As a seasoned crypto investor with over a decade of experience navigating the digital asset landscape, I find the recent news about Bitwise’s proposed Solana ETF incredibly intriguing. Having seen the rise and fall of numerous projects, I’ve learned to read between the lines when it comes to regulatory filings and industry sentiment.

Bitwise Asset Management is seeking to create a trust based in Delaware for their planned Solana Exchange-Traded Fund. This action indicates a fresh drive to broaden their cryptocurrency options as there’s increasing demand for blockchain-related assets.

Based on my extensive background in finance and past experiences with similar projects, I believe this documentation outlines the initial actions needed to introduce a new financial tool into the market. It seems to me that if everything goes as planned, it could potentially lead to the submission of this proposal to the US Securities and Exchange Commission (SEC) for their approval.

Bitwise Plans Strategic Expansion With Solana ETF

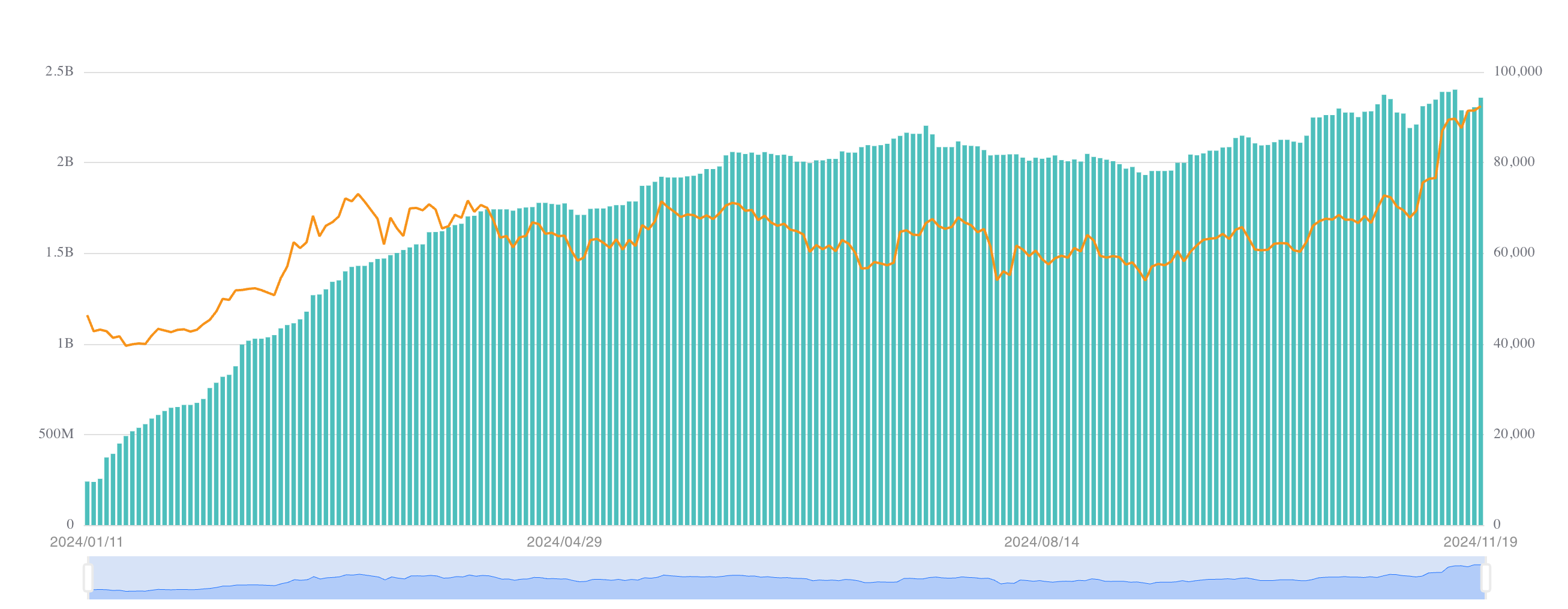

Based on state department records, the Bitwise Solana ETF proposal aims to mirror the value of Solana (SOL). This action is a part of Bitwise’s wider growth plan and occurs after the company experienced an impressive 400% increase in managed assets this year. At present, Bitwise manages at least $5 billion in assets.

In recent times, significant additions like the Ethereum staking service Attestant and the prosperity of Bitwise’s BITB Bitcoin ETF underscore a swift growth trend for the company. It is worth mentioning that Bitwise’s BITB has garnered a massive $2.3 billion in investments. Additionally, its Ethereum ETF (ETHW) is currently experiencing positive inflows amounting to $373 million.

Even though Bitwise hasn’t specified a ticker or exchange for listing yet, their Solana ETF application places them among competitors such as VanEck, 21Shares, and Canary Capital. These entities have also expressed interest in capitalizing on Solana’s rising popularity, with VanEck comparing Solana to digital assets like Bitcoin and Ethereum in their filing.

As a crypto investor, I find that the classification of Ethereum (ETH) as a commodity in the Ethereum ETF proposal holds true for Solana as well. This perspective, shared by Mathew Siegel, head of research at VanEck, makes perfect sense to me.

Progress is being made with the filing, but getting regulatory approval for a Solana ETF may face obstacles. The Securities and Exchange Commission (SEC) has traditionally examined crypto ETFs closely due to worries over market manipulation, custodial risks, and determining the nature of assets such as Solana. Experts in the industry have cast doubt on the likelihood of an immediate SEC approval for a Solana ETF, given past submissions where Solana’s classification as a commodity has been brought into question.

In addition, applications for Solana ETFs had been withdrawn from the CBOE (Chicago Board Options Exchange) because of ongoing regulatory issues. These uncertainties significantly lowered the chances of approval to virtually nothing earlier in the year, leading to doubt among market players.

Renewed Hope Under Trump Administration

With Donald Trump’s re-election, there seems to be a shift in direction within the industry, as many view it as a possible trigger for the crypto sector. Trump’s administration is showing signs of being pro-crypto, which could lead to policies that foster a more inviting regulatory landscape for ETFs like the one proposed by Bitwise.

Analysts believe that Trump’s focus on promoting innovation and minimizing red tape might pave the way for the Securities and Exchange Commission (SEC) to endorse more Cryptocurrency Exchange Traded Funds (ETFs), which could potentially include investment options centered around Solana.

Dan Jablonski, head of growth at Syndica, stated that the most significant victory for Solana could stem from a new Trump Presidency, potentially resulting in the long-desired ETF (Exchange Traded Fund) between 2025 and 2026. Unsurprisingly, it’s the talented VanEck team who are set to spearhead this endeavor, with backing from 21Shares and Canary Capital.

Should the Solana ETF receive approval, it signifies a potential transformation in the U.S. regulatory landscape. Essentially, this would allow the United States to align itself with countries such as Brazil, which introduced a Solana ETF earlier in 2022. These advancements could bolster the U.S.’s standing as a key player in the international cryptocurrency market.

If an Exchange Traded Fund (ETF) based on Solana were to be approved during the Trump administration, it might lead to significant changes within the U.S. cryptocurrency sector. This could ignite increased institutional investment, stimulate technological advancements, and potentially establish the nation as a frontrunner in blockchain technology development.

Furthermore, this could indicate a more welcoming regulatory landscape for cryptocurrency, possibly enticing additional investment, skilled personnel, and even an XRP Exchange-Traded Fund (ETF), with Bitwise and Canary Capital being among the early contenders.

Beyond the crypto index fund upgrades from Grayscale and Bitwise, there are presently spot ETF applications for SOL, XRP, and HBAR. It’s likely that at least one issuer will attempt an ETF for ADA or AVAX as well, according to Nate Geraci on Twitter.

Based on information from BeInCrypto, the price of Solana’s powering token has risen by approximately 1.48% due to recent developments. At present, one SOL is being traded for around $238.91.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- PENGU PREDICTION. PENGU cryptocurrency

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- All 6 ‘Final Destination’ Movies in Order

- Clair Obscur: Expedition 33 – All Act 3 optional bosses and where to find them

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- Clair Obscur: Expedition 33 – Every new area to explore in Act 3

- 30 Best Couple/Wife Swap Movies You Need to See

- The Last Of Us Season 2 Drops New Trailer: Premiers April On Max

2024-11-21 11:11