Ah, Bitfinex. The cryptocurrency exchange that just made headlines by slashing trading fees to a whopping zero. Yes, you heard that right-zero! It’s like the Black Friday of crypto trading, but without the long lines and people fighting over flat-screen TVs. 🎉

In what they’re calling a “long-term competitive strategy,” Bitfinex has decided to cut those pesky maker and taker fees. And guess what? This isn’t just a one-time offer; it’s the new default. They’ve thrown open the doors to spot trading, margin trading, derivatives, securities, and even OTC trading on Bitfinex Securities. Just don’t ask them when this glorious free-for-all is going to end. They’re keeping that under wraps, probably because they’ve misplaced the calendar. 🗓️

Now, if you’re sitting there wondering how on Earth they plan to make money without those lovely fees, join the club! Bitfinex claims they have multiple revenue streams, which sounds suspiciously like corporate jargon for “we have other ways to get your money.” They mentioned withdrawal fees and various capital market activities, which is code for “don’t worry, we’ll find a way to charge you.” 💸

“Removing trading fees creates a competitive position. Being recognized as a major exchange that charges no maker or taker fees will encourage increased trading from existing customers, attract new customers who value both low cost and professional infrastructure…”

Oh sure, that sounds great! But let’s be real: folks in the comments section on X (formerly Twitter, but do we really want to dive into that rabbit hole?) are a bit skeptical. One user, under the charming moniker LeeThang.Base.Eth.ink 🌊RIVER 🍊,💊 🫎 (❖,❖), suggested that while zero fees might tighten spreads, we should all brace ourselves for the mysterious hidden costs lurking just around the corner. You know, like that one sock that always disappears in the laundry. 🧦

smart play. zero fees will tighten spreads, but expect hidden costs in funding, withdrawals or flow fees.

– LeeThang.Base.Eth .ink 🌊RIVER 🍊,💊 🫎 (❖,❖) (@minhthang1987) December 18, 2025

Crypto Exchange Competition Intensifies With DEXs

The competition among cryptocurrency exchanges is heating up faster than a microwave burrito. Thanks to the rise of decentralized alternatives, we now have a division of labor: CEXs (centralized exchanges) and DEXs (decentralized exchanges). It’s like choosing between a fancy restaurant and a food truck-you know one is probably going to give you food poisoning, but you still go for it anyway. 🍔

Bitfinex, owned by iFinex Inc. (the same brilliant minds behind Tether, aka the stablecoin kingpin), finds itself in a dog-eat-dog world filled with major players like Binance, Coinbase, and Kraken. Meanwhile, DEXs are popping up like mushrooms after a rainstorm, with names like Uniswap and PancakeSwap making us question whether we’re investing or ordering brunch. 🥞

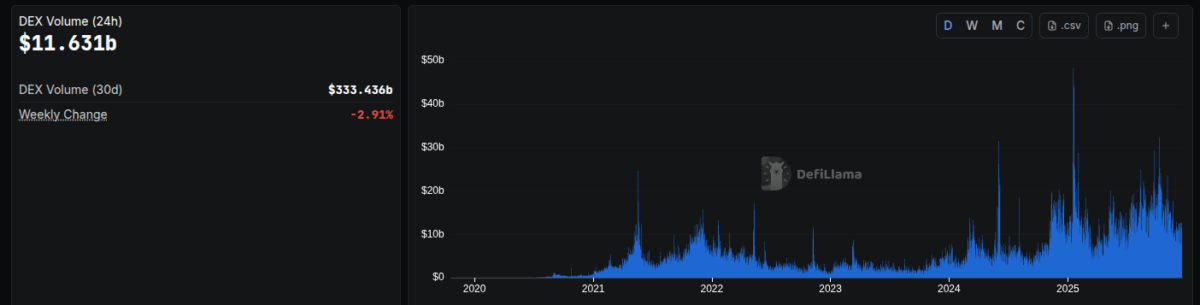

According to DefiLlama, the daily volume in these DEX protocols skyrocketed from nearly zero in 2020 to an impressive $50 billion peak in January 2025. Now, it’s happily settling down at around $11.63 billion-like a toddler finally taking a nap after a sugar rush. 😴

DEX volume (24 hours) as of Dec. 18, 2025 | Source: DefiLlama

So, it seems that Bitfinex and its counterparts are scrambling to come up with new strategies-because nothing says “we’re serious” like a mad dash for market share. With other exchanges like Kraken diving into new revenue streams, we can only sit back and watch this soap opera unfold. Popcorn, anyone? 🍿

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Gold Rate Forecast

- Wuchang Fallen Feathers Save File Location on PC

- Banks & Shadows: A 2026 Outlook

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- QuantumScape: A Speculative Venture

- 9 Video Games That Reshaped Our Moral Lens

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

2025-12-18 23:05