As someone who’s been navigating the complex world of finance for decades now, I must say that the introduction of Bitcoin ETF options is nothing short of revolutionary. It’s like watching the Wild West meet Wall Street, and it’s a sight to behold!

Starting from now, investors have the opportunity to interact with an additional level of borrowing power and risk control mechanisms. This development marks another significant step in the institutional acceptance of Bitcoin.

Analyst Eric Balchunas posted on Twitter, “A substantial amount of options trading, approximately half a billion dollars, has occurred on $IBIT (an impressive figure for its first day)… Here’s a list ranking the contracts by volume, and it’s mostly calls. This suggests a highly optimistic outlook, especially the Dec20th C100 contract, which essentially predicts the price of Bitcoin will double within the next month.

Options: A New Frontier for Bitcoin ETFs

Alison Hennessy, who heads ETP Listings at Nasdaq, recently stated on Bloomberg TV that trading options for IBIT will likely start very soon. In her words, “We aim to list and trade these options as early as tomorrow.” The Options Clearing Corporation (OCC), a key player in clearing equity and derivative transactions worldwide, is ready to handle the settlement and risk management for these unique options. This readiness comes with approval from the Commodity Futures Trading Commission (CFTC).

As an analyst, I find the launch of spot Bitcoin ETF options to be a double benefit. Primarily, it significantly boosts liquidity, which is vital for attracting institutional investors. Secondly, it provides a risk management tool that was not available to ETF investors before. However, while these options make investing easier, they could potentially amplify market volatility. Thus, despite the optimism, caution is warranted.

A Booming Market

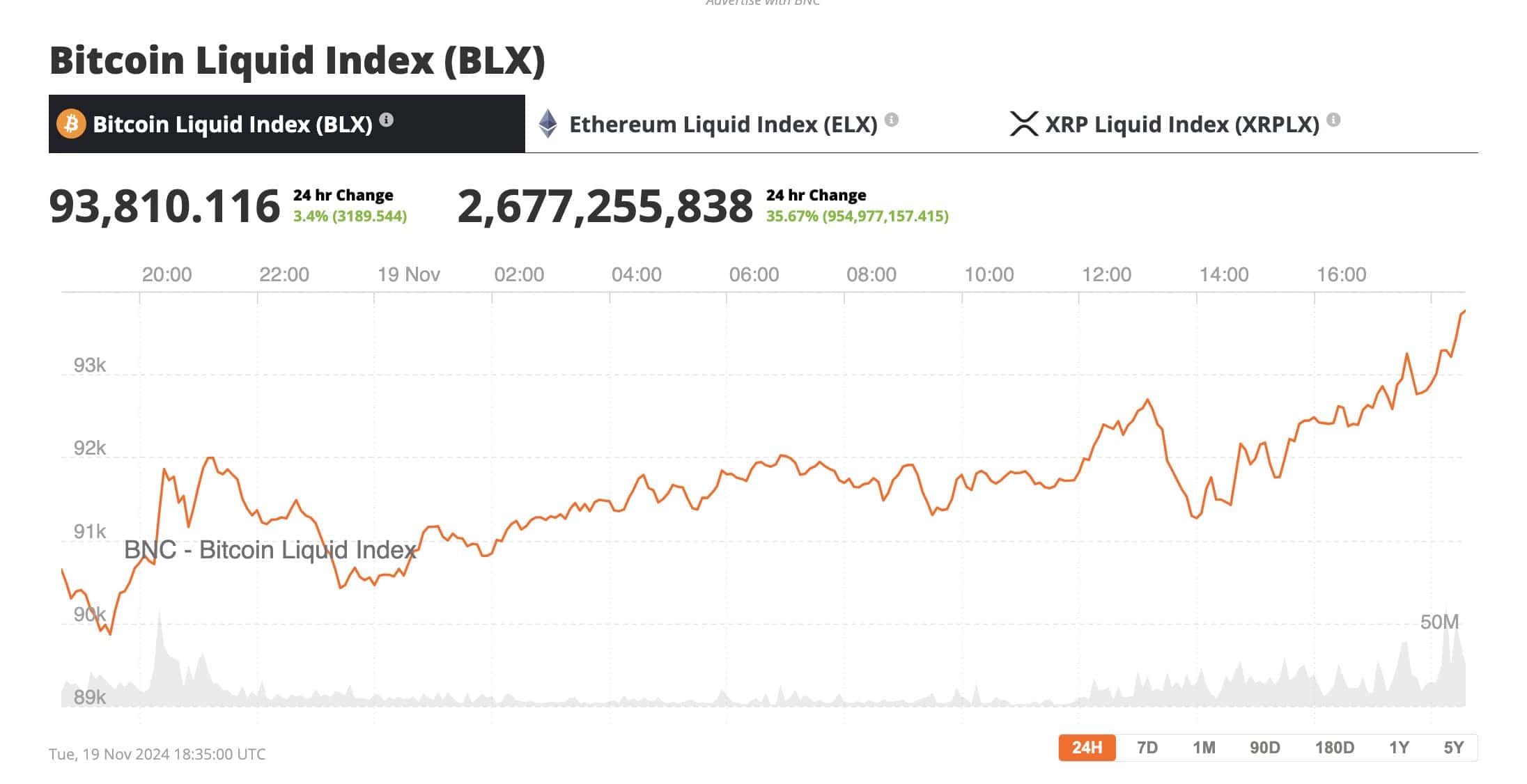

This year, Bitcoin’s remarkable surge above $93,800 has ignited interest in spot Bitcoin Exchange-Traded Funds (ETFs). Notably, BlackRock’s IBIT has attracted an impressive $29 billion of the $27 billion inflows into this investment class. The ETF’s success highlights Wall Street’s increasing interest in legally sanctioned Bitcoin investments.

Given the current selection of choices, market experts predict an increase in institutional involvement. Having the opportunity to safeguard investments and boost returns by capitalizing on market fluctuations provides a high-end set of strategies for investors maneuvering through Bitcoin’s frequently stormy seas.

Options: The Institutional Magnet

Investment tools called options let people buy or sell assets at a predetermined price during a certain period. These are highly praised for their versatility, providing routes to both potential profits and risk reduction. For Bitcoin ETFs, options could serve as the crucial element that transforms Wall Street’s tentative interest into widespread adoption at full speed.

According to James Seyffart from Bloomberg, it’s expected that the rollout will occur this week as all regulatory obstacles have been overcome, leaving only minor details to be finalized.

The Bigger Picture

The approval of Bitcoin ETF options by the SEC signifies a significant milestone in the development of crypto market regulations. With industry titans such as BlackRock taking the lead, it appears that Bitcoin’s transformation from a niche asset to a prominent player within the financial sector is imminent. Yet, as the market matures, uncertainties remain about how these innovative tools will impact Bitcoin’s pricing trends.

As a crypto investor, I can’t help but feel the excitement in the air. The introduction of options trading by Nasdaq might just mark the beginning of a new chapter in crypto-financialization. This could be the moment when Bitcoin secures its position in institutional portfolios for good. However, whether this development will lead to price stability or instability is a narrative that I’ll be closely watching unfold.

On day X, Jeff Park, the head of Alpha Strategies at Bitwise, released a comprehensive report detailing his views on the potential game-changing impact of Options approval. Here’s a brief summary of his perspective:

Why Bitcoin ETF Options Are Game-Changing

The author presents three main arguments supporting the notion that introducing options trading for Bitcoin ETFs brings about groundbreaking changes in the financial world.

- Existing Bitcoin Options (Deribit, LedgerX, CME) Are Not Comparable to ETF Options:

- Platforms like Deribit and LedgerX lack central guarantors, limiting their appeal for institutional adoption.

- Current Bitcoin futures on CME (24% market share) also don’t solve capital efficiency issues.

- ETF options bring multi-asset portfolio cross-margining, allowing capital-efficient trades across products like bonds, equities, and gold ETFs. This creates the potential for “free leverage.”

- Paper Bitcoin Dilutes Volatility, But ETF Options May Increase It:

- Derivatives backed by USD collateral (like futures) don’t hold real Bitcoin, which mutes volatility.

- Bitcoin ETF options differ as they create synthetic flows while potentially boosting market volatility.

- Selling calls is capital intensive compared to buying, creating asymmetric risks that could trigger arbitrage opportunities. Margins for short calls expose sellers to infinite losses, which could lead to more volatile markets.

- “You Can’t Short Squeeze a Trillion-Dollar Asset” Myth:

- Despite Bitcoin’s high market cap, options amplify leverage in unique ways.

- The example of a leveraged position in Deribit ($1400 premium, 10x delta on futures) demonstrates how even small capital injections can move the market, potentially enabling significant upward pressure.

Bitcoin ETF Options Will Reshape the Financial Market

Later on, Jeff delves further into the revolutionary aspects of Bitcoin ETF options, presenting crucial ideas:

- Fractional Banking of Bitcoin’s Notional Value:

- Bitcoin’s capped supply limits its leverage capabilities in current setups.

- ETF options introduce synthetic exposure in a regulated environment. This ensures the OCC mitigates counterparty risks, allowing Bitcoin’s notional value to multiply through leverage without compromising systemic stability.

- Duration-Based Portfolio Exposure:

- Unlike daily options (e.g., zero-days-to-expiration trades), ETF options offer long-term exposure through dated calls and puts.

- This allows retail and institutional investors to create portfolios with greater risk management, hedging strategies, and cost-efficiency.

- Volatility Dynamics:

- Bitcoin’s inherent volatility is key to its appeal but also its complexity.

- Bitcoin options will introduce “negative vanna” – a scenario where volatility and spot prices rise together, creating explosive feedback loops.

- Gamma squeezes, already seen in stocks like GME, will be amplified here, as Bitcoin ETF options lack dilution mechanisms. This means dealers will continually hedge by buying more Bitcoin, increasing upward pressure.

- The Leverage Effect:

- Bitcoin’s supply constraints mean it behaves differently from traditional commodities or equities.

- Unlike stocks, Bitcoin can’t issue more supply to ease demand, ensuring leverage flows directly into price action.

- This could lead to exponential rallies as ETF options funnel more capital into constrained supply markets.

- First-Ever True Financialization of a Scarce Digital Asset:

- The Bitcoin ETF options market will operate within a fully regulated framework, ensuring transparent and compliant trading.

- The introduction of synthetic leverage via ETF options will fuel Bitcoin’s appeal as both a speculative and hedge asset, while the system remains decentralized.

Key Takeaway

This advancement signifies a significant milestone within the financial market arena. Not only does it strengthen Bitcoin’s status as a reliable store of value, but it also paves the way for unparalleled trading dynamics associated with a decentralized asset in a regulated setting. Let’s embrace this change!

Read More

- 30 Best Couple/Wife Swap Movies You Need to See

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- PENGU PREDICTION. PENGU cryptocurrency

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- The Last Of Us Season 2 Drops New Trailer: Premiers April On Max

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- ANDOR Recasts a Major STAR WARS Character for Season 2

- In Conversation With The Weeknd and Jenna Ortega

- Scarlett Johansson’s Directorial Debut Eleanor The Great to Premiere at 2025 Cannes Film Festival; All We Know About Film

- All Hidden Achievements in Atomfall: How to Unlock Every Secret Milestone

2024-11-20 13:14