Ah, the capricious nature of Bitcoin (BTC)! In the span of a mere thirty days, it has danced a merry jig, gaining a delightful 9%, only to stumble and lose 3% in the past week. Its market cap, a staggering $2 trillion, hovers like a cloud of uncertainty. Despite this recent dip, BTC seems to be consolidating, as its EMA lines cling to one another like old friends at a reunion, while the DMI chart whispers of a trend strength so weak it could be mistaken for a gentle breeze.

In the meantime, the number of BTC whales—those grandiose holders of at least 1,000 BTC—has plummeted to a one-year low. It appears that some of these mighty titans have decided to offload their treasures. With key support at $101,300 and resistance at $105,700, the next move of BTC will be akin to a game of chess, determining whether it continues its cautious consolidation or boldly attempts a leap toward the illustrious $110,000. 🐋💸

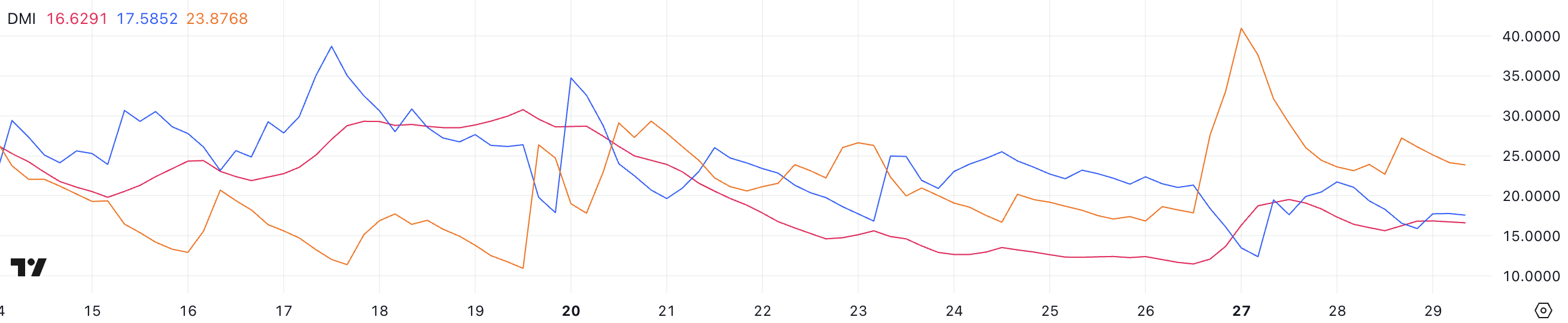

Bitcoin DMI Signals Uncertainty

The DMI chart, a veritable oracle of market sentiment, reveals an ADX of 16.6, fluctuating between 15 and 19 over the past two days. Such values, below the fabled 20, suggest a state of consolidation, while those above 25 hint at a more vigorous trend. Alas, BTC currently lacks the momentum to make a decisive move in either direction, much like a cat contemplating a leap onto a windowsill. 🐱

Moreover, the DMI chart reveals +DI at 17.5 and -DI descending from 27.2 to 23.8. Just two days prior, -DI reached a peak of 40.9, coinciding with BTC’s dramatic fall from $105,000 to $98,600 in mere hours. This suggests that the bearish pressure has eased, and BTC is now in a state of consolidation, much like a weary traveler resting after a long journey.

If +DI manages to rise above -DI, accompanied by a gallant ADX, an uptrend may emerge. Otherwise, BTC may remain ensnared in its range-bound existence or continue its previous downward spiral.

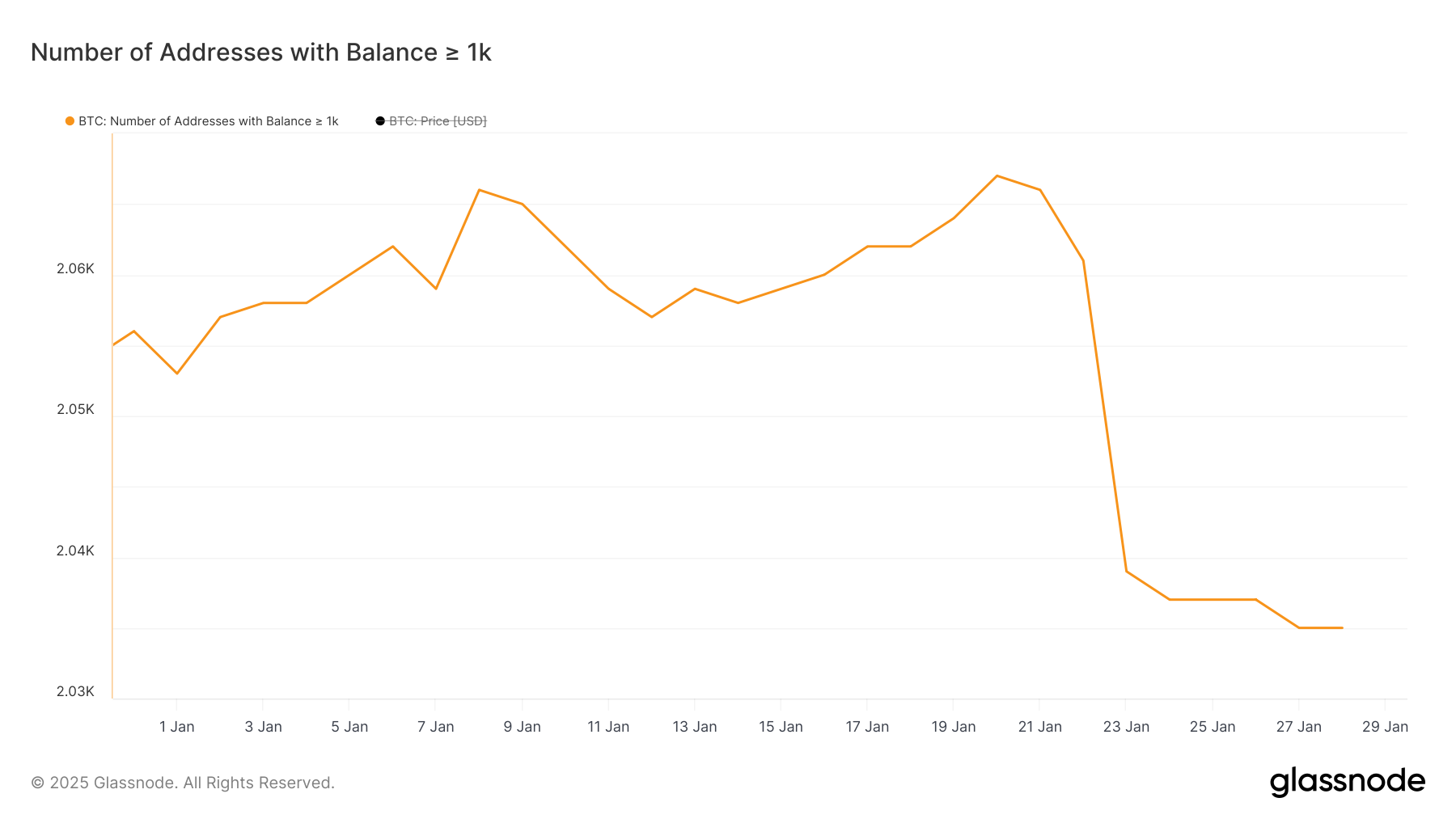

Bitcoin Whales Drop to Lowest Level in a Year

The number of BTC whales has dwindled to a mere 2,035, the lowest since January 2024. A notable decline occurred between January 20 and January 24, when the count fell from 2,067 to 2,037. Such a sharp drop suggests that some of these grand holders have been offloading their BTC, perhaps in search of greener pastures or simply waiting for the next big wave. 🌊

Monitoring BTC whales is of utmost importance, for they possess a significant share of Bitcoin’s supply and can sway market trends with a mere flick of their fins. A decline in whale addresses may indicate a distribution phase, where large holders are selling rather than accumulating, much like a buffet where the food is disappearing faster than one can say “cryptocurrency.” 🍽️

With whale numbers at a one-year low, BTC price could face increased selling pressure, making it a Herculean task for the price to maintain any semblance of upward momentum. However, should new accumulation commence, it could provide the much-needed support to stabilize the market, akin to a sturdy bridge over turbulent waters.

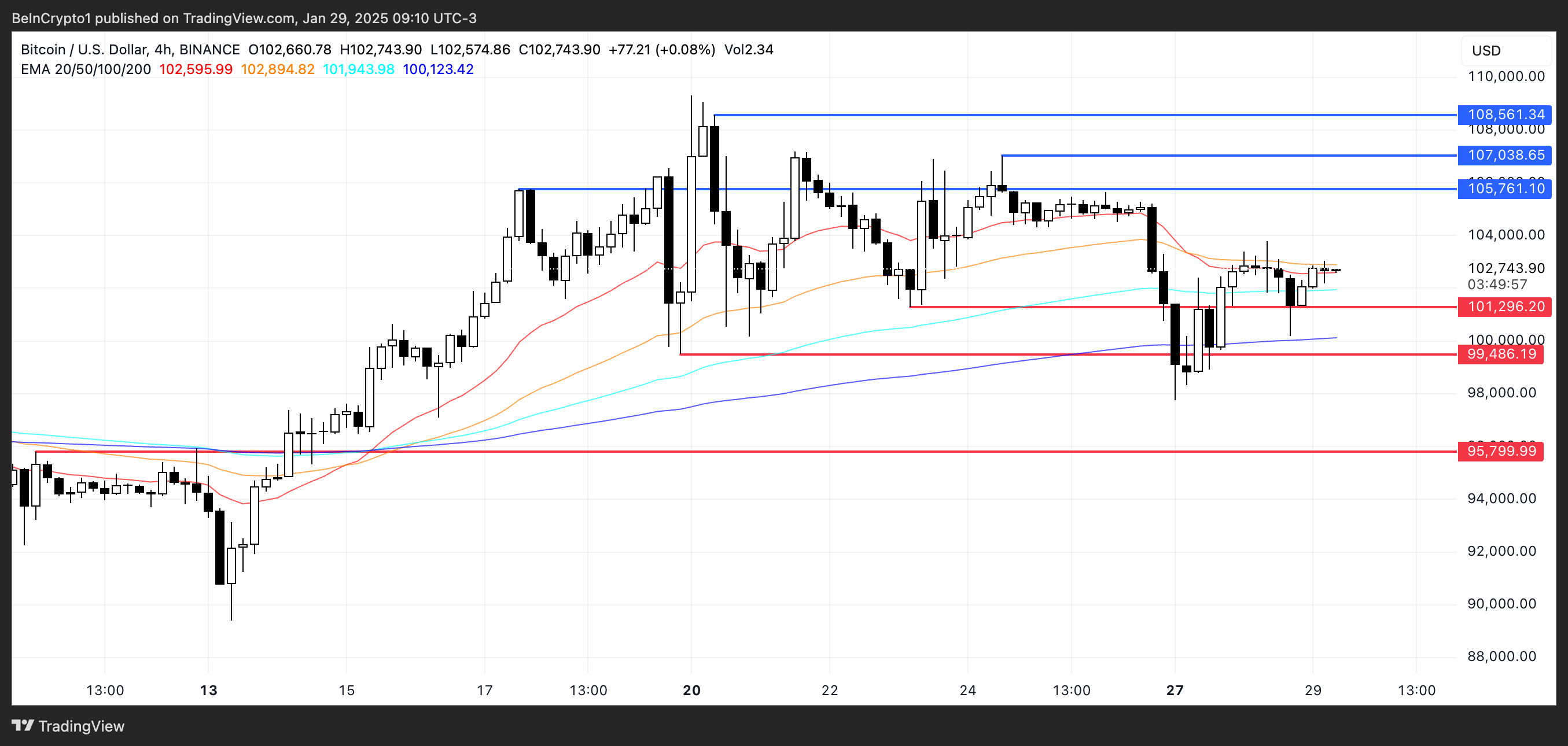

BTC Price Prediction: Will It Finally Reach $110,000 In February?

The EMA lines of Bitcoin suggest a phase of consolidation, as they trade closely together, much like a group of friends huddled together for warmth. The current support level rests around $101,300, which has held firm thus far.

However, should Bitcoin test and falter at this support, it could tumble further to $99,400, with a deeper decline potentially reaching $95,800. Oh, the drama! 🎭

On the brighter

Read More

- Margaret Qualley Set to Transform as Rogue in Marvel’s X-Men Reboot?

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- Does Oblivion Remastered have mod support?

- To Be Hero X: Everything You Need To Know About The Upcoming Anime

- DODO PREDICTION. DODO cryptocurrency

- Oblivion Remastered: How to get and cure Vampirism

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Demon Slayer: All 6 infinity Castle Fights EXPLORED

- Summoners War Tier List – The Best Monsters to Recruit in 2025

2025-01-29 23:06