As a seasoned crypto investor with a few battle scars from previous market cycles, I find myself both hopeful and cautious about Bitcoin‘s current price action. The optimistic predictions for a $110,000 rally are intriguing, but history has taught me that the road to such heights is often fraught with uncertainty and unexpected twists.

Bitcoin’s latest price movements have been characterized by an effort to maintain the upward thrust required to elevate its value further.

As an analyst, I’ve noticed that despite some traders predicting a swift surge towards $110,000, the current market behavior seems uncertain, indicating that a substantial increase may not occur immediately.

Bitcoin Traders Are Optimistic

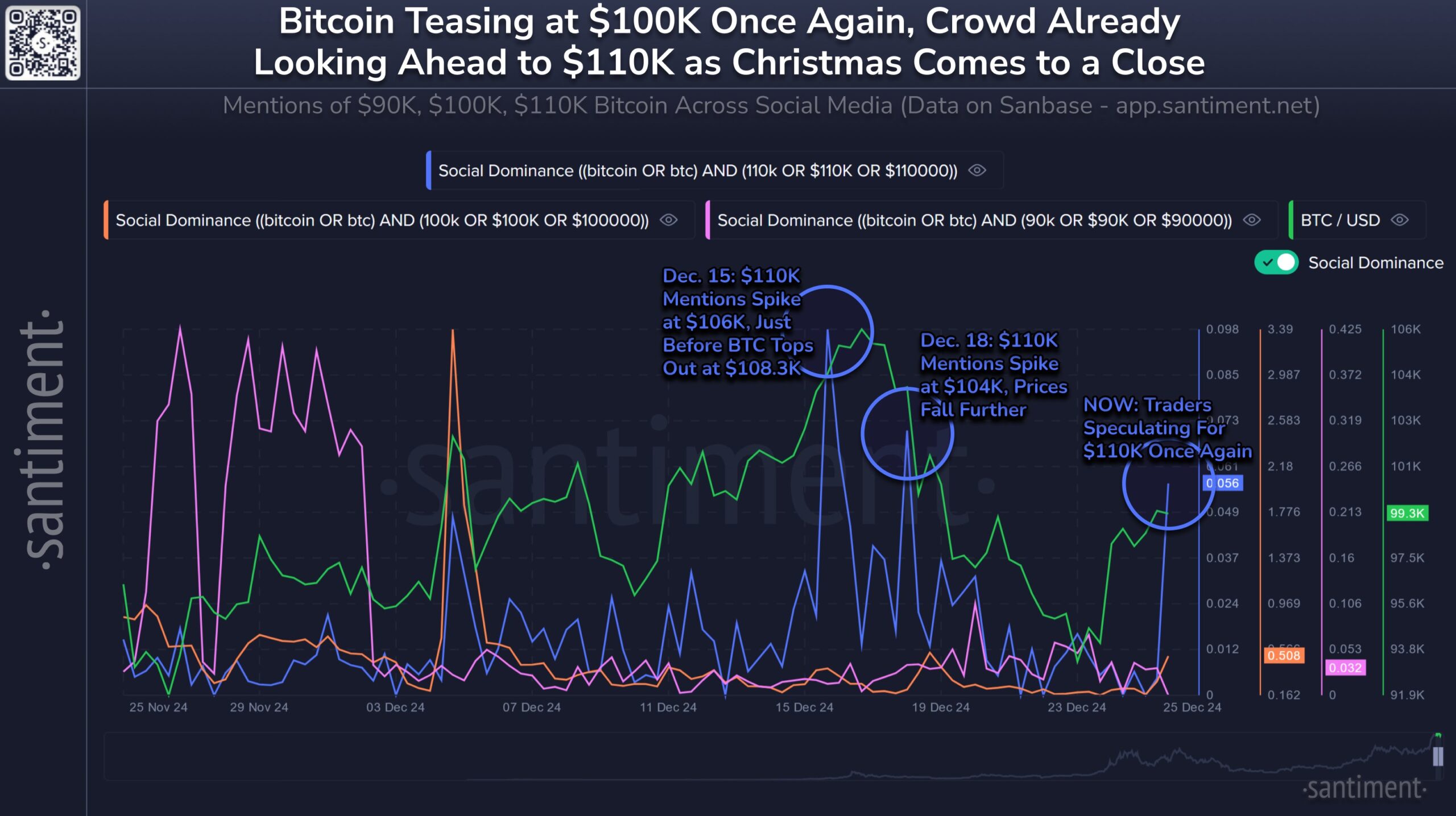

Bitcoin traders remain hopeful that the cryptocurrency will reach $110,000, as data from Santiment shows an increase in social influence around this price point. However, past trends indicate that Bitcoin usually increases in value after discussions about such significant price thresholds start to wane. This pattern suggests that while a surge could occur, it may not happen immediately and could take several days to manifest.

The elevated social dominance reflects the market’s eagerness for another rally, but excessive hype often precedes a period of stagnation. For Bitcoin to sustain upward momentum, market sentiment needs to stabilize, allowing organic growth rather than speculative pressure to drive the price higher.

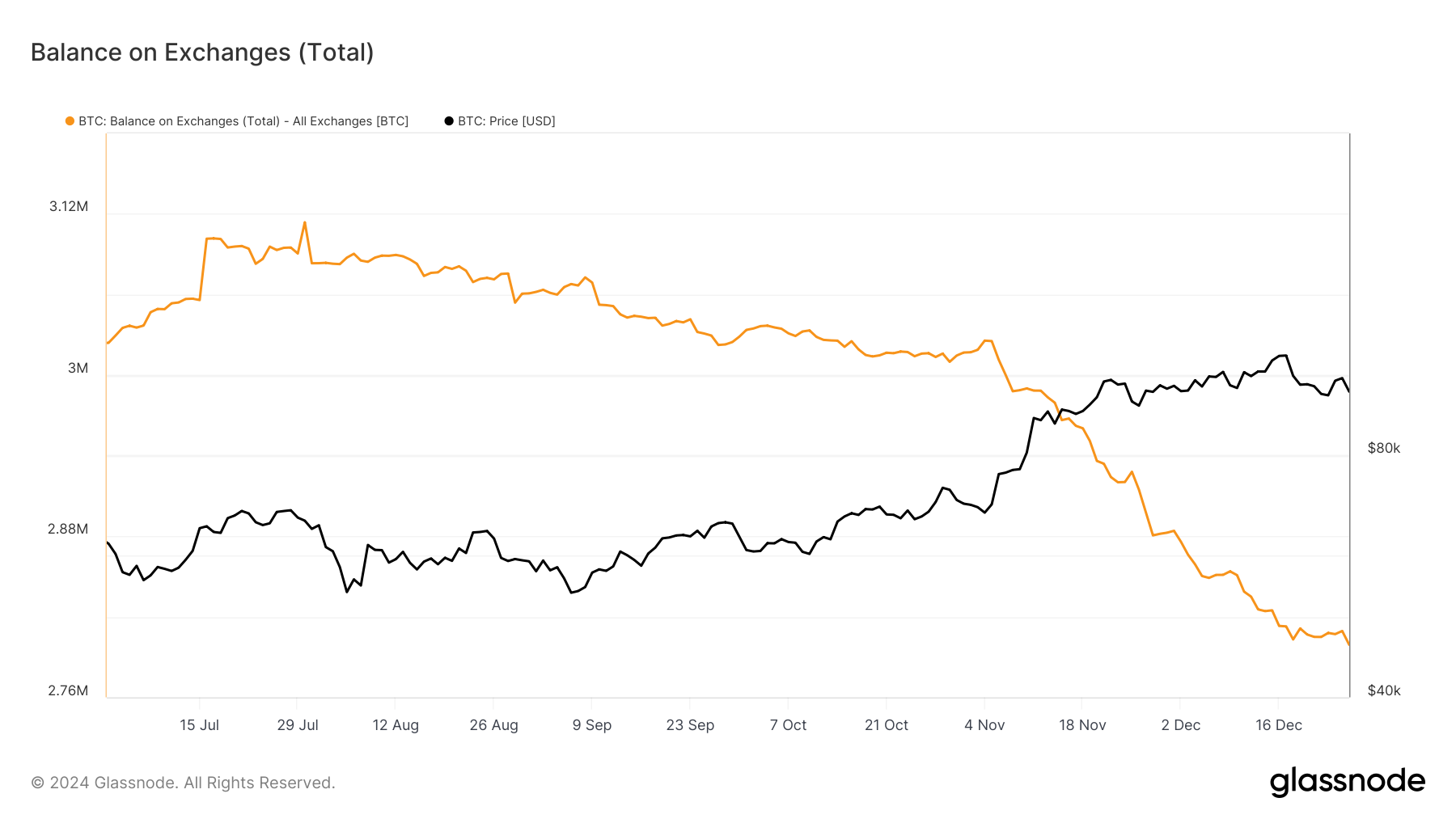

Bitcoin’s overall trend seems to be showing some signs of caution. Recent data from exchanges indicates that the pace of accumulation has slowed over the last nine days, suggesting that investors are becoming more cautious about Bitcoin’s immediate future. This decrease in accumulation could indicate uncertainty among many market participants who are waiting for stronger market indicators before making further moves.

As a crypto investor, I’ve noticed that if Bitcoin’s price starts surging again, it might spark renewed interest among investors who have been on the sidelines, possibly resuming the accumulation spree we saw earlier. However, at present, there seems to be little substantial buying activity, which is contributing to the phase of consolidation. This means that BTC is currently confined within its existing price range, struggling to break free and reach new highs.

BTC Price Prediction: Looking Forward To A Rise

Currently, Bitcoin is approximately 13.5% shy of reaching the $110,000 mark, which surpasses its previous all-time high (ATH) of $108,384. Despite traders being hopeful, the overall market indicators are inconclusive, leaving some doubt about whether Bitcoin can maintain the pace to trigger a substantial price surge.

As a researcher studying the Bitcoin market, I find it plausible that we could witness an upward rally if Bitcoin successfully establishes $105,000 as a robust support level. To accomplish this, Bitcoin needs to break free from its current holding pattern and surpass the significant psychological resistance at $100,000. This potential move could trigger renewed interest in buying, leading to a potential upward trend.

In other words, if investors start selling their Bitcoins due to impatience and take their profits, the $95,668 support level might be broken. If this happens, Bitcoin could slide down to around $89,800. This would weaken the bullish argument and make Bitcoin more susceptible to additional drops in value.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Summer Game Fest 2025 schedule and streams: all event start times

2024-12-27 15:22