In the grand theater of cryptocurrency, the stage is set, and Bitcoin stands at a precipice, teetering on the edge of the $108,000 abyss. The wise sages of Bitunix have cast their gaze upon the latest scrolls of liquidations, foretelling that should Bitcoin dare to breach this sacred support, a deluge of liquidations may follow. Oh, the drama! 🎭

Bitcoin’s (BTC) recent escapades have birthed a veritable liquidation pocket, as the seers at Bitunix revealed to the world. On this fateful Tuesday, May 27, the total crypto liquidations soared to a staggering $211 million, with the scales tipping heavily towards long positions. A staggering $131 million in longs were swept away, while a mere $79.84 million in shorts were left to bask in the sunlight. Talk about a long-side wipeout! 🧹

Our Bitunix analysts, with their crystal balls, interpret this imbalance as a cautionary tale against the folly of overly aggressive long positions while BTC dances near this pivotal support. The market, dear friends, is a fickle mistress!

“Let us not forget the importance of the support at $108,500–$109,000. Chasing higher is not recommended; instead, we must observe whether the $110,800–$112,000 pressure band is shattered before we consider further ventures,” the wise Bitunix scribes advised. 📜

Bitcoin’s price suggests caution in the short term: Bitunix

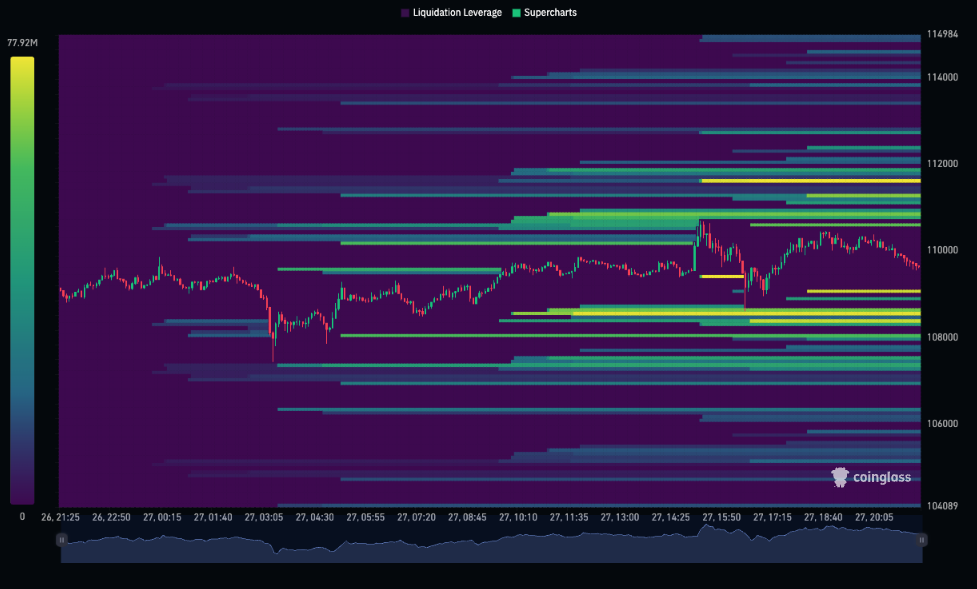

According to the oracle of Bitunix, the liquidation heat map reveals a concentrated cluster of liquidations around the $108,000 level, signaling that this zone may serve as a key liquidity support area, where buyers tend to step in. A veritable oasis in the desert of volatility! 🏜️

Yet, the sages caution that traders must tread lightly. A drop below the $108,000 threshold could unleash a new wave of liquidations, sending the price spiraling into the unknown. Risk control, dear traders, is the name of the game! 🎲

“A drop below $108,000 could trigger a new round of liquidations. Traders are advised to exercise strict risk control as the market could weaken again if capital inflows do not resume,” the Bitunix prophets warned. ⚠️

Despite the tempest of short-term risks, glimmers of hope shine through the clouds. A report from UTXO’s Guillaume Girard and Will Owens reveals that Bitcoin’s institutional demand is currently outpacing supply. Buyers are entering the market faster than miners can mint Bitcoins, a scenario that could escalate into a grand spectacle in the coming years. 🌟

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- 30 Best Couple/Wife Swap Movies You Need to See

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Gold Rate Forecast

- Every Minecraft update ranked from worst to best

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Ncuti Gatwa Exits Doctor Who Amidst Controversy and Ratings Crisis!

2025-05-27 22:51