The cryptocurrency narrative has entered a curious phase. Following the 2024 electoral shift, Bitcoin (BTC +2.79%) experienced a parabolic surge, buoyed by regulatory deregulation and the establishment of a U.S. Strategic Bitcoin Reserve. Yet recent price action suggests the market is recalibrating to macroeconomic realities: Federal Reserve policy uncertainty, liquidity constraints, and the enduring specter of $38 trillion in public debt. The question remains: Is Bitcoin a vehicle for wealth creation, or merely a speculative illusion?

The Gold Analogy: Alchemy or Arithmetic?

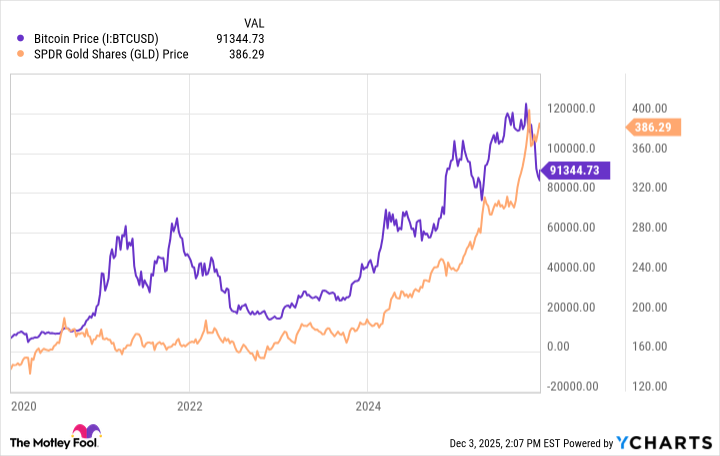

The “digital gold” hypothesis has gained traction in financial circles. Proponents cite Bitcoin’s capped supply (21 million tokens) and its role as an inflation hedge. However, this comparison falters on two critical fronts:

- Volatility vs. Stability: While gold exhibits annual price swings of ±10%, Bitcoin’s 30-day volatility often exceeds 200%.

- Utility Gaps: Gold maintains intrinsic value through jewelry and industrial applications; Bitcoin’s utility remains largely speculative.

Halving events (reducing block rewards every 4 years) theoretically constrain supply, yet mining centralization and energy costs introduce operational risks not present in traditional commodities markets.

The six-year correlation between Bitcoin and gold (r²=0.38) is statistically significant but functionally meaningless. Both assets respond to fiat currency depreciation fears, yet their structural differences render direct comparisons methodologically flawed. The U.S. Treasury’s 13% interest burden on debt may justify safe-haven demand, but Bitcoin’s energy-intensive proof-of-work mechanism lacks the economic efficiency of gold’s millennia-old infrastructure.

Making Millionaires: Probability vs. Possibility

Wall Street’s bullish projections for Bitcoin rest on three unproven assumptions:

- Market Cap Expansion: Current $1.8 trillion valuation implies 6.8x growth to match gold’s $29.4 trillion cap.

- Regulatory Stability: The SEC’s ongoing enforcement actions against crypto firms suggest institutional risk remains unresolved.

- Adoption Trajectory: Mainstream adoption requires solving scalability, security, and UX challenges absent in legacy financial systems.

Contrarian analysis reveals structural asymmetries. Unlike equities, Bitcoin lacks earnings, cash flow, or dividend yield. Its “value capture” mechanism relies on network effects and speculative momentum-both vulnerable to systemic shocks. The 2022 Terra/LUNA collapse (a 60% drawdown in 72 hours) demonstrates how quickly crypto liquidity can evaporate.

Portfolio allocation to Bitcoin should be treated as a diversification tool, not a wealth multiplier. Historical price cycles show 40-60% corrections occurring every 12-18 months. Investors seeking “millionaire status” would need to compound at 25%+ annualized returns-a rate achievable only through concentrated risk-taking or leverage, both incompatible with prudent capital preservation.

While Bitcoin’s resilience is undeniable (surviving five major crashes since 2010), its role as a “store of value” remains unproven. The asset class exists in a regulatory gray zone, with jurisdictional fragmentation creating operational risks for institutional investors. As central banks experiment with CBDCs, Bitcoin’s competitive moat may narrow rather than widen.

For now, the data suggests Bitcoin functions as a high-risk, high-reward play on monetary policy uncertainty. Whether it becomes a “millionaire maker” depends on one’s risk tolerance and time horizon. But investors should approach this narrative with the same skepticism applied to tulip mania or dot-com euphoria. After all, the difference between a speculative bubble and a revolution is measured in years, not months. 🐍

Read More

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Gold Rate Forecast

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- EUR UAH PREDICTION

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- Silver Rate Forecast

- Why Nio Stock Skyrocketed Today

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

2025-12-08 12:08