Traders on leading prediction markets are placing increasingly bullish bets that bitcoin (BTC) will achieve record highs by the end of 2025, with overwhelming odds favoring a surge past $120,000. It’s like they’ve all read the same tea leaves, or perhaps they’ve just discovered the secret to time travel. 🕰️🚀

Prediction Markets Signal Confidence in Bitcoin Price Surge to $125K+

Prediction markets let traders buy and sell contracts tied to the outcome of real-world events, with prices reflecting the perceived probability of those outcomes. Polymarket and Kalshi are two prominent platforms in this space, offering insights into crowd-sourced forecasts on topics ranging from politics to crypto asset prices. The data from both prediction marketplaces reveals surging confidence in bitcoin’s price potential, as if the entire world has suddenly decided to join a giant, decentralized Ponzi scheme. 🤷♂️💰

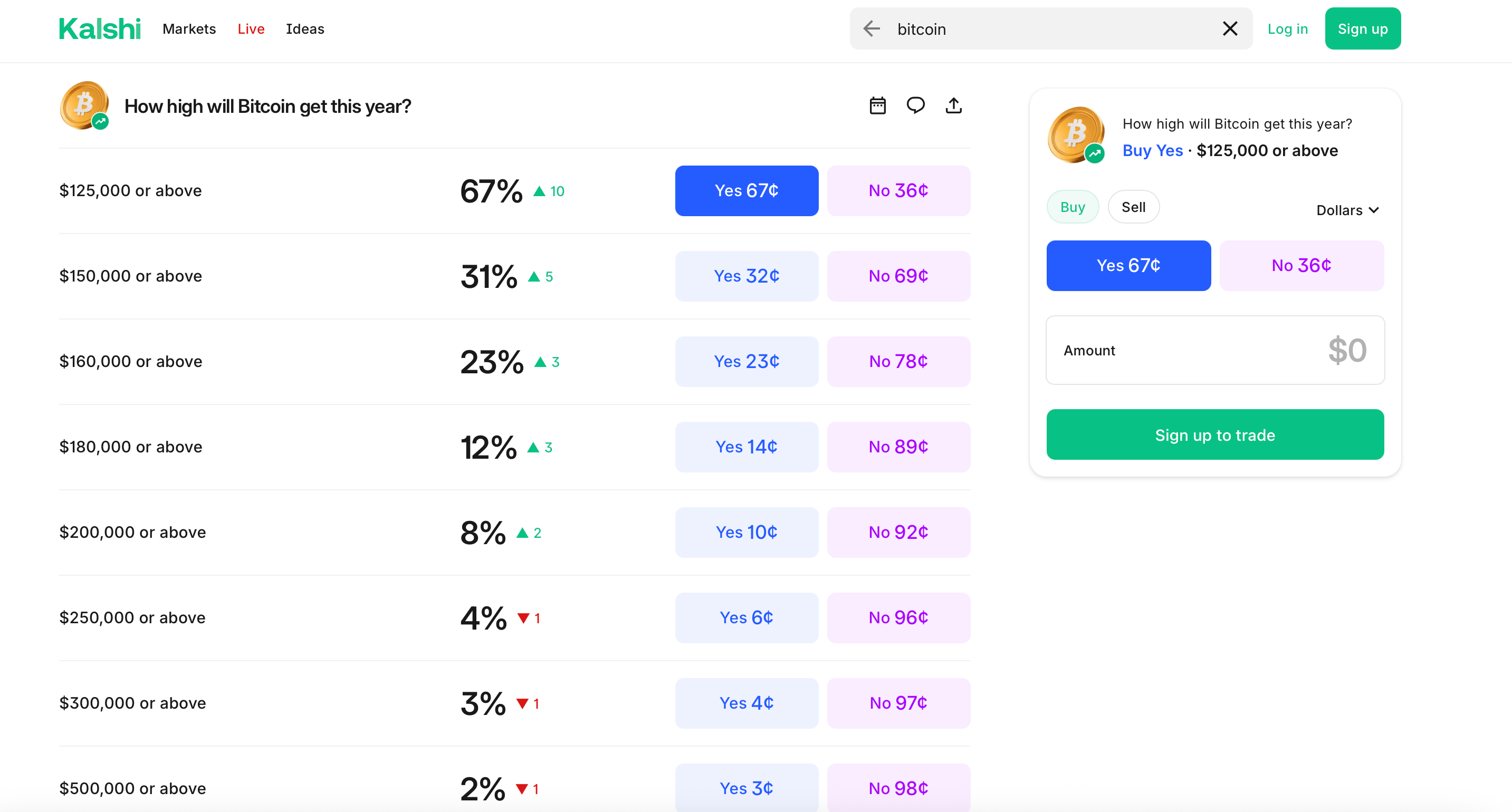

On Kalshi, traders now assign a 67% chance that bitcoin will reach at least $125,000 by December 31, 2025 – a significant 10-percentage-point increase in confidence. The odds stand at 31% for hitting $150,000 and 23% for surpassing $160,000, both showing modest gains across the board. Expectations for even higher targets taper off: 12% for $180,000, 8% for $200,000, 4% for $250,000, 3% for $300,000, and just 2% for $500,000. It’s like they’re betting on a lottery where the jackpot is the price of a small island. 🏝️💰

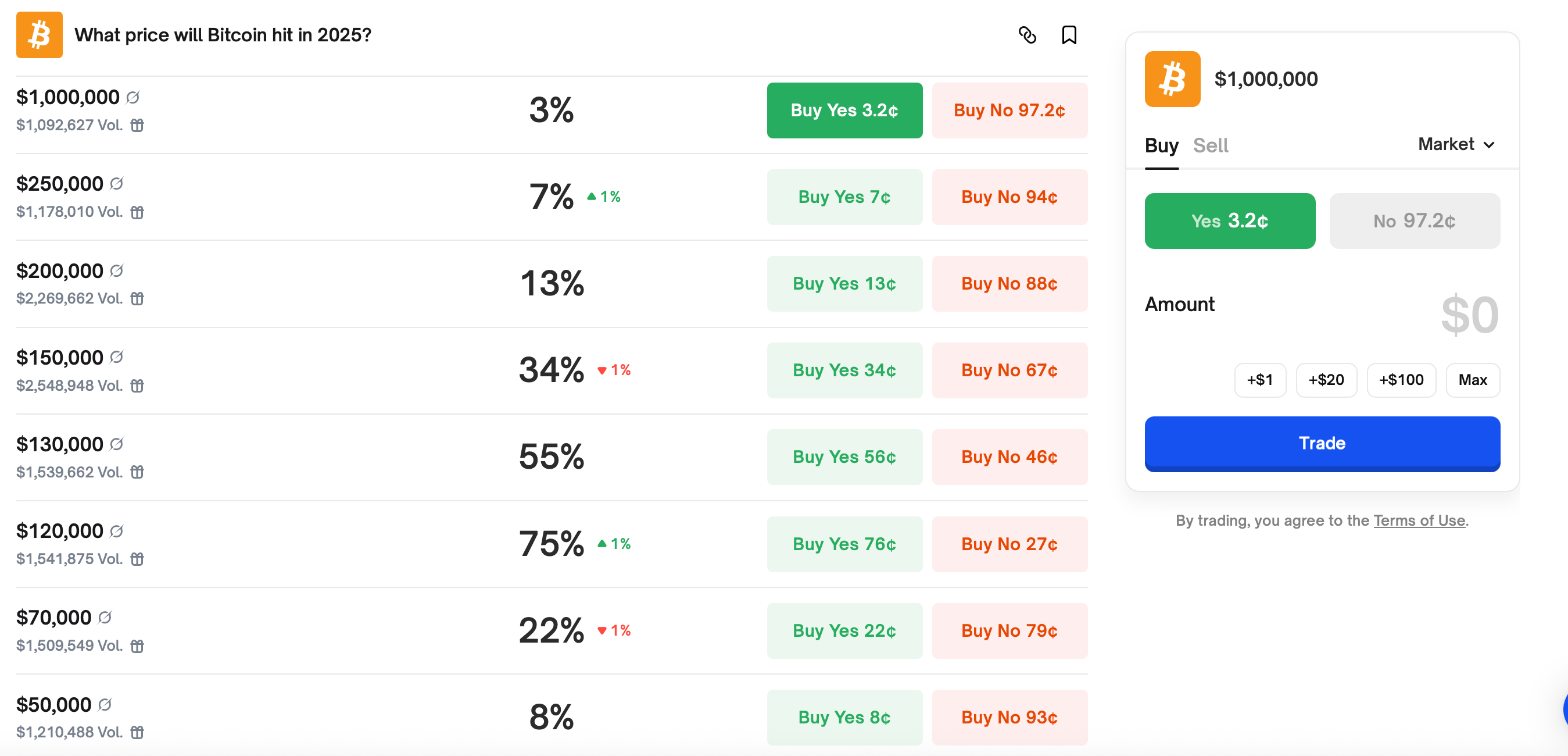

Over on Polymarket, traders exhibit even stronger near-term bullishness. They price in a 75% likelihood that bitcoin hits $120,000 or higher by year’s end, with a 55% chance it reaches $130,000. The odds drop to 34% for a $150,000 target. Like Kalshi, confidence diminishes sharply for loftier goals: only 13% see $200,000, 7% see $250,000, and a mere 3% believe in a $1 million bitcoin this year. Crucially, only 5% expect a crash back to $20,000 or lower. It’s like they’re all on a rollercoaster, but the only direction they see is up. 🎢🚀

The data from both platforms consistently shows the bulk of trader expectations clustering firmly between the $120,000 and $150,000 range. This concentration highlights a market sentiment that is cautiously optimistic yet increasingly confident in substantial upside potential. The rising probabilities, particularly for the $125,000-$130,000 thresholds, signal a significant shift in trader outlook compared to previous assessments. It’s as if they’ve all decided to ignore the laws of gravity and economics. 🌍🚫💰

The overwhelming conviction in prices far exceeding current levels, coupled with minimal bets on a major crash, paints a strikingly optimistic picture for bitcoin’s trajectory through 2025. These prediction markets serve as a powerful barometer of informed sentiment, pointing towards a potentially explosive year for the flagship cryptocurrency. It’s like they’ve all read the same book, and it’s called “The Hitchhiker’s Guide to the Crypto Galaxy.” 📚🚀

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Gold Rate Forecast

- Wuchang Fallen Feathers Save File Location on PC

- Banks & Shadows: A 2026 Outlook

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- QuantumScape: A Speculative Venture

- ETH PREDICTION. ETH cryptocurrency

2025-07-06 20:57