So here we are again, folks, watching Bitcoin do what it does best—pretend to be a rollercoaster while everyone debates whether they’re on the ride of their lives or just stuck in line at Chuck E. Cheese. Right now, BTC is chilling between $115,000 and $120,000 like an indecisive houseguest who can’t figure out if they want to leave or raid your fridge. The market’s been sideways for over two weeks, which sounds boring until you remember that sideways markets often explode into chaos faster than your aunt after one too many glasses of chardonnay.

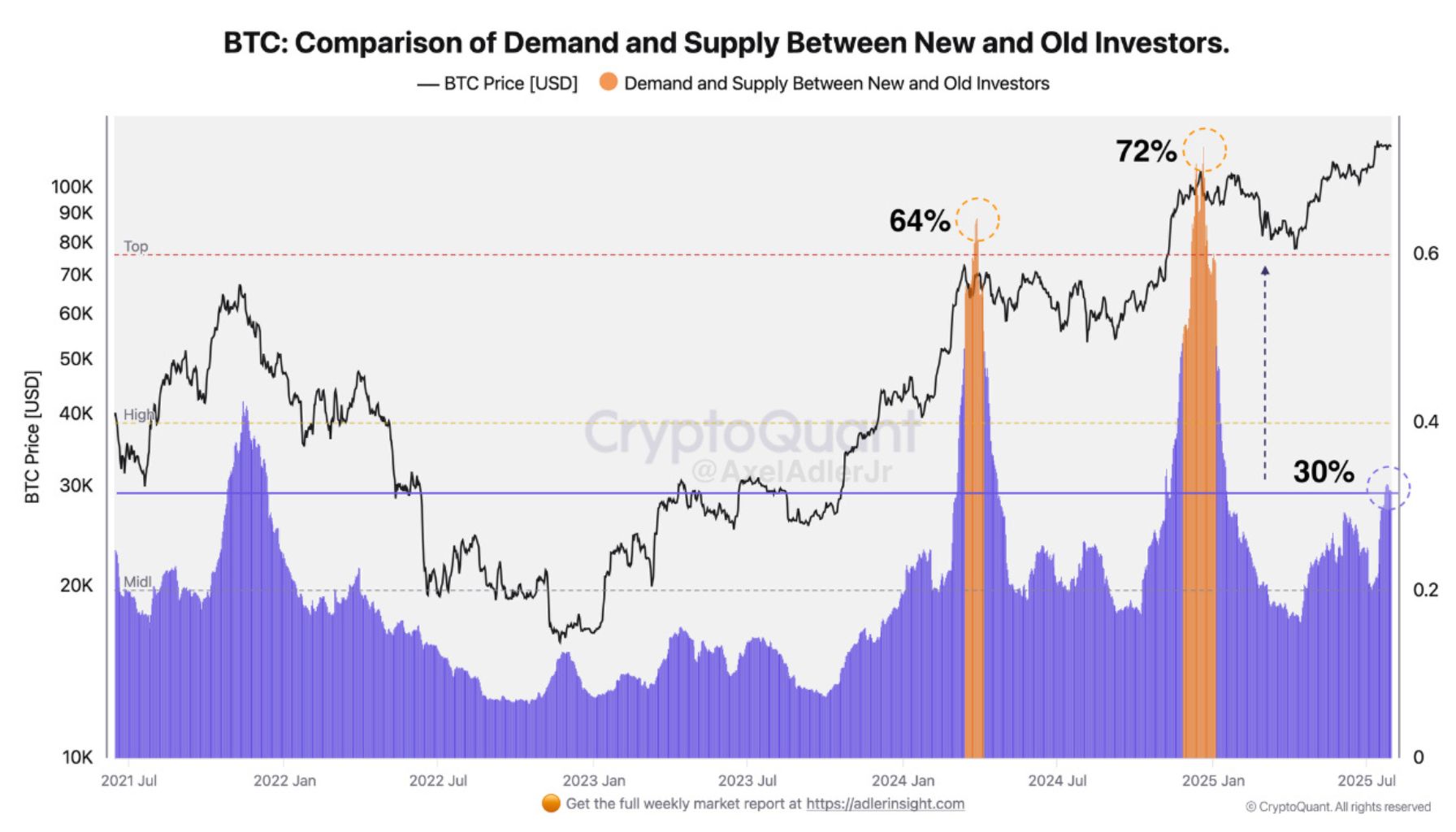

According to some data from CryptoQuant (which I assume is run by people wearing lab coats and saying things like “innovative blockchain synergy”), new investors are flooding in—but not *too* fast. Their dominance is currently at 30%, which apparently means we’re safe from the kind of euphoria-induced mania where people start naming their kids Satoshi. For context, when this number hit 60-70% earlier, Bitcoin prices peaked faster than my enthusiasm for free snacks at a networking event. But don’t worry, old-timers are still selling coins slowly enough to keep the whole thing from collapsing under its own absurdity.

Axel Adler, a top analyst whose name makes me think he should host a late-night talk show, explains that previous spikes in newbie activity lined up perfectly with price tops. Back in March 2024, new investor dominance hit 64%; by December, it soared to 72%. Both times, seasoned holders cashed out faster than you can say “crypto yacht.” Today’s numbers sit comfortably lower, but the upward trend has me wondering if these fresh-faced optimists have any idea how much stress they’re signing up for.

Meanwhile, Bitcoin is camping out between $115,724 and $122,077, testing support levels like a toddler poking at cake frosting. Every time it dips near $115K, it bounces back like a cat refusing to be ignored. Resistance looms above at $122K, where sellers seem determined to ruin everyone’s fun. Oh, and let’s not forget about those moving averages—the 50-, 100-, and 200-period ones—all stacked neatly in bullish order, as if they’ve been practicing for a parade.

What does all this mean? Well, if bulls push through $122K with gusto, we might see fireworks—or at least another round of headlines proclaiming Bitcoin will soon replace oxygen as humanity’s most essential resource. If bears take control and drag us below $115K, though, buckle up for potential carnage. Either way, it feels like we’re collectively waiting for something big to happen, even if no one knows exactly what that “something” is.

In conclusion, Bitcoin remains the financial equivalent of a moody teenager: unpredictable, occasionally brilliant, and always capable of ruining your day. Whether you’re Team HODL or Team Panic Sell, one thing’s certain—we’ll all be talking about it tomorrow. Probably over coffee. Or martinis. Depending on how today goes. 🍸📈

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- ETH PREDICTION. ETH cryptocurrency

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- 9 Video Games That Reshaped Our Moral Lens

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

- Gay Actors Who Are Notoriously Private About Their Lives

2025-07-31 20:33