In a turn of events that could only be described as a financial soap opera, Bitcoin (BTC) has decided to take a little tumble, slipping below the $90,000 mark for the first time since November. Currently, it’s lounging at a cozy $88,956, perhaps contemplating its life choices.

This little dip has sent ripples of bearish concern through the crypto community, as if someone just told a room full of cats that bath time was imminent. 😼

Range-Bound or Breakout? Experts Weigh In

According to Brian, the lead analyst at Santiment (and possibly a wizard in disguise), Bitcoin whales have decided to take a breather, which is a fancy way of saying they’re not buying up the market like it’s a clearance sale. This could mean more downward pressure on our beloved coin.

“Bitcoin whales seem to have taken a bit of a breather and aren’t accumulating at the moment (mostly staying flat),” Brian told BeInCrypto, probably while sipping a cup of tea.

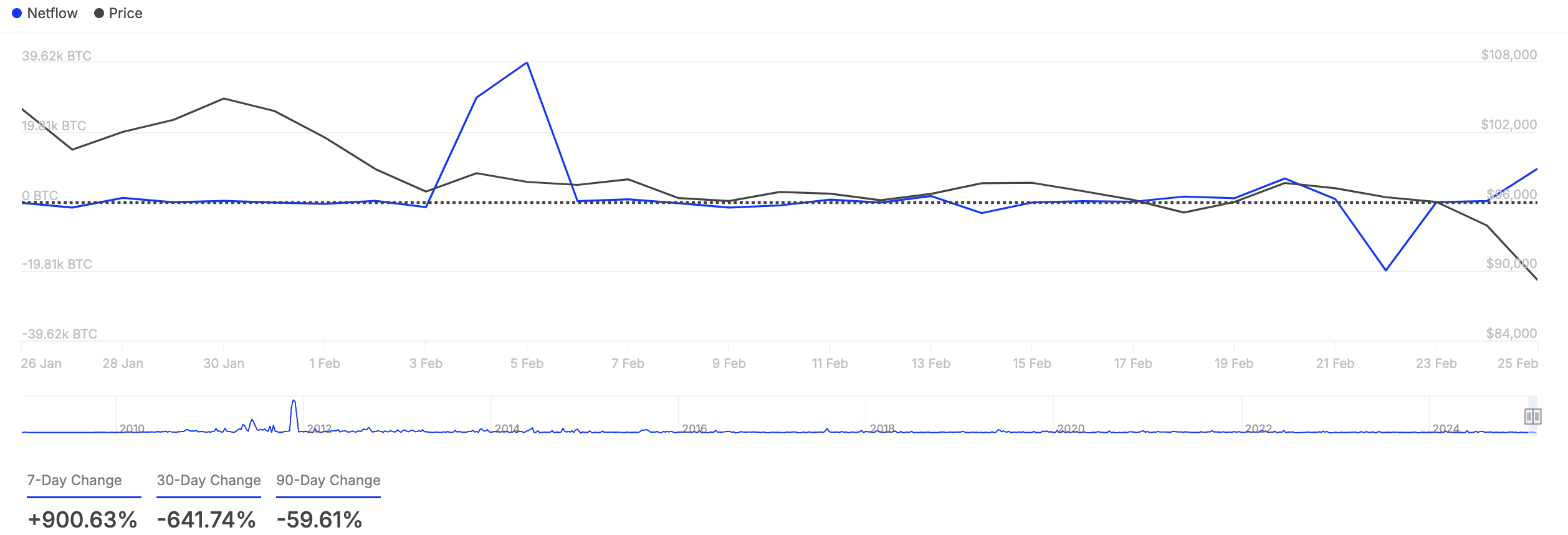

Indeed, the decline in Bitcoin’s large holders’ netflow is as dramatic as a soap opera cliffhanger, plummeting by over 600% in the past 30 days, according to IntoTheBlock. 📉

Now, when we say “large holders,” we’re talking about those whale addresses that hoard more than 0.1% of an asset’s circulating supply. Their netflow is like a financial heartbeat, tracking how many coins they’re buying and selling. When it drops, it’s like they’re saying, “No thanks, I’ll pass on the crypto buffet.” 🍽️

For John Glover, Ledn’s Chief Investment Officer (CIO) and self-proclaimed crypto oracle, BTC is likely to remain stuck in a range between $89,000 and $108,000 in March. It’s like being trapped in a particularly boring episode of a reality show.

“From a technical perspective, BTC is following 1 of 2 paths. In the first place, there is a good potential for a dip to $89,000 or even $77,000 before the next rally. In the second, we have already seen the lows, and the next move will be higher, up to ~$130,000. It’s impossible to predict which path we’re on, and short-term predictions are meaningless when intraweek/intra-month moves are dictated by news and, recently, by the actions of big players like Strategy. My personal view is that we remain stuck in a range of $89,000 to 108,000 in March,” Glover said, probably while gazing into a crystal ball.

And let’s not forget about President Donald Trump’s pro-crypto stance, which has some investors wondering if his policies will send Bitcoin soaring or crashing. Glover, however, believes that the “Trump effect” has already played out, much like a sitcom that’s run its course.

“The majority of the ‘Trump effect’ has already been felt. We know he is very supportive of digital assets and has set in motion his plans to streamline regulations associated with crypto. I don’t think he is a major factor in the short run,” Glover stated, probably while checking his Twitter feed.

Bitcoin Nears Oversold Levels – Is a Rebound on the Horizon?

Now, Bitcoin might be feeling a bit oversold, like a pair of shoes at a yard sale, as indicated by its Relative Strength Index (RSI) readings. At press time, this momentum indicator is downward at 31.16, which is like a warning light on a dashboard that says, “Hey, maybe it’s time to stop and refuel.” ⛽

The RSI measures whether an asset is oversold or overbought, ranging from 0 to 100. Values above 70 mean it’s overbought and due for a decline, while values below 30 suggest it’s oversold and might just bounce back like a rubber ball. 🏀

BTC’s RSI reading hints at a possible rebound toward $92,325 if the selling pressure eases. But if this decline continues, we might see the price drop to $80,835, which would be about as welcome as a rainstorm

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- USD ILS PREDICTION

- 30 Best Couple/Wife Swap Movies You Need to See

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- Everything We Know About DOCTOR WHO Season 2

- 9 Kings Early Access review: Blood for the Blood King

- Every Minecraft update ranked from worst to best

- Tyla’s New Breath Me Music Video Explores the Depths of Romantic Connection

2025-02-26 18:26