As a seasoned researcher with years of market analysis under my belt, I can’t help but feel a mix of excitement and caution when it comes to Bitget Token (BGB). While I’ve witnessed its impressive rally setting new all-time highs almost daily, recent indicators are flashing signs that the bullish momentum might be cooling off.

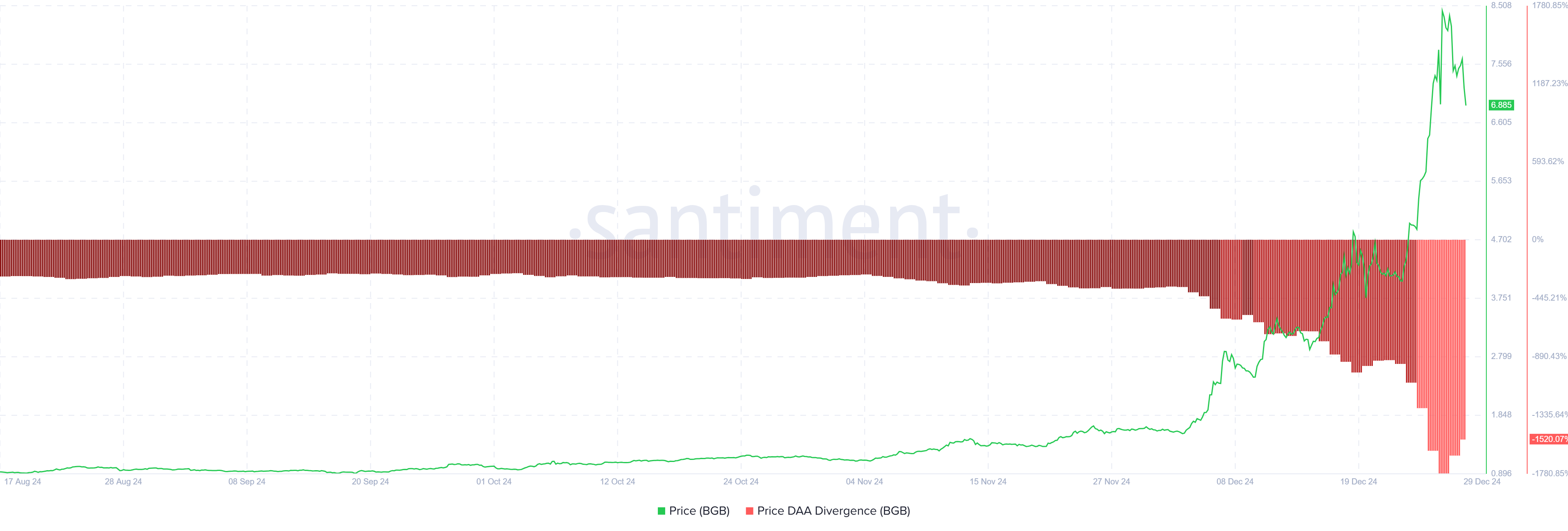

The Price DAA Divergence indicator, which has been silent for four months, is now raising a sell signal. This could potentially lead to increased selling pressure as investors reassess their positions. The pullback in participation could dampen BGB’s ability to sustain its upward momentum, leaving the token more susceptible to short-term corrections.

However, I’ve learned that every bearish trend comes with an opportunity for growth. Historically, BGB has demonstrated strong recoveries whenever its correlation with Bitcoin improves following a low. While the negative correlation poses a short-term challenge, it also provides an opportunity for BGB to decouple and carve its path based on unique market conditions.

Looking at the current price action, a decline seems imminent. If the drawdown continues, BGB could slip to test the $4.90 support level. But as they say in the crypto world, “Bear markets are just opportunities to plant trees.” A strong recovery supported by bullish broader market cues could push BGB beyond its current ATH of $8.49, solidifying its position as a standout performer in the market.

On a lighter note, remember when I predicted Dogecoin‘s meteoric rise back in 2021? Well, if my prediction for BGB turns out to be accurate, maybe next time I’ll predict the lottery numbers!

As a crypto investor, I’ve been thrilled to witness the phenomenal surge of Bitget Token (BGB). Nearly every day for the past month, it has been reaching and even surpassing new record highs, setting an impressive trend indeed.

On the other hand, recent signs point towards a possible slowdown in the bullish trend, which could result in heightened selling activity as investors reconsider their holdings.

Bitget Token May Face Selling

The DAA Divergence indicator is showing its first warning to sell for the past four months, causing some uncertainty about whether BGB’s upward trend can continue. This signal arises from a significant decrease in investor involvement, as many are choosing to stay on the sidelines and watch market movements during the new year period.

As a crypto investor, I’ve noticed a decrease in participation that could potentially hamper BGB’s continued uptrend. It’s reasonable for investors to tread cautiously after such substantial growth, but this hesitance also exposes the token to short-term corrections, particularly if the broader market starts showing bearish tendencies.

Currently, BGB’s macro momentum is being shaped by its opposite relationship with Bitcoin, which has a correlation coefficient of -0.16. This inverse connection implies that as the price of Bitcoin increases, the trajectory of BGB tends to decrease, and vice versa. If the price of Bitcoin continues to climb, this trend could be troubling for BGB’s growth.

Historically, when the correlation between BGB (asset/market) and Bitcoin strengthens after reaching a low point, it has shown robust recoveries. Although this negative correlation presents a short-term hurdle, it also opens up an opportunity for BGB to break free and define its own trajectory based on distinctive market circumstances.

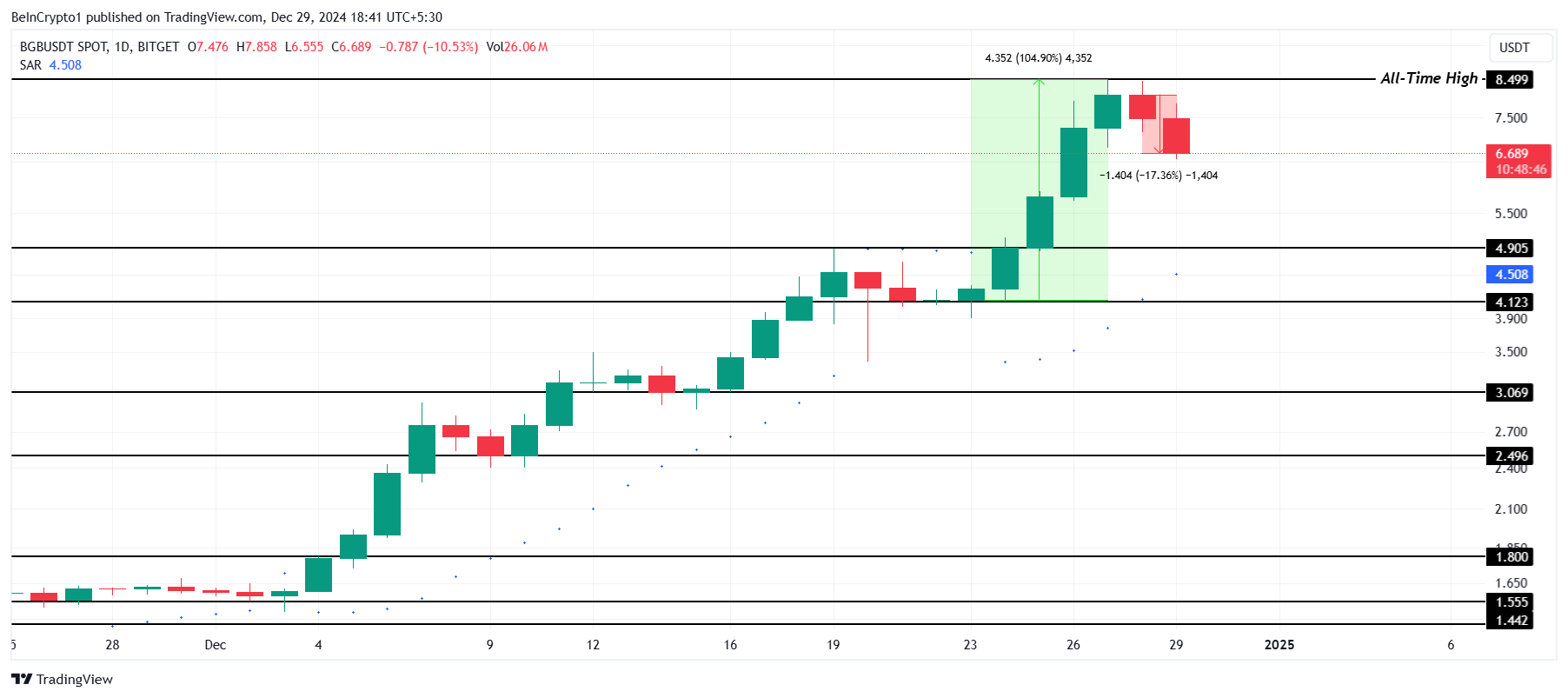

BGB Price Prediction: Going Back to The ATH

The cost of BGB decreased by 17% over the last day, after experiencing a 104% surge during the previous seven days. It seems that this dip is simply a cooling-off phase following a prolonged period of intense growth, and there might be more adjustments in the immediate future.

If the current downtrend persists, British Gaming Coin (BGB) may drop to challenge the $4.90 support zone, potentially undoing a substantial part of its recent advancements. This potential drop might lead to significant selling by investors, which could exacerbate the token’s price decline.

If the broader market shows optimistic signs and recovers strongly, BGB could surpass its current all-time high ($8.49). This new record would contradict the bearish perspective and suggest a fresh wave of momentum for the token, further establishing its dominance in the market.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- 30 Best Couple/Wife Swap Movies You Need to See

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Gold Rate Forecast

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Every Minecraft update ranked from worst to best

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Ncuti Gatwa Exits Doctor Who Amidst Controversy and Ratings Crisis!

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

2024-12-29 21:19