In a most astonishing turn of events, Bitcoin has galloped forth with an audacious 8% leap in the last 24 hours, as if it were a prize stallion recovering from a rather embarrassing tumble last month. Now prancing at a rather respectable $93,202, it is making a valiant attempt to establish $93,625 as its new sanctuary. This sudden resurgence has rekindled the bullish fervor, though one must advise a modicum of caution—after all, the market is as fickle as a debutante at her first ball. 🕺

As Bitcoin flexes its muscles, traders and market trends seem to be engaged in a rather spirited disagreement, heightening the risks of volatility. It’s almost as if they’re playing a game of charades, and no one knows the answer! 🤷♂️

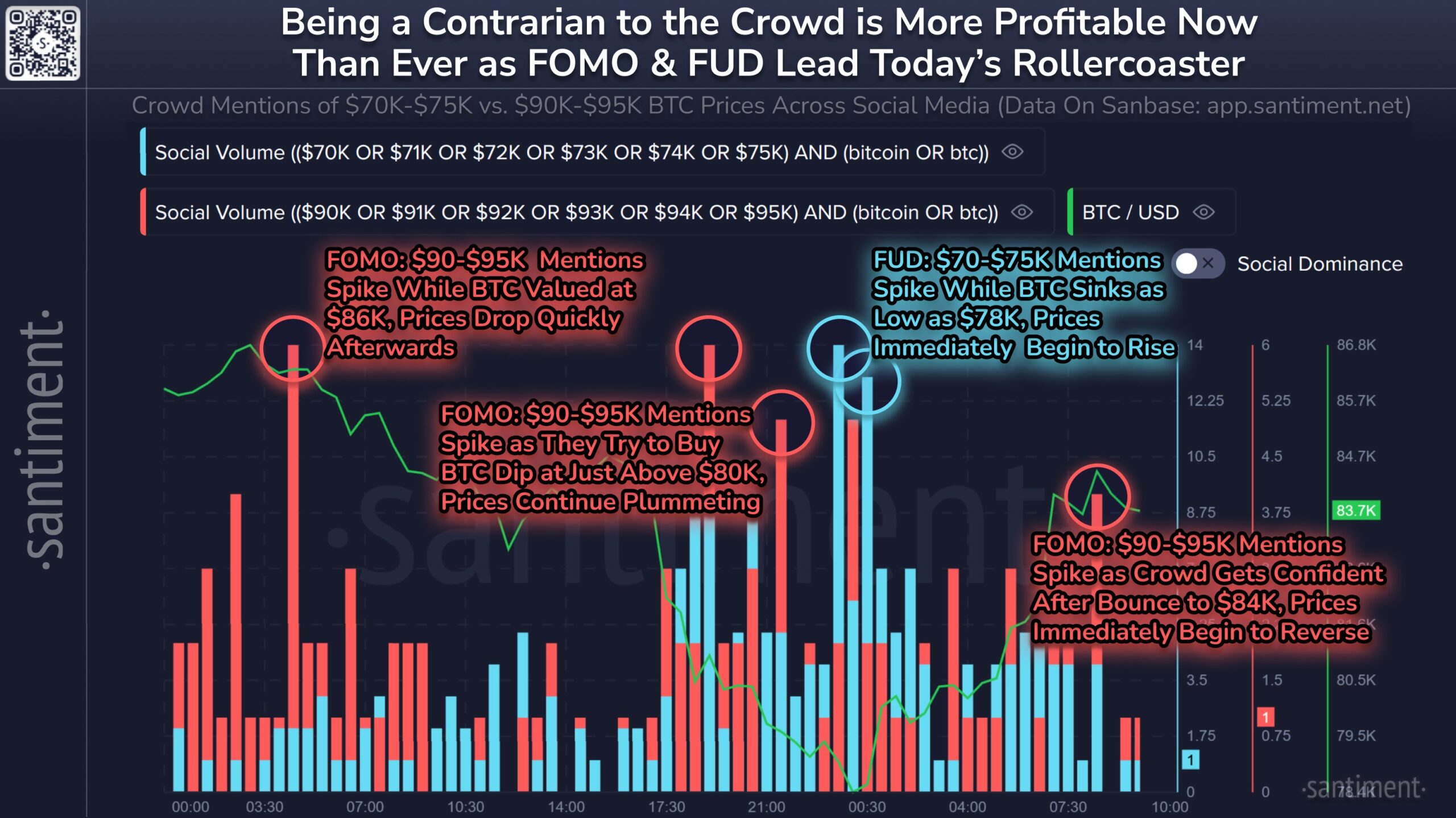

Beware the Sentiment-Driven Trades!

According to the ever-reliable Santiment data, a rather amusing trend emerges—traders frequently misinterpret Bitcoin’s whimsical price movements. When they expect a jubilant rally, the market often decides to sulk instead. Conversely, when they brace for a dismal drop, Bitcoin delights in surprising everyone with a cheeky uptrend. This delightful unpredictability suggests that sentiment-driven trades are akin to playing roulette in a dimly lit casino. 🎰

Investors ought to keep a keen eye on volatility as Bitcoin sets its sights on the illustrious $100,000 mark. Historically, those who have dared to swim against the tide of trader sentiment have fared better than those who followed the herd. In these uncertain times, perhaps it’s wise to consider doing the opposite of what everyone else is doing—after all, who doesn’t enjoy a good plot twist? 📈

Bitcoin’s dominance, currently at a rather impressive 60.74%, is forming a fractal reminiscent of the tumultuous 2020-2021 period, when it soared to dizzying heights before taking a nosedive. A similar trend appears to be on the horizon, suggesting that history may be preparing to repeat itself. On occasion, Bitcoin has shown signs of recovery during periods of waning dominance, though the strength and sustainability of such moves depend on the broader market conditions—much like a soap opera plot that keeps you guessing! 📺

As dominance wanes, altcoins are gaining a bit of limelight, but fear not—Bitcoin often reaps the rewards in the long run. The current market structure resembles a transitional phase, where BTC could very well see further upside. If this fractal holds, Bitcoin’s recent price surge may continue, reinforcing its positive momentum. 🌟

BTC Price Must Secure Its Support!

With Bitcoin’s 8% rise, it has gallantly reached $93,202. Should BTC manage to hold $93,625 as its fortress, a further ascent to $97,696 becomes a tantalizing possibility. Securing this level would bolster bullish momentum, reinforcing Bitcoin’s recovery—like a knight reclaiming his castle! 🏰

Transforming the 50-day EMA into a bastion of support is crucial for maintaining these gains. This maneuver would effectively erase February’s losses and lay the groundwork for further appreciation. If Bitcoin can keep this trajectory, it may be poised for a retest of higher resistance zones—like a determined athlete aiming for the gold! 🥇

However, should it falter and fail to hold above $95,761, the bullish momentum could very well evaporate, leading to a descent toward $92,005. Losing this pivotal level may trigger a cascade of declines, weakening Bitcoin’s upward trajectory—much like a soufflé that collapses under the weight of its own ambition. 🎂

Read More

- Elder Scrolls Oblivion: Best Battlemage Build

- 30 Best Couple/Wife Swap Movies You Need to See

- To Be Hero X: Everything You Need To Know About The Upcoming Anime

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- ATH PREDICTION. ATH cryptocurrency

- Snowbreak: Containment Zone Katya – Frostcap Guide

- ALEO PREDICTION. ALEO cryptocurrency

- Are Lady Gaga’s Ever-Changing Wedding Plans Suiting Fiancé Dizzy? Here’s What’s Happening

- Ein’s Epic Transformation: Will He Defeat S-Class Monsters in Episode 3?

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

2025-03-03 10:26