Bitcoin, this digital phantom, haunts the ledgers of the modern age. It is, by a vulgar accounting, the largest of its kind, a leviathan swimming in a sea of speculative froth, commanding more than half the value of all such… creations. A curious dominion, wouldn’t you agree? One built not on tangible wealth, nor industrious labor, but on the sheer, unsettling power of belief.

Cathie Wood, a woman who traffics in futures and forecasts, once dared to predict a price of $1.5 million per coin by 2030. A bold pronouncement, fueled, no doubt, by the intoxicating scent of exponential growth. She has since… recalibrated. A downward revision to $1.2 million. A concession, perhaps, to the creeping realization that even phantoms are subject to the laws of gravity, or at least, the fickle whims of the market. Still, a 1,159% potential upside. A sum that whispers promises of salvation to some, and the distinct echo of ruin to others.

But should one chase this digital chimera? The question festers, doesn’t it? Like a moral abscess. We are told it is a store of value. But value… what is value? Is it not a shared delusion, a collective agreement upon worth? And what happens when that agreement… fractures?

The Three Pillars of a Precarious Hope

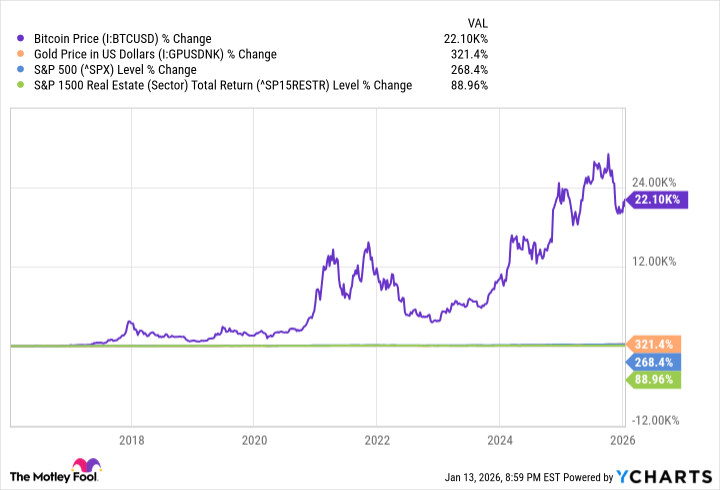

Bitcoin has, undeniably, performed a spectacle of growth in the past decade – a 22,100% return. A figure that mocks the staid performance of established assets. But let us not mistake a fever dream for enduring health. It is, in essence, remarkably… unuseful. It languishes, a digital pauper, largely unwelcome in the mundane exchanges of daily life. It does not grease the wheels of commerce, nor does it flow through the vital arteries of payment networks like, say, XRP. A curious paradox – immense valuation, limited utility.

Ms. Wood now places her faith in stablecoins, these pale imitations of true currency, which, ironically, are gaining traction precisely because they lack Bitcoin’s volatility. They process trillions annually, surpassing even the titans of traditional finance – Visa and Mastercard. A humbling observation, wouldn’t you say? That the very attempt to stabilize the digital realm may ultimately eclipse the ambition of creating a wholly new one.

Bitcoin’s value, therefore, rests not on its practicality, but on the increasingly fragile foundation of… investment. It is perceived as scarce, immutable, secure. A digital fortress against the perceived failings of fiat currency. But scarcity alone does not confer value. A diamond, after all, is merely a pretty rock, elevated to extravagance by artifice and desire.

Ark Invest speaks of six factors, three of which are deemed paramount. Institutional investment, emerging market currency, and the elusive mantle of ‘digital gold‘. They envision a future where institutional behemoths park trillions in Bitcoin, where desperate citizens of failing economies cling to it as a lifeline, and where it absorbs a substantial portion of the world’s above-ground gold reserves. A grand vision, indeed. But is it anchored in reality, or merely a reflection of wishful thinking?

- Institutional Investment: The promise of ETFs attracting vast sums. But capital, like water, seeks the path of least resistance. It will flow to where the returns are guaranteed, not merely anticipated.

- Emerging Market Currency: A seductive notion – a refuge for the desperate. But desperation is a fickle ally. It can just as easily turn to panic, and panic… well, panic is rarely conducive to rational investment.

- Digital Gold: The most audacious claim of all. To usurp the ancient allure of gold, to become the ultimate store of value… a task that requires not merely technological superiority, but a fundamental shift in human psychology.

These catalysts, according to Wood’s models, could propel Bitcoin to that dizzying height of $1.2 million. But models, like prophecies, are often built on sand. They are elegant constructions, perhaps, but they rarely withstand the tempest of unforeseen events.

The Fragility of Faith

Last year, Bitcoin faltered, losing 6% while gold soared by 64%. A stark contrast. It reveals a fundamental truth: when uncertainty reigns, investors still flock to the tangible, the familiar, the proven. Bitcoin, despite its technological marvel, remains, in their eyes, a gamble. And when faced with genuine peril, they prefer the comfort of the known, even if it offers a more modest return.

The influx of capital into spot ETFs, while encouraging, is contingent upon expectation. If Bitcoin fails to deliver on its promise, the enthusiasm will wane, and the money will flow elsewhere. It is a precarious equilibrium, built on a foundation of hope and speculation.

A $1.2 million Bitcoin would necessitate a market capitalization of $25.2 trillion. Five times the value of Nvidia, the world’s largest company. A sum that dwarfs the entire U.S. economy. A truly astonishing proposition. And one that, frankly, strains credulity. It is not merely ambitious; it is… hubristic.

I remain unconvinced. If one seeks a store of value, a hedge against inflation, a refuge from uncertainty, I suggest one consider… gold. The shiny, yellow metal has endured for millennia. It has weathered countless storms. It has proven its worth. Bitcoin, for all its promise, remains a fragile experiment. A digital phantom, haunting the ledgers of a world desperately seeking… something to believe in.

Read More

- Top 15 Insanely Popular Android Games

- Gold Rate Forecast

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- EUR UAH PREDICTION

- Silver Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

2026-01-17 23:52