What to know (if you’re into economic soap operas):

By Francisco Rodrigues 🎬 (All times ET unless this gets too boring and we forget to update it)

Crypto markets are currently doing the Macarena of financial assets: rising, falling, spinning in circles while the rest of the world yells “WHY?!” Weak U.S. job numbers and a government shutdown that’s basically *Weekend at Bernie’s* for politicians have traders convinced the Fed will cut rates faster than you can say “quantitative easing.”

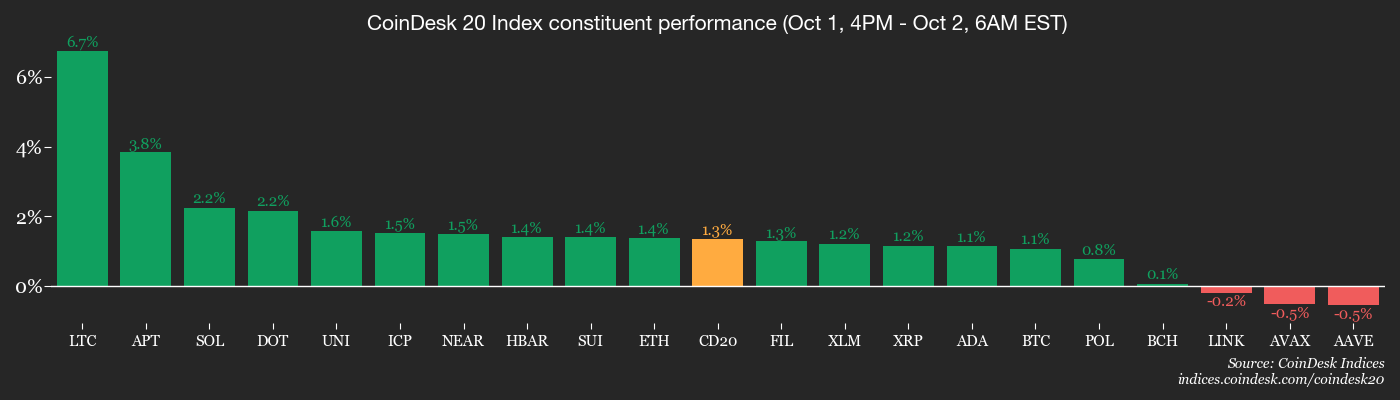

Bitcoin? Up 2.15% to $118,700 because nothing says “safe haven” like a digital token named after a breakfast meat 🥓. The broader market (aka the CoinDesk 20) also inched up 2.33%, proving crypto’s resilience. Or maybe everyone’s just too distracted by the shutdown to notice their portfolios.

The chaos began when ADP’s September payroll data dropped like a mic: 32,000 jobs lost instead of gained. With the government shutdown silencing official labor reports, traders are clinging to this dumpster fire of data like it’s a life raft. Result? Rate cut odds are now 99% on the CME – basically a “sure thing” unless the Fed decides to prank us all.

“Markets responded with *stability* 🤭 after the shutdown,” said Philipp Zentner of LIFI Protocol, because “last time we had a 35-day shutdown, everything was fine!” 🙃

So crypto’s riding the dovish vibes like a skateboard down a hill. Derivatives markets? Open interest jumped 4% to $216 billion, which sounds impressive until you realize it’s mostly fueled by caffeine and wishful thinking. Spot ETFs also got $2.3B in inflows this week – because who doesn’t want to bet on a decentralized future while the government argues over whose turn it is to pay the electric bill?

But not everyone’s buying the hype. 🚨 “Buying BTC via stock premiums is hitting limits,” warned Justin Wang of Zeus Network. Translation: Institutions need better toys if they want this party to last.

As the shutdown drags on (and the economy becomes a Choose Your Own Adventure book), investors are fleeing to gold and crypto. XYO’s Markus Levin declared BTC’s chart is “showing a classic Elliott Wave completion within a rising wedge.” 📈 Translation: It’s either about to skyrocket or implode. No pressure.

Stay alert! Also, maybe stock up on popcorn.

What Not to Miss (Unless You’re Bored of Drama)

For more events, check CoinDesk’s “Crypto Week Ahead” – it’s like a TV guide, but for financial chaos.

- Crypto

- Nothing scheduled. 🎉

- Macro

- Oct. 2, 8:30 a.m.: U.S. Jobless Claims (delayed thanks to shutdown). Estimated numbers? Pure fan fiction at this point.

- Earnings (Based on “experts” who probably guessed)

- Nothing scheduled. 🎉

Token Shenanigans

See CoinDesk’s “Crypto Week Ahead” for more. Or don’t. We’re not your mom.

Conferences

See CoinDesk’s “Crypto Week Ahead” 🙄

- Day 2 of 2: Northern FinTech Summit 2025 (London)

- Day 2 of 2: TOKEN2049 Singapore

- Oct. 2: Stablecoin Summit 2025 (Singapore)

- Day 1 of 3: Lightning Plus Plus Berlin

Token Talk

By Oliver Knight 💬

- Plasma’s Paulie Punt swears no team members sold XPL tokens. “It’s a three-year lock-up!” he cried, while on-chain data smirked. 🤥

- Paulie also denied being “ex-Blast employees.” Only 3/50 team members, he claims. The rest? Google, Goldman Sachs… and *checks notes* Nuvei? Impressive LinkedIn profiles, at least.

- Wintermute’s XPL holdings? “We know nothing!” said Paulie, which is either honest or a masterclass in poker face.

- XPL’s price? Down from $1.68 to $0.97. Daily volume? Still $2.6B. So… half the people here are lying, or it’s a Ponzi scheme. 🚨

Derivatives Positioning

- BTC futures open interest hit $32.6B (Binance: $13.6B). Bulls are *screaming* into the void.

- 3-month basis stable at 7% – so “basis trade” is still profitable. For now.

- Options market? A hot mess. Short-term put skew at 3.25% (hedging fears), but 56% call volume (rally dreams). Pick a lane!

- Funding rates: 9-10% annualized across most exchanges. Deribit? 60%. Someone’s betting their firstborn on BTC.

Market Movements

- BTC: $118,927.57 (+2.23%)

- ETH: $4,392.20 (+2.59%)

- CoinDesk 20: +2.41%

- DXY: 97.53 (-0.18%)

- Gold: $3,902.00 (+0.12%)

- Nikkei 225: +0.87%

- S&P 500: 6,711.20 (+0.34%)

- U.S. 10-Year Yield: 4.094% (-1.2 bps)

Bitcoin Stats

- BTC Dominance: 58.84% (-0.36%)

- Hashrate: 1,059 EH/s

- Hashprice: $49.91

- Total Fees: $423,349

- BTC in Gold: 30.6 oz

Technical Analysis

- BTC broke past a bearish order block at $118,675. Bulls are *twirling their mustaches*.

- Retest of the order block = healthy retracement. Translation: Buy the dip, or get trampled by the herd.

Crypto Equities

- Coinbase: $346.17 (+2.57%)

- Circle Internet: $129.03 (-2.68%)

- Galaxy Digital: $35.83 (+5.97%)

- MARA: $18.61 (+1.92%)

- Core Scientific: $17.97 (+0.17%)

- CoinShares ETF (WGMI): $45.07 (+1.88%)

Crypto Treasury Companies

- MicroStrategy: $338.41 (+5.03%)

- Upexi: $6.53 (+13.17%)

- Lite Strategy: $2.56 (+5.79%)

ETF Flows

Spot BTC ETFs

- Daily net flow: $675.8M

- Cumulative flows: $58.4B

- Total BTC holdings: 1.32M

Spot ETH ETFs

- Daily net flow: $80.9M

- Cumulative flows: $13.9B

- Total ETH holdings: 6.61M

Read More

- Gold Rate Forecast

- Top 15 Insanely Popular Android Games

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Why Nio Stock Skyrocketed Today

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- EUR UAH PREDICTION

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- EUR TRY PREDICTION

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

2025-10-02 15:38