As an experienced crypto investor who has weathered numerous market cycles and witnessed the rise of Bitcoin from its humble beginnings, I can confidently say that we are currently witnessing the dawn of a new era for digital assets. The surge in institutional interest, coupled with increasing confidence in Bitcoin as a hedge against inflation and economic uncertainty, paints a bullish picture for the foreseeable future.

According to analyst Mike Colonnese at H.C. Wainwright, Bitcoin is currently in a phase where its price is being determined. He believes that favorable opinions about Bitcoin will continue to prevail until the end of 2024. In fact, he predicts that Bitcoin’s value could soar to six figures by the end of this year, attributing this prediction to the growing acceptance of Bitcoin among institutions.

Nigel Green, head of deVere Group, who correctly foresaw Bitcoin reaching $80,000, thinks this marks the beginning of a new period of growth. Green states that due to its limited supply, Bitcoin functions as a deflationary asset and an effective safeguard in times of inflation. He points out that more investors are seeking refuge in Bitcoin to shield themselves from the depreciation of cash value.

Institutional Investment Surge

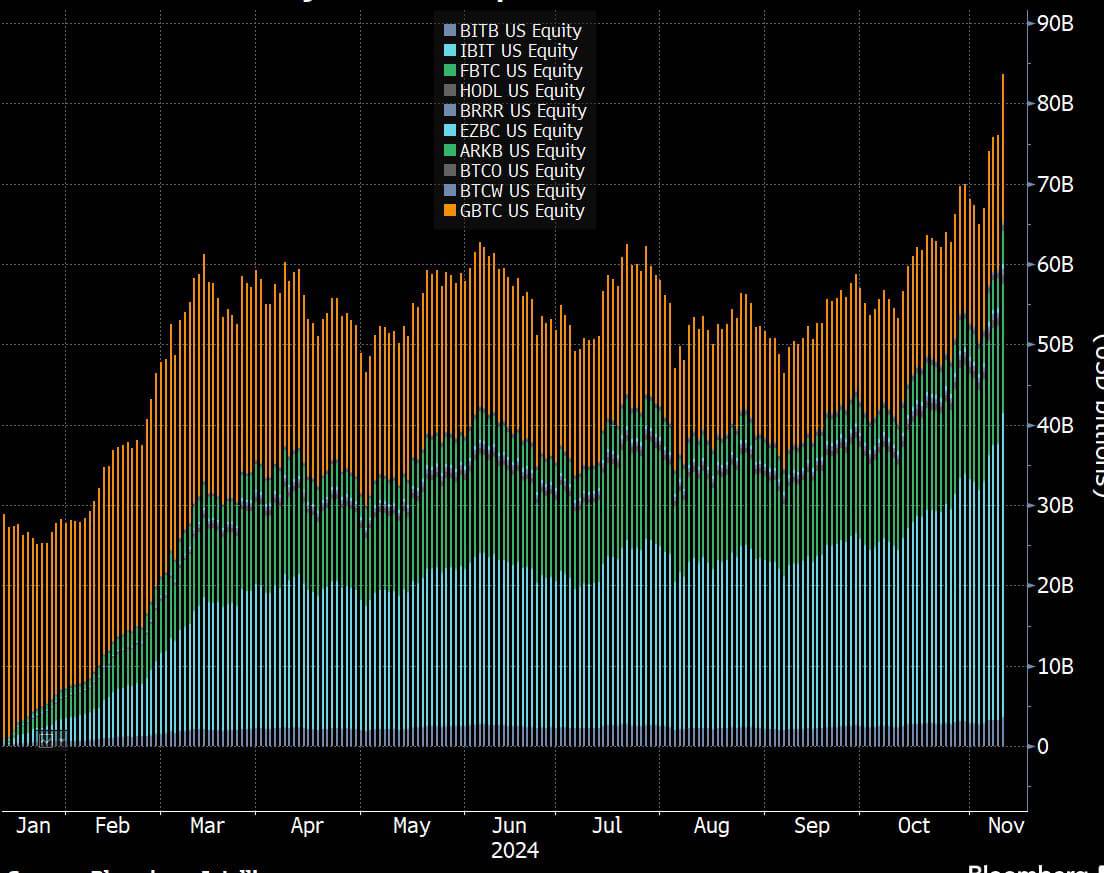

Institutional investment in Bitcoin and Ethereum has notably increased, with analysts at Citi reporting the largest-ever single day influx of funds into spot Bitcoin Exchange-Traded Funds (ETFs). This massive inflow amounted to approximately $2.01 billion for Bitcoin ETFs, while Ethereum ETFs saw a significant increase of around $132 million.

Jag Kooner, who oversees derivatives at cryptocurrency exchange Bitfinex, remarks that while predicting Bitcoin prices can be challenging, reaching $100,000 within the next few months appears quite reasonable. Kooner further explains that due to the strong bullish momentum and the fact that a recession has been successfully avoided—which once seemed likely—Bitcoin is expected to have minimal downside potential.

Prediction Markets and Statistical Analysis

The general outlook towards the market is becoming increasingly positive, with a strong belief that Bitcoin could potentially reach $100,000 by the end of 2024. As per data from Kalshi’s prediction market platform, there’s approximately a 52% likelihood of this happening. Meanwhile, Polymarket suggests an even greater optimism with a probability of 57%. This indicates a growing faith in Bitcoin’s continued growth trend.

Sumit Gupta, one of the founders at CoinDCX, highlights the importance of this recent surge. “This new all-time high demonstrates the growing excitement around digital currencies and the optimism spurred by international economic and regulatory developments,” Gupta points out. He further notes that reaching $100,000 is a significant psychological hurdle for Bitcoin.

Technical Factors and Market Dynamics

With a positive forecast in mind, the market value of stablecoins has grown significantly to surpass $180 billion. This growth indicates an increasing flow of funds into the cryptocurrency sector, which might soon direct its attention towards Bitcoin and other virtual currencies.

In the wider cryptocurrency sector, there has been a surge in positive indicators. For instance, the CoinDesk 20 Index (CD20) has risen by approximately 29% over the past few days. Furthermore, the BlackRock’s iShares Bitcoin Trust ETF (IBIT) is witnessing unprecedented trading activity. On Monday alone, it saw a trading volume of $1 billion within just 35 minutes, and on the same day, it set a new daily record of $4.5 billion in trading volume as Bitcoin exceeded $88,000, according to Eric Balchunas from Bloomberg.

Historical Context and Market Patterns

Historically, Bitcoin has seen its best performance in November, averaging a return of approximately 45%. With only 11 days having passed in November this year, Bitcoin has already risen by 20%. To hit the $100,000 mark, it needs an additional 17% increase.

As a researcher, I’ve been closely observing the cryptocurrency market, and I find myself aligning with Matt Hougan, the chief investment officer of Bitwise Asset Management. He articulates that it’s challenging to pinpoint specific factors that might induce sellers to enter the market and halt the ongoing momentum before reaching a certain level. However, he emphasizes that there are no absolute guarantees, and we could witness temporary pullbacks. Yet, in the broader context of our evolving crypto market cycle, he remains optimistic. Indeed, I share his viewpoint that we should maintain a bullish stance, as the bias continues to favor upward movements.

With Bitcoin’s impressive surge in value, many experts believe it’s not just plausible but more likely than ever to reach $100,000. Yet, they warn that despite a positive outlook, investors should be aware of the market’s unpredictable nature and potential fluctuations.

Read More

- Who Is Abby on THE LAST OF US Season 2? (And What Does She Want with Joel)

- DEXE/USD

- ALEO/USD

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- Discover the Exciting World of ‘To Be Hero X’ – Episode 1 Release Date and Watching Guide!

- Save or Doom Solace Keep? The Shocking Choice in Avowed!

- Yellowstone 1994 Spin-off: Latest Updates & Everything We Know So Far

- ‘I’m So Brat Now’: Halle Berry Reveals If She Would Consider Reprising Her Catwoman Character Again

- To Be Hero X: Everything You Need To Know About The Upcoming Anime

- Who Is Sentry? Exploring Character Amid Speculation Over Lewis Pullman’s Role In Thunderbolts

2024-11-13 14:46