around $100K, and then bounced back faster than you can say “Bob’s your uncle” as the short-sellers got their comeuppance. 🤣

Bitwise suggests this is further proof that Bitcoin is now a macro hedge – less “risky investment,” more “digital insurance policy against the U.S. Treasury.”

Technical analyst Rekt Capital noted that Bitcoin had a “Phenomenal Daily candle yesterday, breaking through ~$106,600 (black) resistance comfortably In fact, Bitcoin has skipped through the $106,600-$109,443 Daily Range entirely (black-black) Bitcoin is once again positioning itself like in late May for a retest (green circle) Retest is now in progress and a Daily Close above $109.443 (red) would enable a revisit of the final Daily resistance before new All Time Highs (red $111,723)

Meanwhile, Bitwise’s top dog, Matt Hougan, is sticking to his guns about that price target. In a recent chin-wag with Cointelegraph, he mentioned that the surge in institutional interest after the ETF approvals is causing a Bitcoin shortage. “We think the market is underestimating how little BTC is actually for sale,” Hougan declared. 🤔

Tether Goes Cypherpunk: Plans Open-Source Bitcoin Mining OS to Cut Out the Middlemen

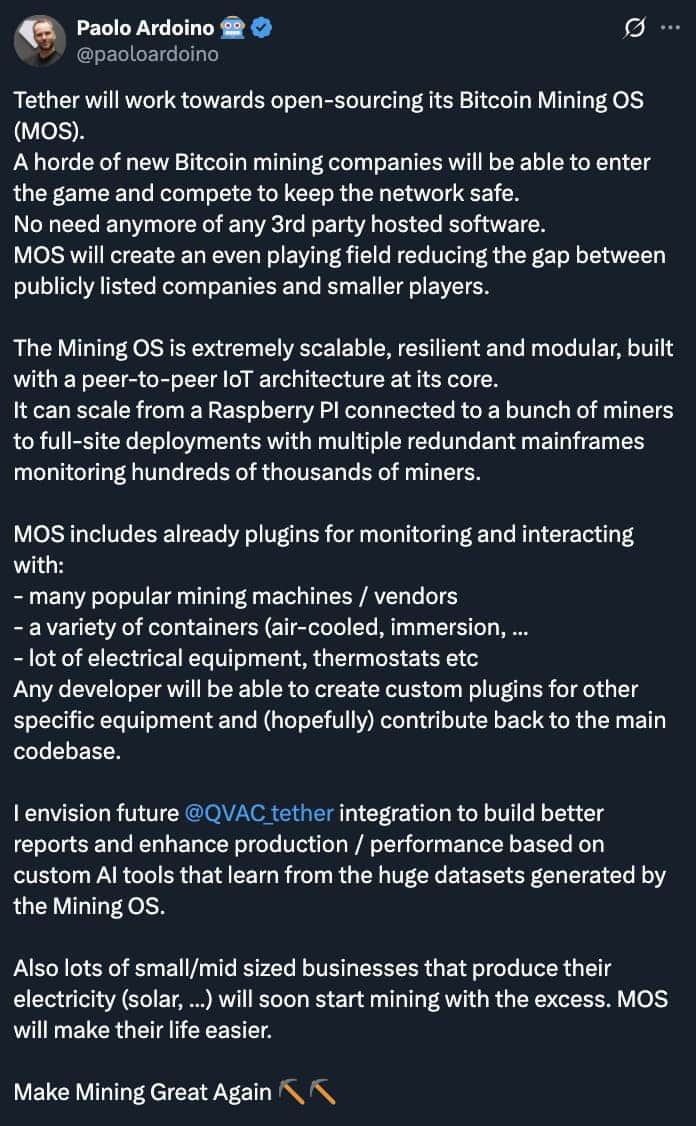

Tether, that behemoth behind USDT, is apparently keen to stir things up in yet another corner of the crypto world – this time, aiming its sights at the very foundations of the thing. CEO Paolo Ardoino has let it be known that Tether is beavering away on an open-source Bitcoin mining operating system – grandly named “Moria” (or just “MOS” for those who prefer brevity) – which should be ready by the end of 2025. 🛠️

The purpose of this exercise? A direct hit at the closed-shop world of overpriced mining software. Ardoino’s message is crystal clear: the Bitcoin mining game needs a bit of democratization – and the current vendors are surplus to requirements.

“A horde of new Bitcoin mining companies will be able to enter the game and compete to keep the network safe,” Ardoino announced on X, sounding rather like the ghost of Satoshi himself. 👻

Peer-to-Peer by Design

According to Ardoino, the MOS is being built from scratch to be adaptable, expandable, and peer-to-peer – making good use of Internet of Things technology. This means it should play nicely with all sorts of mining setups, from shipping containers to off-grid power systems and other Heath Robinson contraptions favored by independent miners. ⚙️

Tether’s grand plan is to make mining software available to all, giving the smaller players a fighting chance against the big boys like Bitmain and MARA.

Why It Matters: The Battle for Mining Sovereignty

The mining world today is dominated by the chaps with the deepest pockets, the cheapest electricity, and the advantages that come with being enormous. This leaves the smaller, aspiring miners stuck on the sidelines, dependent on the big vendors for software and control.

Tether’s move to open-source MOS is both a philosophical statement and a strategic maneuver – betting that the next wave of mining growth will come not from the mega-farms, but from the smaller, more agile miners armed with better tools.

It also continues Tether’s push for decentralization, following their partnership with the Ocean mining pool in April to decentralize block-building by throwing their weight behind the open protocol.

AI Is the New Crypto? Not So Fast

Meanwhile, the mining fraternity is divided on where their future lies. Since the halving, many have turned to AI infrastructure to keep the lights on. Hive Digital, for example, is now making more money from AI than from Bitcoin mining – and they’re not alone. 🤖

“Institutions are much more interested in us with our AI than Bitcoin,” Hive chairman Frank Holmes told Cointelegraph.

And yet, some miners are doubling down on Bitcoin. Cango, for instance, has ditched its old businesses and piled $100 million into BTC in just a couple of months, proving that focusing on mining can still pay off – if you know what you’re doing.

Tether’s open-source MOS could be a game-changer, lowering the barriers to entry for new miners and shifting the balance of power away from the established players. If Bitcoin is digital gold, then mining software is the pickaxe – and Tether has just handed everyone a free one. ⛏️

Read More

2025-06-10 22:56