Stop the presses! Bill Miller IV (the guy with more Roman numerals than most people have bank accounts), chief investment honcho at Miller Value Partners, got chatty with CNBC. Apparently, cryptocurrency governance is evolving faster than your grandma’s excuses for not using email. Bitcoin? It just polka-danced back over the six-figure line, and Miller’s betting it still has more room than a stretch limo at a clown convention. 🚗🤡

Miller: Bitcoin Is the Chutzpah Check on Fiat Follies—Did Somebody Say $20 Trillion?

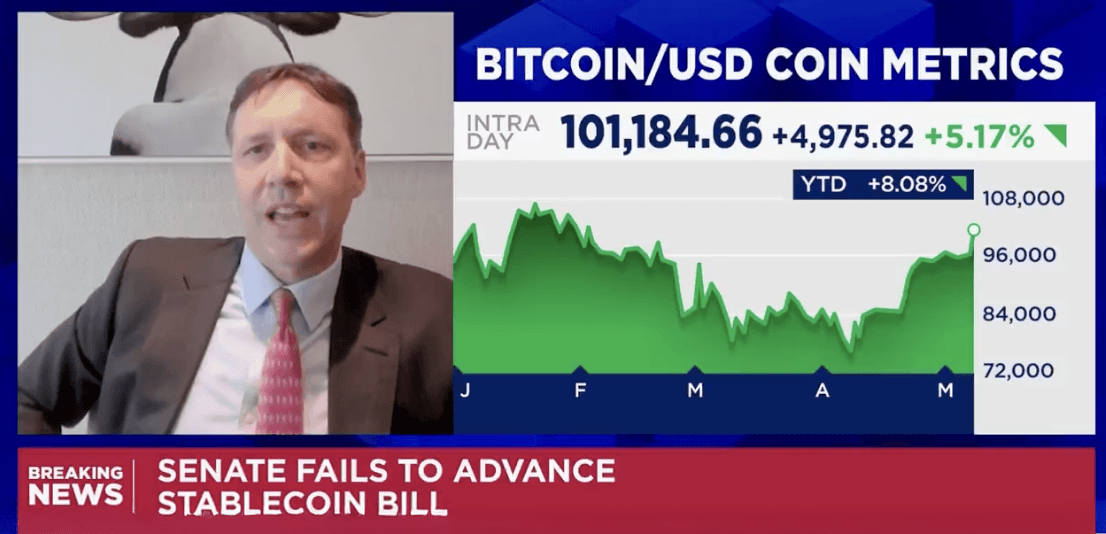

In his banter with CNBC, Miller pointed out that U.S. bureaucrats trying to figure out crypto regulation look like they’re reading a map upside-down. Stablecoins? The Senate can’t agree on a bill, which means the only thing stable in D.C. is the cafeteria’s meatloaf.

So why listen to Miller? Well, aside from being a value investor extraordinaire, he bought bitcoin in 2013, before it was cool—or before most folks even knew how to spell “cryptocurrency.” He started pitching it in public by 2015. That’s dedication. Or he just likes rollercoasters.

He also dropped this nugget: government agencies like the Fed are easing up. Forgot your paperwork to run crypto custody? Don’t worry! Uncle Sam’s too busy having a staring contest with his own shadow to notice. Meanwhile, bitcoin’s not just surviving, it’s outperforming gold—the boomer’s favorite paperweight.

“It’s back in the six figures and still has a lot of room to go,” Miller quipped. “Bitcoin’s main job? Acting as the hall monitor for governments printing money like it’s going out of style. And from where I’m sitting, we’re only at recess.”

Miller’s wisdom, straight from the comedy club:

Gold? That’s a $20 trillion market cap—Bitcoin’s barely at $2 trillion. But can you lug gold around in your underwear? Didn’t think so. Bitcoin’s harder to steal, easier to move, and you can click a button and count your coins. Try that with Fort Knox—after you apply for security clearance and fill out a mountain of paperwork that would make Kafka weep.

He even did the math for Fort Knox: 44,000 labor hours and 18 months just to count the stuff. With bitcoin? Just point, click, verify—and voilà! Transparency for the masses. It’s like “Where’s Waldo?”, but with fewer stripes.

“Wouldn’t it be nifty,” Miller said, “if Americans could just pop onto the blockchain, check their nation’s bitcoin stash, and go about their day? Instant audit, zero hassle, and not a single accountant in sight.”

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- USD ILS PREDICTION

- 30 Best Couple/Wife Swap Movies You Need to See

- Everything We Know About DOCTOR WHO Season 2

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Ncuti Gatwa Exits Doctor Who Amidst Controversy and Ratings Crisis!

- Clair Obscur: Expedition 33 – All Act 3 optional bosses and where to find them

- 9 Kings Early Access review: Blood for the Blood King

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Summoners War Tier List – The Best Monsters to Recruit in 2025

2025-05-10 23:16