As a seasoned crypto investor with a few battle scars to show for it, I must say that the latest news about Bitwise Investments considering an XRP ETF has me both hopeful and cautious. The memory of the BlackRock fake filing fiasco is still fresh in my mind, so I’ll hold off on popping the champagne just yet.

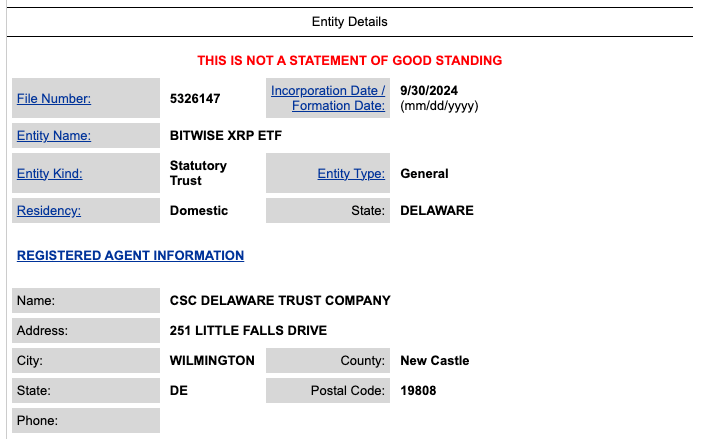

Bitwise Investments has initiated the initial process for a possible XRP-based exchange-traded fund (ETF), making a filing on September 30, 2024 in Delaware. The filing was acknowledged by a representative from Bitwise to Cointelegraph and is registered with the State of Delaware’s Division of Corporations. Yet, this action seems to be an early step, and it might take several months before a formal application is submitted to the U.S. Securities and Exchange Commission (SEC), if it happens at all.

Based on Ana Paula Pereira’s report for Cointelegraph, this latest development follows Brad Garlinghouse’s earlier predictions, made during the Consensus 2024 conference in May, that an XRP Exchange-Traded Fund (ETF) was imminent. If given the green light, this XRP ETF would offer institutional investors a safe and regulated method to invest in cryptocurrency, which could increase trading activity and popularity.

The Cointelegraph report highlights that while the Delaware filing is a substantial initial move, it doesn’t guarantee an immediate Securities and Exchange Commission (SEC) application. As per the report, the process might still be in its early stages, and if a formal filing occurs, it could take several months to materialize.

This news also stirs memories of the fake filing in November 2023 when an application for a “BlackRock iShares XRP Trust” briefly fueled XRP price gains of 12% before being debunked. Delaware authorities are still investigating that incident.

Currently, Ripple is engaged in an ongoing legal dispute with the SEC. Although a court decision from July 2023 classified XRP as not a security for public trading platforms, a recent appeal filed in September 2024 has temporarily halted the final judgment, leaving the ultimate resolution of the case uncertain.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- 30 Best Couple/Wife Swap Movies You Need to See

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Every Minecraft update ranked from worst to best

- Ncuti Gatwa Exits Doctor Who Amidst Controversy and Ratings Crisis!

- USD ILS PREDICTION

- 9 Kings Early Access review: Blood for the Blood King

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

2024-10-02 11:09