After Bitcoin (BTC) surpassed the $120,000 mark in July, on-chain data revealed a series of notable profit-taking activities by whales. 🐟💸

In this context, closely monitoring whale behavior and capital flows in and out of major platforms will remain key to determining the market’s next moves. Because nothing says “excitement” like watching a bunch of crypto whales do the cha-cha. 🐝💃

The Market in a Short-Term Distribution Phase

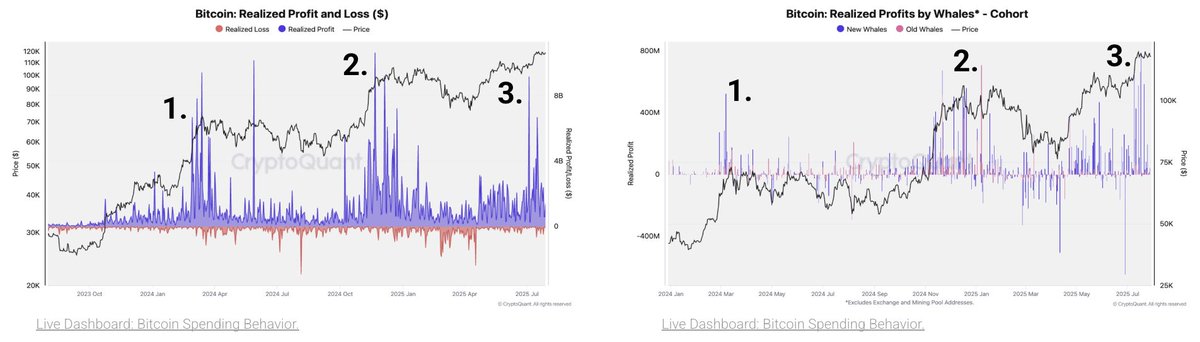

Following the recent market correction, Bitcoin trades around the $115,000 zone. According to CryptoQuant, Bitcoin is entering its “third major profit-taking wave” of this bull cycle. Because apparently, whales need three separate parties to celebrate their gains. 🎉🎊

CryptoQuant noted that the primary profit-takers are new whales who have accumulated recently and are now sitting on significant gains. New whales? More like “newly minted crypto enthusiasts who think they’re Warren Buffett with a calculator. 🧮🦄”

In addition, the market continues to see some early-era whales from the Satoshi timeline selling off. The account ai_9684xtpa on X confirmed that several old wallets from Bitcoin’s early days are again moving BTC and selling after years of dormancy. These wallets are like the “I remember when” stories at a family reunion—everyone’s like, “Oh yeah, I remember that,” but no one actually knows what they’re talking about. 🧠💭

These wallets often draw attention due to their potential psychological impact on the market, even though their size remains small relative to the total circulating supply. Because nothing says “market-moving” like a 0.0001% drop. 📉🙃

Long-Term Sentiment Remains Positive

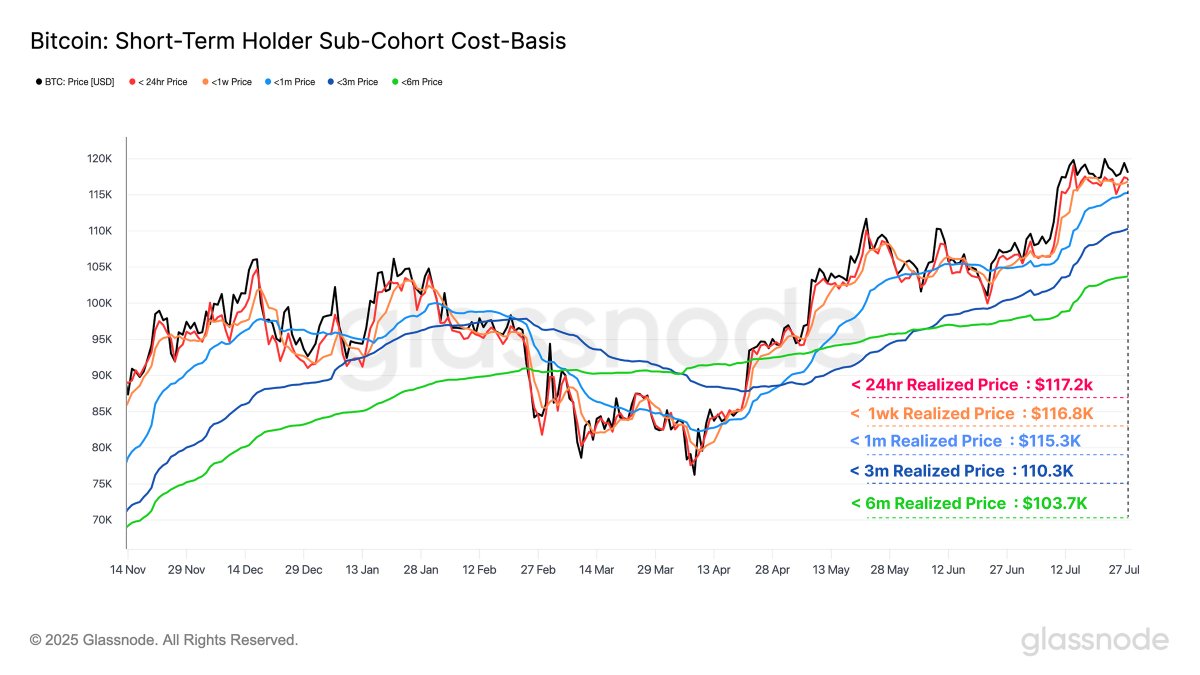

Alongside the short-term wave of profit-taking, the market still presents several noteworthy bullish indicators. Data from Glassnode shows that Bitcoin’s current price is above the short-term holder (STH) cost basis range—a key factor in forming strong support zones if the market pulls back. Like a toddler’s bedtime routine: “We’re not going down, we’re just taking a nap.” 🛌💤

Meanwhile, Coin Bureau quoted Bernstein’s analysis, saying that the crypto bull run is still early. This perspective reinforces the confidence of long-term investors, especially as institutional capital continues to flow into the market through ETFs and platforms like Coinbase and Robinhood. Because nothing says “trust” like a bunch of banks finally admitting they’re not as scared of crypto as they claim. 🏦📉

CryptoQuant also noted that new investor dominance is rising but still has room before reaching extreme levels. This indicates that the current cycle attracts a large influx of new participants, rather than revolving solely around veteran holders like in previous cycles. Welcome to the party, newbies! Just don’t cry when the market throws a curveball. 🎉💣

Given the strong price increases over recent months, some analysts warn that Bitcoin may require a correction period to rebuild buying momentum. Because nothing says “healthy market” like a 20% crash. 📈📉

“July marked a transition from trend to consolidation. Elevated speculation and profit-taking are dragging on momentum, signaling that BTC may need a reset or sideways grind before the next breakout attempt,” said analyst Willy Woo. 🕺🕺

Additionally, on-chain data from Santiment showed that whales have accumulated around 0.9% of Bitcoin’s total circulating supply in just the past four months. This suggests that long-term confidence remains intact despite technical pullbacks. Because nothing says “confidence” like holding onto your crypto while everyone else is panicking. 🧠💪

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- Games That Faced Bans in Countries Over Political Themes

- Gay Actors Who Are Notoriously Private About Their Lives

- 9 Video Games That Reshaped Our Moral Lens

- ETH PREDICTION. ETH cryptocurrency

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- Banks & Shadows: A 2026 Outlook

2025-08-01 15:37