In the dusty corners of the financial world, where the air is thick with uncertainty and the scent of ambition lingers, the Federal Reserve has decided to keep its rates steady. Meanwhile, Bitcoin, that rebellious child of the digital age, clings to its lofty perch above $100,000, much like a cat on a hot tin roof, defying gravity and logic alike. 🐱👤

Jerome Powell, the man with the weight of the economy on his shoulders, has spoken. He’s taken a scalpel to the previous assurances about inflation, leaving investors scratching their heads like chickens in a henhouse. The future of rate cuts now hangs in the balance, swaying like a pendulum, dependent on the whims of the labor market and inflation trends. It’s a game of economic chicken, and the stakes are high. 🐔💰

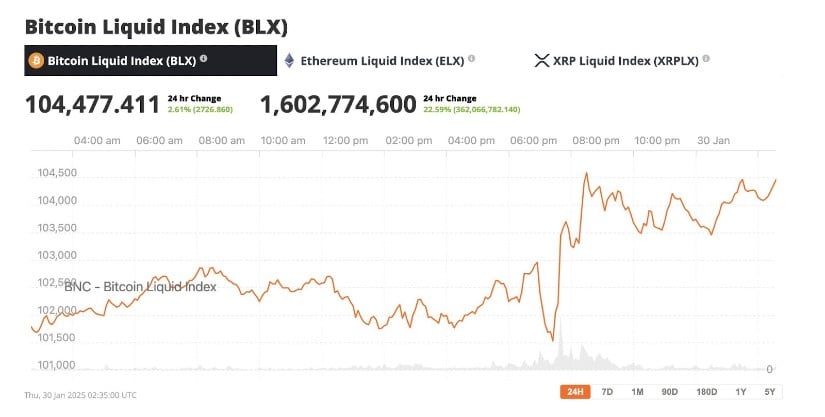

Bitcoin, in its usual dramatic fashion, took a slight tumble, dipping 1% to flirt with $102,000 after the Fed’s announcement. The entire cryptocurrency market, a wild beast in its own right, followed suit, with major players like Solana and XRP taking a nosedive. Yet, Bitcoin, that stubborn creature, has managed to hold its ground above the psychological barrier of $100,000, a number that traders watch like hawks eyeing their prey. 🦅

Bitcoin is holding strong well above $100,000, source Bitcoin Liquid Index

Macroeconomic and Political Considerations

The economic landscape is as tangled as a spider’s web, with the first FOMC meeting under President Trump’s new administration adding a layer of intrigue. Proposed tariffs on our neighbors to the north and south are like a storm cloud on the horizon, casting shadows over market sentiment. The uncertainty is palpable, like waiting for the other shoe to drop. 👢

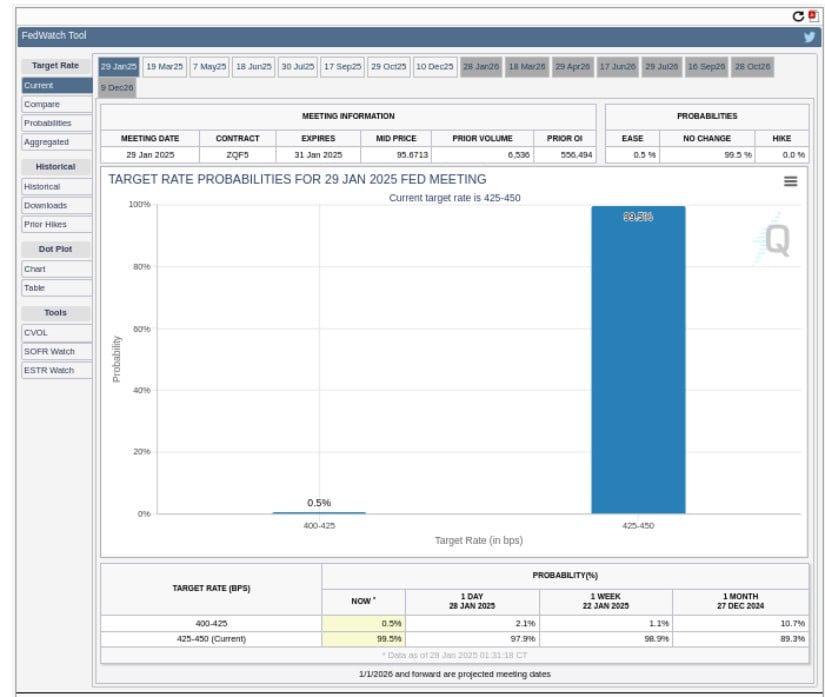

Investor expectations are as fickle as a cat on a hot tin roof. The CME FedWatch tool shows a near tie in the race for a 25-basis-point rate cut in June or July. Yet, with the markets only pricing in a couple of potential cuts in 2025, caution reigns supreme. 🐱👤

Market Reactions and Bitcoin’s Outlook

Bitcoin’s recent escapades mirror the broader financial markets, which are reacting to the Federal Reserve’s policies and the global economic circus. Earlier this week, the cryptocurrency took a brief dip below $100,000, thanks to the launch of DeepSeek AI, which wiped out a staggering $1 trillion in global market value. But like a phoenix rising from the ashes, Bitcoin rebounded, showcasing its resilience and the dwindling reserves held by exchanges, hinting at a future scarcity. 🔥

Now, all eyes are on the Czech Republic, where Aleš Michl, the Governor of the Czech National Bank, is stirring the pot. He’s proposing a bold move to allocate up to 5% of the bank’s €140 billion reserves into Bitcoin. If this goes through, the CNB could become the first Western central bank to dip its toes into the murky waters of cryptocurrency. 🌊

Michl, ever the optimist, acknowledges Bitcoin’s wild swings but sees it as a shiny new toy in the investment playground, especially with big players like BlackRock jumping on the bandwagon. He believes that diversifying into Bitcoin could bolster the bank’s portfolio, despite the risks that come with it. It’s like playing poker with a deck of cards that might just be marked. 🎲

But not everyone is on board with this idea. Critics are raising eyebrows, arguing that Bitcoin’s unpredictable nature makes it a risky bet for central bank reserves. Michl himself admits that this investment could go belly up, drawing comparisons to past corporate disasters like Enron. Yet, he remains hopeful, suggesting that Bitcoin’s value might just dance to its own tune, regardless of external influences, including Trump’s pro-crypto cheerleading. This initiative reflects Michl’s adventurous spirit and his willingness to shake things up in the world of central banking. We’re rooting for you, Michl! 🎉

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Summer Game Fest 2025 schedule and streams: all event start times

2025-01-30 19:23