Behold, Singapore’s crypto maestro Jihan Wu, with a flourish of his powdered wig, has divested 943.1 BTC from his corporate treasury, trading it for dreams of AI and data centers. One might call it a financial masquerade, or perhaps a tragicomedy of modern finance.

Bitdeer’s Bitcoin Balance Sheet: A Theatrical Exit

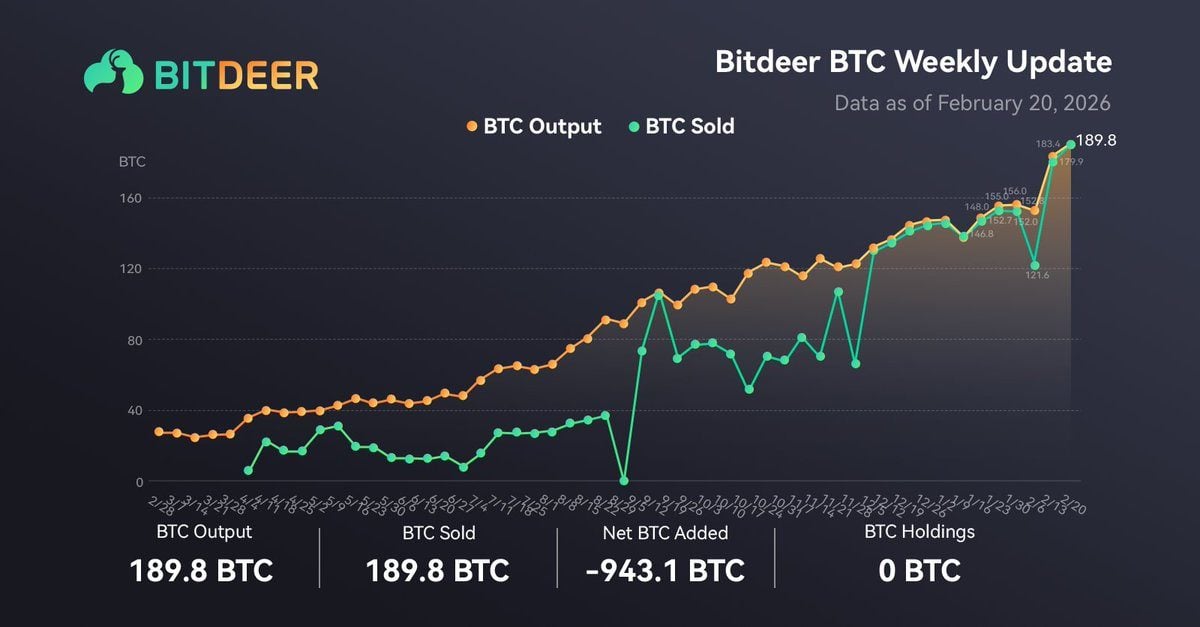

In a weekly missive (read: here), Bitdeer declared its corporate BTC holdings-excluding customer deposits-now zero. The finale? 189.8 BTC mined and 943.1 BTC liquidated, as if staging a grand dénouement. Mon dieu! What a tale of coin-by-coin austerity!

This eight-week odyssey began December 2025, when Bitdeer held 2,017 BTC. Since then, they’ve sold more than they mined, trimming their balance sheet with the precision of a court jester’s scissors. By February, the treasury was but a memory, and the cupboard, bare as a beggar’s pocket.

In January alone, Bitdeer mined 668 BTC but sold 1,155 BTC. By mid-February, reserves dipped below 1,000 BTC, and by week’s end, the curtain fell. Their new strategy? Sell same-day BTC, abandoning the noble art of treasury hoarding. A bold move, or a fool’s errand? Only time will tell.

Once the 51st largest BTC treasury, Bitdeer now ranks… nowhere. Founded by the illustrious Jihan Wu, the company operates data centers in the U.S., Canada, Norway, and Bhutan. A global empire, or merely a stage set for a financial farce?

By 2026, their hash rate soared above 63 EH/s, yet their BTC balance dwindled. To fund their AI ambitions, they’ve raised $325 million in convertible notes and $43.7 million in equity. A financial tragi-comedy, indeed!

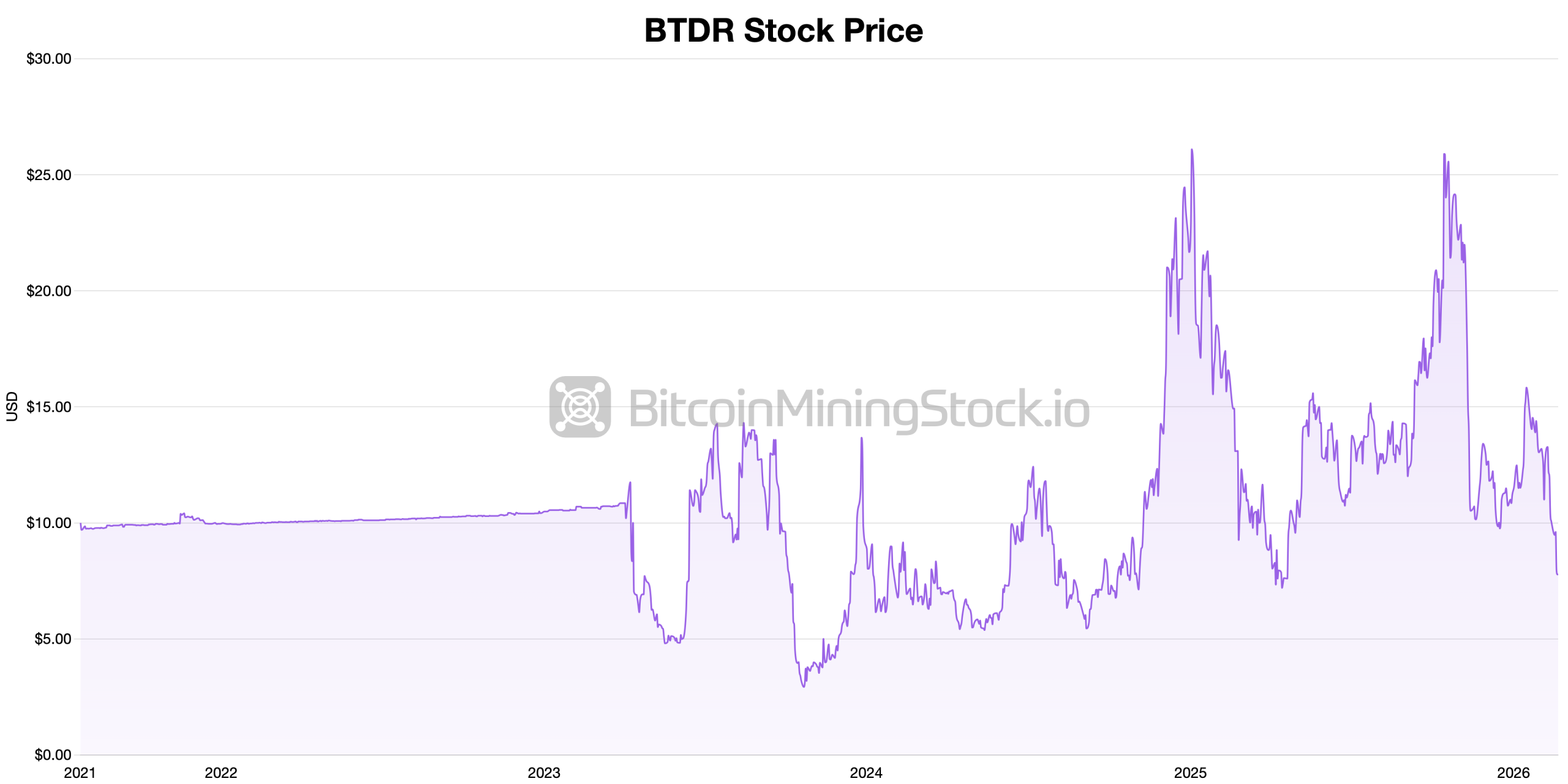

Proceeds? For data centers, AI, ASICs, and “general corporate purposes.” Alas, $135 million will repurchase 5.25% notes due 2029, a maneuver to delay the inevitable. Investors, however, reacted with the enthusiasm of a courtier hearing bad news. BTDR shares fell 22% in a week. A stock plunge worthy of Molière’s Le Bourgeois Gentilhomme!

BTDR’s 12-month slump? A 47% drop. The mining sector, too, now dabbles in AI and HPC. Bitdeer’s BTC liquidation-a surrender or a calculated reset? The jury’s out, but the drama continues.

FAQ 🔎

- Why did Bitdeer sell 943.1 BTC?

Ah, monsieur, the motives are cloaked in mystery. Perhaps to fund AI, data centers, or simply to avoid the “curse of the hoarder.” A financial comedy of errors, if ever there was one! - Does Bitdeer still hold BTC?

As of Feb. 20, nary a BTC remains in their corporate coffers (customer deposits excluded). A treasury reduced to ashes, like a candle snuffed out by a rogue breeze. - How did the market react?

BTDR shares tumbled, as if struck by Cupid’s arrow. Dilution fears and strategic shifts left investors weeping into their tea. A 22% drop in five days? A tragedy, truly! - Is this a permanent BTC exit?

Who knows? Bitdeer was once the 51st largest treasury. Now, it’s a ghost in the DAT lists. A fleeting star, or a phoenix waiting to rise? Only the gods know.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Wuchang Fallen Feathers Save File Location on PC

- Banks & Shadows: A 2026 Outlook

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- QuantumScape: A Speculative Venture

- ETH PREDICTION. ETH cryptocurrency

2026-02-22 20:57