Oh, dear reader, gather ’round for the tale of Bitcoin-a digital beast that dances between riches and ruin like a circus performer on roller skates. Today, it sits at $118,400, with a market cap so large it could buy every chocolate factory in the world (and then some). Its 24-hour trading volume? A cool $45.32 billion. The intraday range? A modest $118,252 to $120,693, proving even this crypto giant can have its quiet moments. But don’t let the calm fool you; beneath lies a cauldron of chaos waiting to boil over. 😈

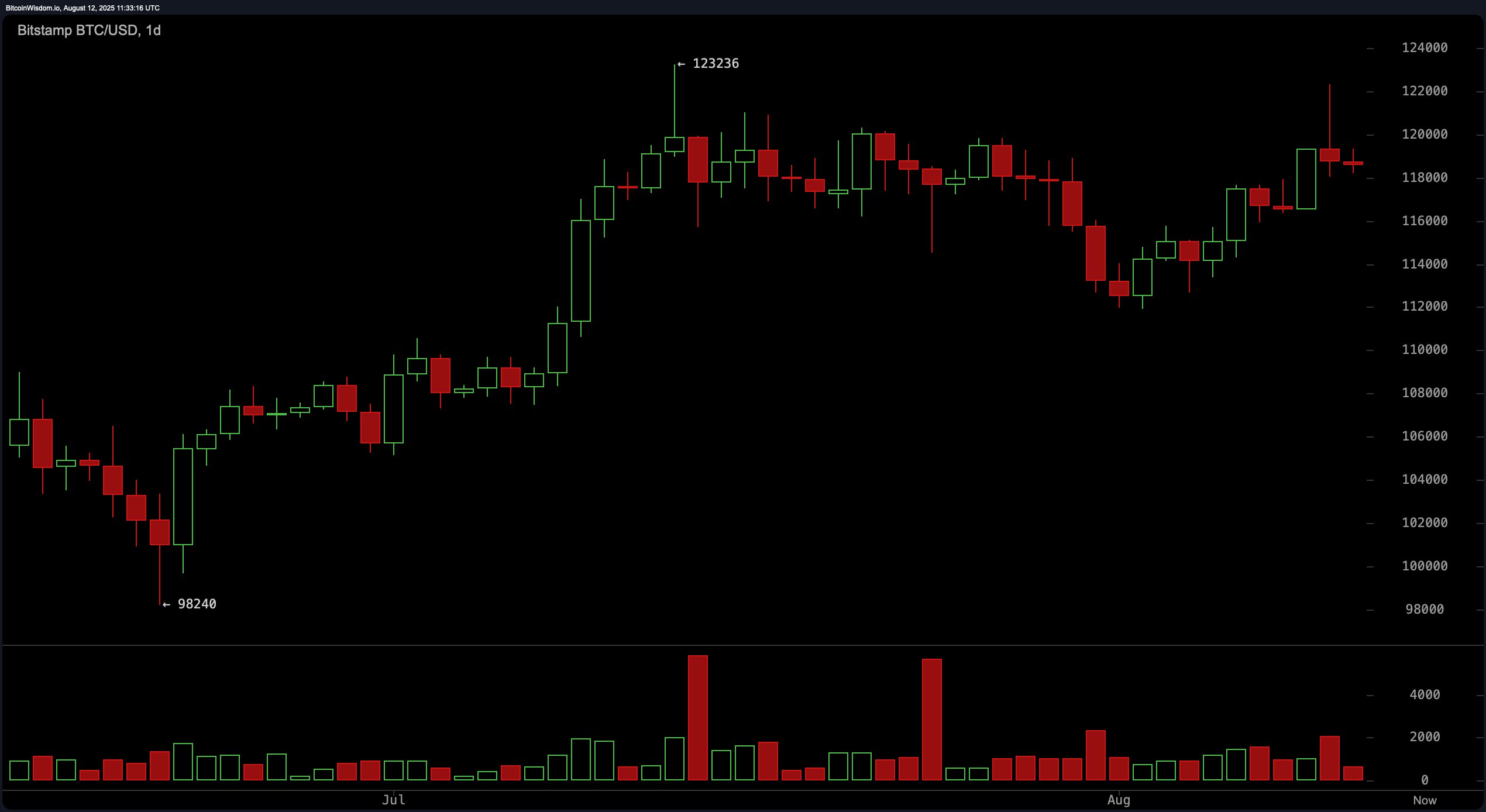

Ah, Bitcoin, the mischievous sprite of the financial world. On the daily chart, it struts about like a peacock, showing off its “bullish macro structure” from June’s rally and July’s peak. But now? Oh, now it’s stuck in a sideways shuffle, trapped between support at $112,000 and resistance just shy of $122,000. It’s as if the poor thing is pacing back and forth, muttering to itself, “Should I stay or should I go?” Volume has dwindled since July’s failed breakout attempt, leaving traders twiddling their thumbs like bored children at a grown-up party. 🎭

Zooming into the 4-hour chart, we see Bitcoin’s short-term antics-a jaunty uptrend starting in August, peaking at $122,300 before tripping over itself and falling flat on its face. Sellers swooped in like seagulls at a picnic, confirming $122,300 as a formidable foe. Now, it hovers near $118,000, teasing us with whispers of bullish triggers if only it dares to reclaim $120,000. But beware! A dip below $117,000 might send it tumbling faster than Charlie Bucket after eating too much candy. 🍬

And then there’s the 1-hour chart-a veritable soap opera of pullbacks and stabilization. Sellers are tired, buyers are shy, and everyone seems to be waiting for someone else to make the first move. Should Bitcoin push above $119,000 with gusto, brave souls might find a chance to profit. But cross the $117,800 line without looking both ways, and you may trigger a cascade of despair. 🌊

What do the oscillators say, you ask? Well, they’re playing it coy, flashing neutral signals with hints of bullish mischief. The RSI lounges at 58, the stochastic sips tea at 74, and the MACD smirks at 794, whispering sweet nothings about positive bias. Meanwhile, the moving averages march proudly upward, waving banners of bullishness across all timeframes. Truly, they’re the cheerleaders of this chaotic spectacle. 📈

Bull Verdict:

If Bitcoin can muster the courage to leap above $120,000 with volume louder than a brass band, it might just soar toward $122,000-or beyond! Imagine the fireworks! 🎆

Bear Verdict:

But alas, failure is always lurking in the shadows. A stumble below $117,800 could unleash a torrent of selling, dragging our hero down to the dreary depths of $113,000. Poor Bitcoin-so bold, yet so fragile. 🥺

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- ETH PREDICTION. ETH cryptocurrency

- Games That Faced Bans in Countries Over Political Themes

- Gay Actors Who Are Notoriously Private About Their Lives

- The Best Actors Who Have Played Hamlet, Ranked

- Banks & Shadows: A 2026 Outlook

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

2025-08-12 16:29