In a rather unremarkable display of financial gymnastics, Bitcoin has decided that moving sideways is the new black. Today, as the crypto community throws confetti to celebrate the day BTC’s market capitalization first crossed the $1 trillion mark back in 2021, our dear Bitcoin seems to be taking a leisurely stroll below the $100,000 mark, as if it were a Sunday afternoon in a sleepy village.

For over two weeks, Bitcoin has been playing hide and seek with the $100,000 threshold, and the technical and on-chain data suggest it might just be getting comfortable down there, perhaps even considering a long-term lease.

Bitcoin Marks Trillion Dollar Anniversary But Stalls Below $100,000

On this very day in 2021, Bitcoin’s market capitalization decided to throw a party and surpassed $1 trillion for the first time. Since then, it has nearly doubled, now boasting a market cap of $1.9 trillion, which is a number so large it could make a mathematician weep.

Yet, as the market pops the champagne to commemorate this milestone, Bitcoin’s price performance is about as exciting as watching paint dry. It remains trapped below $100,000, caught in a tug-of-war between bullish optimism and bearish pessimism, like a cat stuck in a tree.

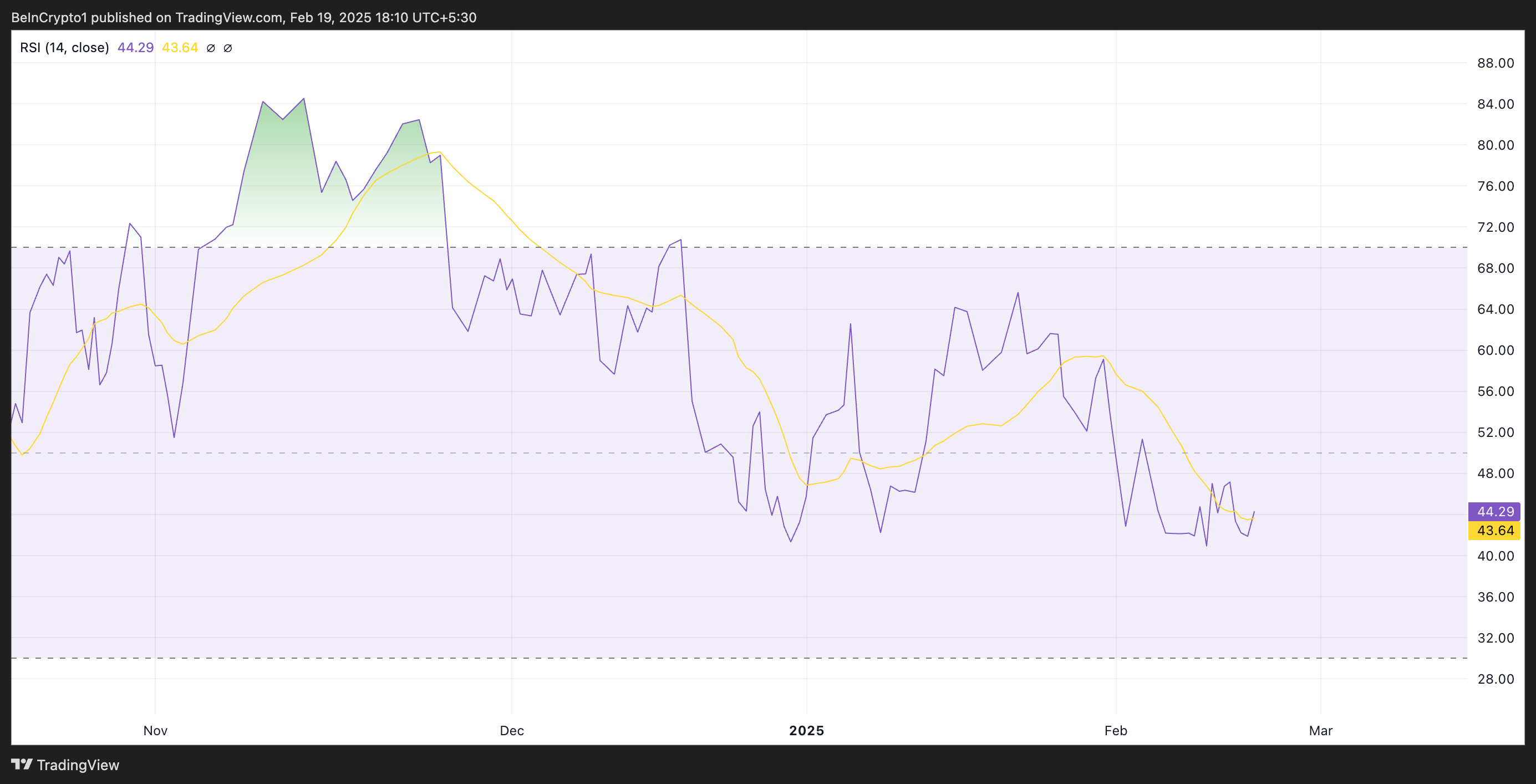

However, BeInCrypto’s assessment of the BTC/USD one-day chart reveals that the bearish bias against our beloved king coin seems to be gaining momentum. The Relative Strength Index (RSI), that fickle friend, currently rests below the 50-neutral line at 44.29, suggesting that the bears are having a bit of a party.

The RSI indicator, which measures whether an asset is oversold or overbought, ranges between 0 and 100. Values above 70 suggest the asset is overbought and due for a decline, while values under 30 indicate it’s oversold and might bounce back. At 44.29, BTC’s RSI suggests that selling pressure is stronger than buying momentum, but not yet at the point where it needs a hug.

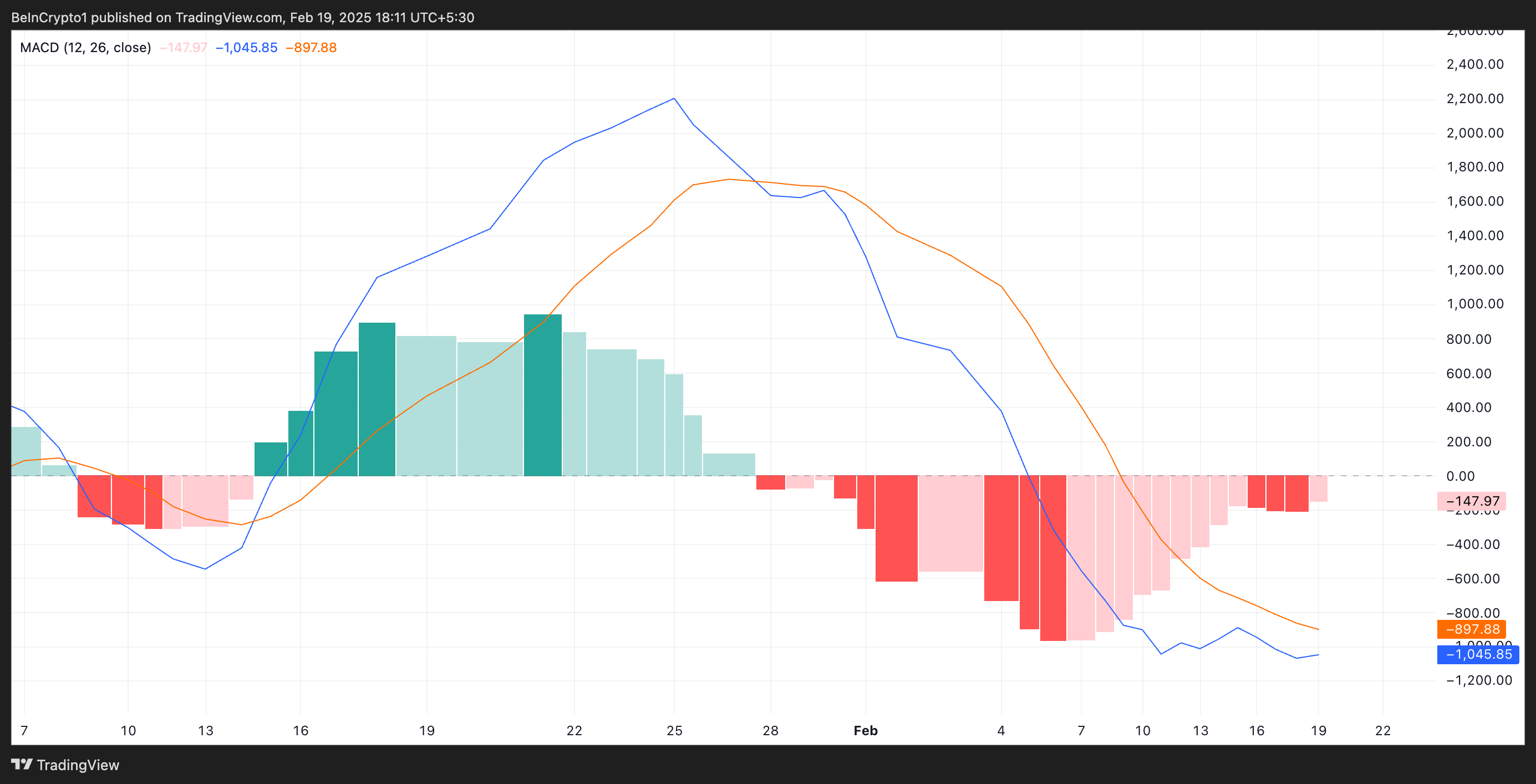

Moreover, the setup of the coin’s Moving Average Convergence Divergence (MACD) supports this bearish outlook. As of this writing, BTC’s MACD line (blue) is sulking under its signal line (orange), which is like a sad story waiting for a happy ending.

The MACD indicator helps traders spot potential buy or sell signals through crossovers. In BTC’s case, when the MACD line is below the signal line, it indicates bearish momentum, suggesting that the asset’s price decline may continue. Traders see this as a potential sell signal, adding to the downward pressure in the market, like a heavy rock in a balloon.

BTC at a Crossroads: $90K Breakdown or $100K Breakthrough?

At press time, BTC is trading at $96,248, just a hair below the strong resistance formed at $99,805. As selloffs strengthen, BTC risks breaking out of its narrow range in a downward trend. In that scenario, the coin’s price could tumble below $90,000, possibly exchanging hands at $89,434, which sounds like a bargain for a digital asset.

On the flip side, if the market’s bullish pressure decides to wake up from its nap, it could invalidate this bearish projection. In that case, the coin’s price could break above the resistance at $99,805, leap over the $100,000 threshold, and attempt to revisit its all-time high of $109,350, which would be a plot twist worthy of a bestseller.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Summer Game Fest 2025 schedule and streams: all event start times

2025-02-19 17:52