Oh, Bitcoin. The crypto diva we all love to obsess over. It’s currently strutting around like it owns the runway after hitting new all-time highs-but guess what? The momentum is starting to feel more like a drunken wobble than a Victoria’s Secret model walk. Sure, BTC flirted with $120,000, but then tripped over its own shoes and fell back below the record. Classic. 🥂📉 Analysts are now whispering about “increased downside risk” like they’re gossiping at a funeral. Spooky stuff.

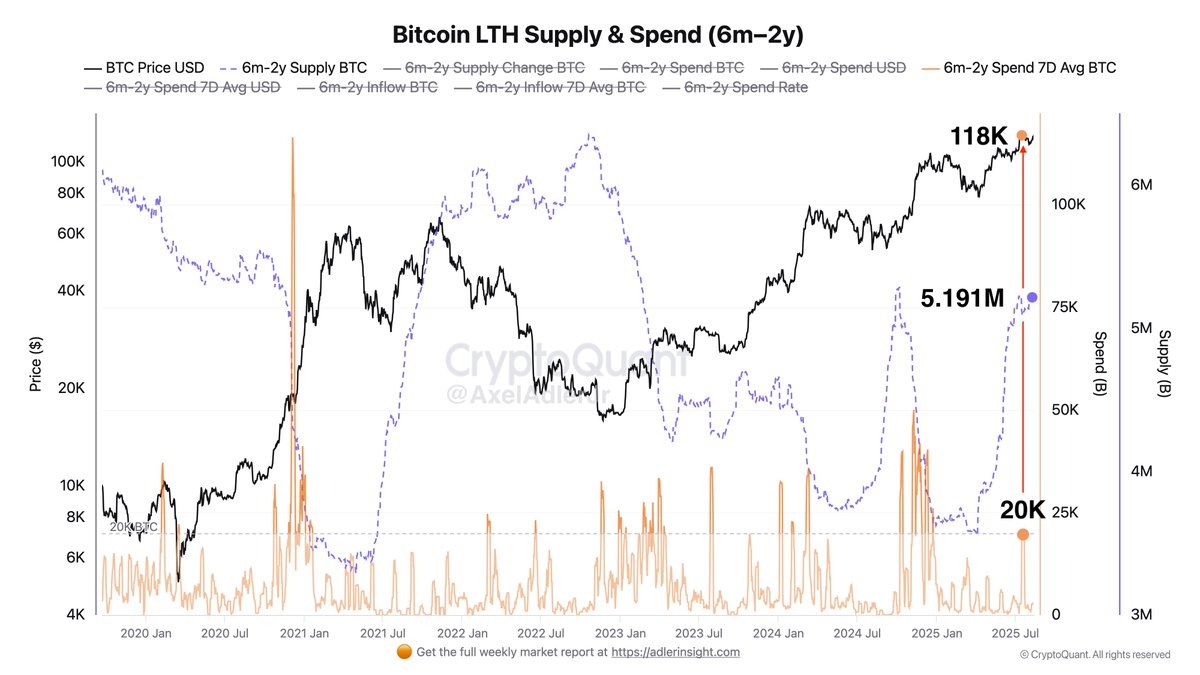

But wait! Before you dump your life savings into Beanie Babies instead, let’s talk about the *real* tea. On-chain data-the kind of thing that makes nerds swoon-is telling us something juicier. Long-Term Holders (LTHs), those mysterious creatures who’ve been cuddling their BTC for six months to two years, have been quietly bulking up their stash. Since April, when Bitcoin was just a measly $83,000, their hoard grew from 3.551 million BTC to a whopping 5.191 million BTC. That’s an extra 1.64 million BTC, folks. Someone call Guinness; these people are breaking records without even trying. 🏆💰

So while traders panic-sell faster than you can say “FOMO,” these LTHs are sitting pretty, sipping chai lattes and saying, “We’re good, thanks.” Their behavior screams conviction louder than my drunk aunt screaming karaoke at Christmas. Even as short-term volatility throws tantrums, this steady accumulation is basically Bitcoin’s version of therapy-a calming force in an otherwise chaotic world. 🧘♀️📈

Axel Adler Drops Knowledge Bombs 💣

Top analyst Axel Adler-yes, he sounds like a Bond villain, I know-has noticed something fascinating about Bitcoin’s latest fling with $118,000. Unlike previous cycles where long-term holders dumped coins faster than bad boyfriends, this time they’ve kept their cool. Sure, there was some profit-taking, with the seven-day average spending climbing to 20,000 BTC, but that’s nothing compared to the 40,000-70,000 BTC fireworks we’ve seen before. These hodlers aren’t panicking; they’re practically zen masters. 🧘♂️💎

This chill attitude suggests one thing: confidence. Accumulation is still winning the battle against distribution, which is code for “the smart money believes Bitcoin will moon eventually.” And honestly, if seasoned pros are doubling down, maybe we should too. Or maybe not. Who am I, your financial advisor? (Spoiler: I’m definitely not.) 🌕🤷♀️

That said, Bitcoin isn’t out of the woods yet. To prove everyone wrong (and itself right), it needs to smash through $125,000 like a piñata at a kid’s birthday party. If it succeeds, buckle up for liftoff. Institutional cash, long-term buys, and reduced selling pressure could send prices soaring. But if it fails? Well, bears might get their paws dirty testing lower levels before the next rally. Drama everywhere. 🐻🎢

Support Zone: The Line Between Glory and Disaster ⚔️

Now, let’s zoom in on the 4-hour chart, shall we? After teasing $123,200 and failing to stick the landing, Bitcoin has retreated to $117,300. Currently clinging to support near the 100 and 200 moving averages, it’s looking precarious but not hopeless. Think of it like standing on a tightrope-wobbly, yes, but with a safety net made of math. 🤹♂️📉

If Bitcoin breaks below $116,900-$117,600, things could get ugly. Like, “ugly sweater contest” ugly. A drop to $115,000 isn’t off the table. But hey, the moving averages are still sloping upward, so don’t lose hope just yet. For now, the market is stuck in limbo, aka consolidation mode, waiting for bulls to step up or bears to take charge. Either way, it’s going to be messy-and honestly, isn’t that why we’re here? 🎢🔥

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- ETH PREDICTION. ETH cryptocurrency

- When Wizards Buy Dragons: A Contrarian’s Guide to TDIV ETF

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- ‘Zootopia 2’ Wins Over Critics with Strong Reviews and High Rotten Tomatoes Score

- The Labyrinth of Leveraged ETFs: A Direxion Dilemma

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

2025-08-16 11:12