So, here’s the deal. BitMine Immersion Technologies – you know, the world’s biggest Ethereum hoarder, controlling like 2.9% of the whole network’s ETH – just had a little shake-up, and it’s a big one. They’ve gone and appointed Chi Tsang as the new Chief Executive Officer, booting Jonathan Bates out. I know, shocking. But wait, there’s more. They’ve also brought in a whole crew of fresh faces to the board: Robert Sechan, Olivia Howe, and Jason Edgeworth. Sounds like a fun bunch.

🧵BitMine is pleased to announce management and Board appointments:

– new CEO, Chi Tsang

3 independent board members:- Rob Sechan @RobSechan , CEO of @NewEdgeWealth – Jason Edgeworth, CIO of JPD Holdings- Olivia Howe, Chief Legal Officer of RigUp

Together, these additions…

– Bitmine (NYSE-BMNR) $ETH (@BitMNR) November 14, 2025

This little power shuffle is one of the biggest changes BitMine has seen since they hit the big leagues on the NYSE. And it’s happening right when they’re hell-bent on their big, bold goal of owning 5% of the total ETH supply. Yeah, 5%. You heard that right.

In the official announcement (which, honestly, felt like they were pitching a movie), BitMine’s chairman Tom Lee made sure to emphasize that this new exec team is dripping with expertise. We’re talking tech, DeFi, banking, and legal know-how. Tom compared it to the telecom and internet boom of the ’90s. I mean, sure, why not? Why not throw in a little nostalgia while we’re at it? Classic move.

And new CEO Chi Tsang? He’s already on the “generational opportunity” hype train, because who wouldn’t be when you’re eyeing 5% of Ethereum? Big plans, big dreams.

As for Jonathan Bates – the outgoing CEO? He’s patting himself on the back for taking the company from a scrappy startup to the world’s largest corporate ETH holder. He’s pretty sure the new team can scale things up. And I guess, after all, if they can pull off 5%, what’s next? 10%? At this rate, who’s stopping them?

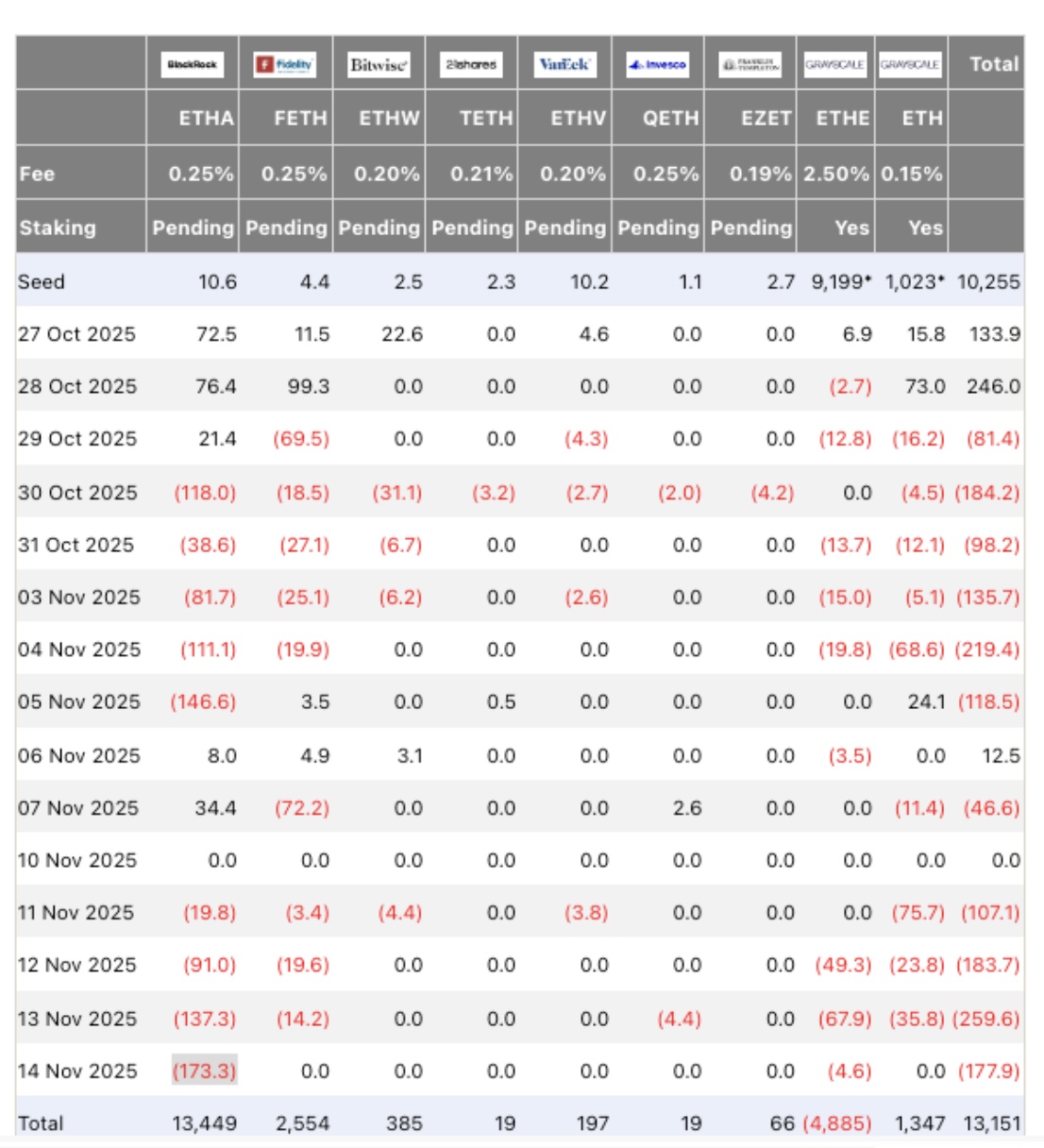

Ethereum ETF Flows, Saturday, Nov 15, 2025 | Source: FarsideInvestors

Meanwhile, things are looking a little… bleak for Ethereum-linked funds. I mean, it’s not great. U.S. Ethereum ETFs had a rough week, with a whopping $728.3 million in net outflows. And BlackRock’s Ethereum ETF? Ouch. A $173.3 million withdrawal on Friday alone. What a mess. ETH even dropped 5% that day, chilling just above $3,200. It’s like everyone’s freaking out about these ETF withdrawals, flooding the market, and making things more unpredictable than usual.

And BitMine’s sitting pretty with a cool 3,505,723 ETH haul – which, if you’re keeping track, is about $11.2 billion at current prices. Not bad for a rainy day, right?

Ethereum Price Forecast: Can ETH Hold $3,200 as Momentum Weakens Into December?

Okay, so here’s the real tea. ETH’s price? Not looking great. It’s had a tough time, especially with all the ETF outflows coinciding with a technical rejection at key moving averages. Translation: it’s been a bumpy ride. On the daily chart, ETH price plummeted below both the 50-day and 100-day moving averages. Now, it’s just hanging out near the 200-day line, trying to hold $3,200. Classic Ethereum move, right? Just keep holding on, like it’s on a roller coaster that won’t stop.

Oh, and let’s not forget – after failing to reclaim the 50-day average back when it was near $3,912, Ethereum’s chances of bouncing back are slimmer than ever.

Ethereum (ETH) Price Forecast | TradingView

Now, the Breakout probability ratio is giving Ethereum a 29% shot at getting back to $3,250. But let’s be real – a 54% chance of falling to $3,000 is a lot more likely. Sorry, folks, but it’s not looking like a strong rally. The 50-day MA? It’s way out of reach unless some big institutional players step in and start throwing some cash around.

Ethereum’s RSI is stuck at a depressing 36, just above the oversold zone. Translation: no one’s buying. And even if it does get a little boost, the RSI isn’t exactly screaming “buy me!” So, yeah, the bearish vibes are real.

If Ethereum breaks below the 200-day average, we’re talking $3,050, maybe even $2,850. If you’re lucky, there’s some stronger support down there. But honestly, who’s really betting on that?

But hey, if the ETF outflows slow down and ETH can hold $3,200 like it’s got something to prove, maybe we’ll see a recovery to $3,450. But unless the ETF drama clears up, getting back to the 50-day MA? That’s about as likely as me winning the lottery.

Read More

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- EUR UAH PREDICTION

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Silver Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- Gold Rate Forecast

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2025-11-16 04:34