Ah, Bitcoin! The enigmatic digital currency that has recently embarked on a six-week journey of ascension, triumphantly breaching the psychological barrier of $110,000.

Yet, amidst the jubilant cheers of investors, whispers of caution flutter through the air like autumn leaves. Could this rally be nearing its zenith? Or is the crypto monarch merely warming up for a grander performance? Historical trends suggest that the saga of Bitcoin is far from its final act, with more gains likely lurking just beyond the horizon.

Bitcoin Investors Signal Further Growth

In the annals of cryptocurrency lore, one of the most telling signs of a bull cycle is the curious phenomenon of the average age of Bitcoin held dwindling like the patience of a cat waiting for a mouse. Over the past five years, three major bull markets have been heralded by this very trend. Since April 16, the Mean Dollar Age of Bitcoin has plummeted from 441 days to a mere 429 days.

This delightful trend is a robust signal of Bitcoin’s continued ascent. Younger coins in circulation imply that fresh investments are flooding the market, akin to a new wave of eager suitors at a ball. Should this trend persist, it further justifies the expectation of additional bullish behavior, potentially prolonging the current rally and propelling Bitcoin toward new price milestones.

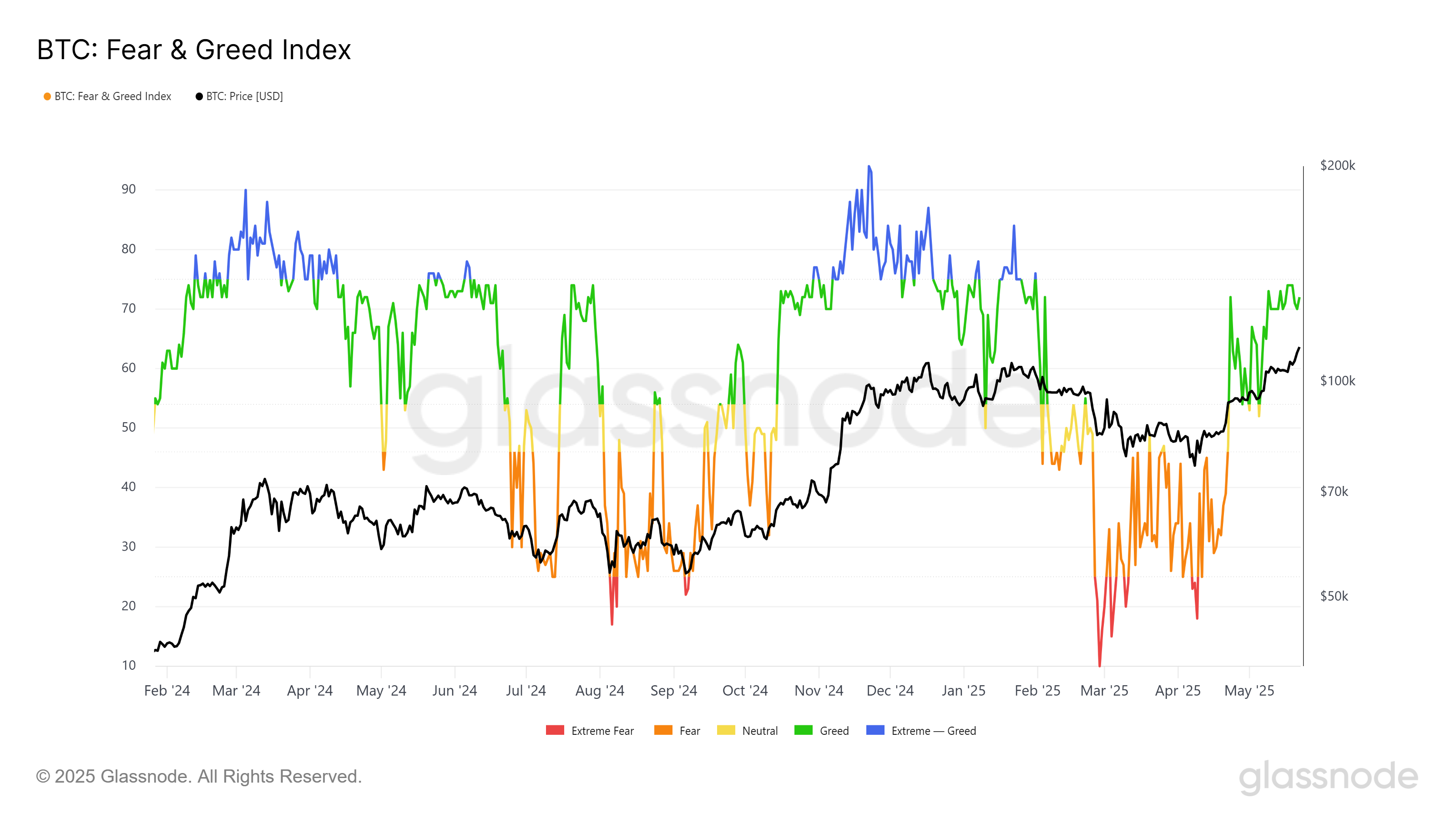

The Fear and Greed index, that fickle friend of the market, also indicates that Bitcoin’s bullish momentum has yet to reach its saturation point. Historically, when this index breaches the Extreme Greed zone, it has been followed by a sharp increase in Bitcoin’s price.

However, our dear Bitcoin has yet to reach this threshold, leaving ample room for further price increases. This suggests that the market is not yet in overbought territory, and there remains significant upside potential. The index’s position in the Greed zone signals that investors are still optimistic about Bitcoin’s future trajectory, much like a hopeful romantic awaiting a love letter.

BTC Price Aims To Continue Uptrend

Bitcoin’s price has seen a steady increase over the past six weeks, culminating in a new all-time high (ATH) of $111,980. Lennix Lai, the Global CCO of OKX, has pointed out the macroeconomic factors, such as favorable market conditions and growing institutional interest, that have contributed to Bitcoin’s recent rally.

“Bitcoin breaking through $111,000 to a new all-time high shows just how strong its technical setup has become. I’m particularly impressed by how it handled the Moody’s US credit downgrade with barely a hiccup before pushing higher… This isn’t your typical crypto hype cycle – we’re seeing genuine structural shifts with the Senate’s 66-32 GENIUS Act vote and corporations snatching up Bitcoin three times faster than miners can produce it.”

Looking ahead, Bitcoin’s price is poised to break through its current ATH and potentially reach $115,000. This continued growth will likely attract more investors, further fueling the rally. If the positive momentum continues, Bitcoin may solidify its position as a leading asset in the market, much like a star performer stealing the spotlight.

However, should investors begin to sell their holdings to secure profits, Bitcoin could experience a short-term pullback. A drop below $106,265 would signal weakening investor sentiment, potentially leading to a decline toward $102,734. If this occurs, the bullish outlook may be invalidated, causing a temporary consolidation phase for Bitcoin’s price, much like a soap opera cliffhanger that leaves viewers on the edge of their seats.

Read More

2025-05-23 12:48