In the dusty corners of the financial world, Bitcoin has found itself in a bit of a pickle, tumbling down below the $108,000 mark, like a wayward tumbleweed caught in a gust of wind, struggling to hold onto the $110,000 support level that once felt as solid as a rock.

This little dip, my friends, is not just a random hiccup; it follows the rise of the US Consumer Price Index (CPI) to a staggering 2.4%. But fear not, for amidst this chaos, the investors’ spirits remain as high as a kite, ready to catch the next wave of recovery.

Bitcoin: The Underdog with a Fighting Spirit

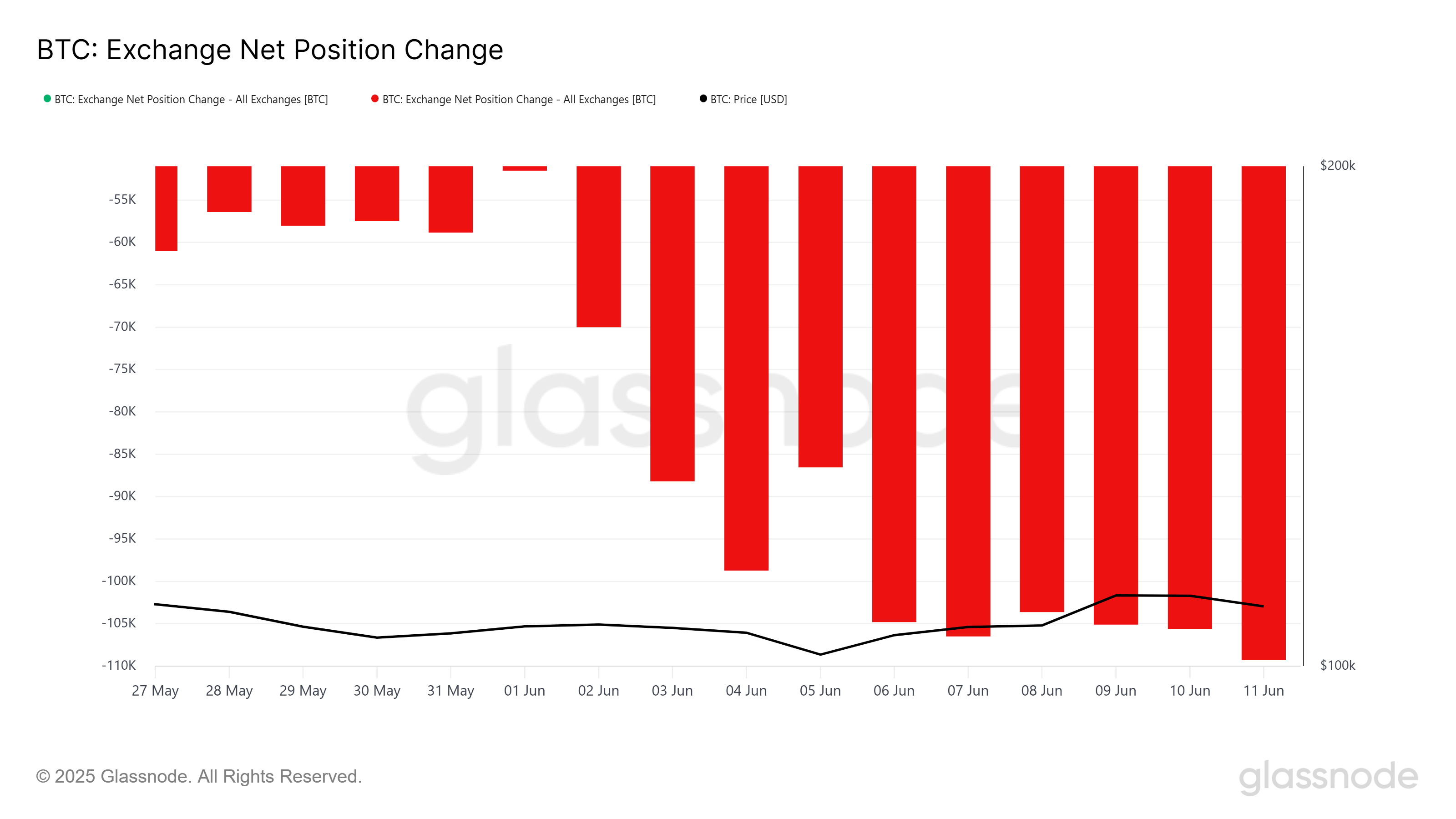

Despite the storm clouds gathering overhead, Bitcoin’s market sentiment is still painted in shades of optimism. The exchanges are seeing consistent outflows, like a river flowing steadily, as investors keep adding to their BTC stash, hoping for a brighter tomorrow. This buying pressure is a testament to their unwavering faith in Bitcoin’s long-term potential, even when the going gets tough.

Now, while Bitcoin may have stumbled at the $110,000 hurdle, the lack of panic selling is a silver lining. Investors are hoarding coins like squirrels preparing for winter, confident that the price will bounce back, despite the recent bumps in the road.

Bitcoin’s macro momentum is still as strong as a mule, bolstered by key pricing models like the 111-day moving average (DMA), 200 DMA, and 365 DMA. These levels have historically been the lighthouse guiding ships through stormy seas. Currently, Bitcoin is sailing well above these markers, suggesting it has built a sturdy ship to weather the storm.

This significant deviation from the key moving averages hints at a potential bullish turn on the horizon. Sure, there may be some short-term fluctuations, but the long-term outlook for Bitcoin is as bright as a summer’s day, especially once it finds a stable support level to rest its weary head.

BTC Price: The Comeback Kid

As of now, Bitcoin’s price is down by 2.3% over the last 24 hours, trading at $107,594. This little dip came after the US CPI report revealed a 2.4% year-over-year increase, with a 0.1% rise in May. But don’t let that fool you; this decline seems more like a temporary detour than a dead end.

The chances of Bitcoin continuing its downward spiral are as slim as a dime. With the bullish sentiment from investors and no signs of large-scale selling, Bitcoin is poised for a comeback before the week wraps up. If it can breach the $108,000 level, it might just find itself on the road to $110,000. And if it secures that as support, who knows? It could inch closer to its all-time high of $111,980, like a determined runner crossing the finish line.

However, should the broader economic landscape take a turn for the worse, Bitcoin might find itself in a bit of a pickle again. If it dips below the support of $106,265, it could be testing the waters around $105,000. A break below this support would be like a dark cloud overshadowing the sunny outlook, signaling potential weakness in the market.

Read More

2025-06-12 08:56