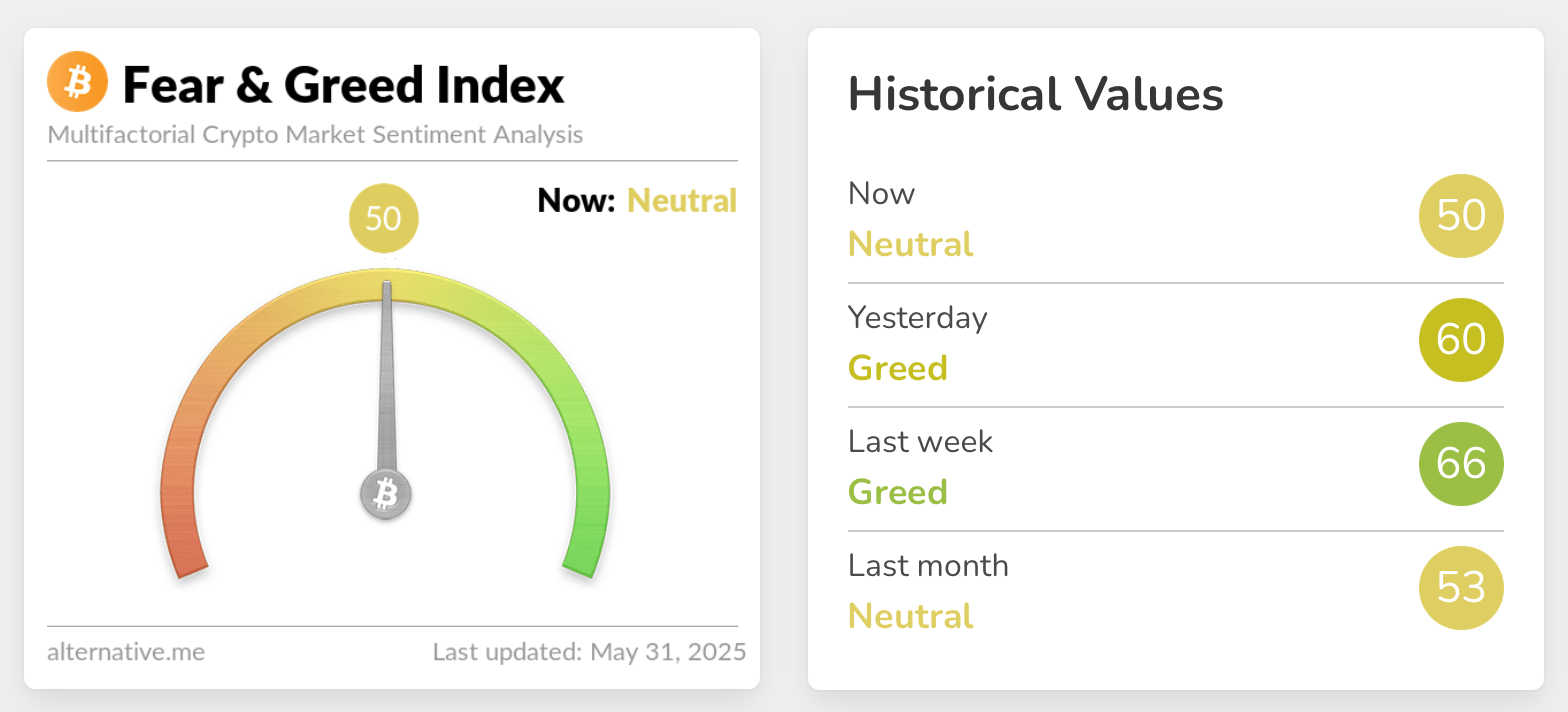

Oh, what a week it has been! Bitcoin, that cheeky little rascal, has tumbled from a dizzying height of $109,000 down to a mere $104,500! And guess what? The Crypto Fear and Greed Index, that whimsical contraption, has decided to join the party, sliding from a raucous “greed” to a more polite “neutral” this weekend. How delightful! 🎉

$112K Then What? Bitcoin Slides as Fear and Greed Gauge Resets

In the topsy-turvy world of crypto, bitcoin (BTC) reached a shiny new all-time high on May 22, like a kid on Christmas morning! But lo and behold, from May 24 to May 31, it decided to take a little nap, slipping 4.13% against the U.S. dollar, from $109,000 to $104,500 per coin. Oh, the drama! 😱

- 0–24: Extreme Fear (yikes!)

- 25–49: Fear (hold onto your hats!)

- 50: Neutral (the calm before the storm)

- 51–74: Greed (oh, the greed!)

- 75–100: Extreme Greed (party time!)

When BTC hit its all-time high (ATH)—a fancy average between $111,814 and $111,970, with some exchanges even flirting with $112,000—the CFGI jumped into the “extreme greed” zone the very next day! On Nov. 22, 2024, bitcoin (BTC) was prancing around at $98,997, while the CFGI was strutting a whopping 94 out of 100. Fast forward to Saturday, May 31, and the CFGI is now a humble 50—sitting right in the “neutral” zone. How quaint! 🥳

Just one point away from “fear” and a smidgen from “greed.” On Friday, May 30, sentiment was a sprightly 60, firmly in the “greed” camp. In short, the emotional tide has shifted faster than a magician’s trick, leaving a fog of market confusion in its wake. This midpoint reading—50—aligns with BTC at $104,500, a 5.56% increase from its November 2024 price, despite the current indecisive mood. Quite the rollercoaster! 🎢

This swift retreat from euphoria highlights the market’s volatility and its delicate psychological state after the ATH. Resting right at the “neutral” midpoint, sentiment is teetering like a tightrope walker, reflecting deep indecision among market participants in this newfangled price discovery game. But fear not! The underlying resilience is quite remarkable; the asset still holds a hefty premium over its previous sentiment cycle, hinting at a potential consolidation phase before the next big move. Stay tuned! 📈

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- 30 Best Couple/Wife Swap Movies You Need to See

- USD ILS PREDICTION

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Ncuti Gatwa Exits Doctor Who Amidst Controversy and Ratings Crisis!

- 9 Kings Early Access review: Blood for the Blood King

- Every Minecraft update ranked from worst to best

- Clair Obscur: Expedition 33 – All Act 3 optional bosses and where to find them

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- 10 Shows Like ‘MobLand’ You Have to Binge

2025-05-31 22:57