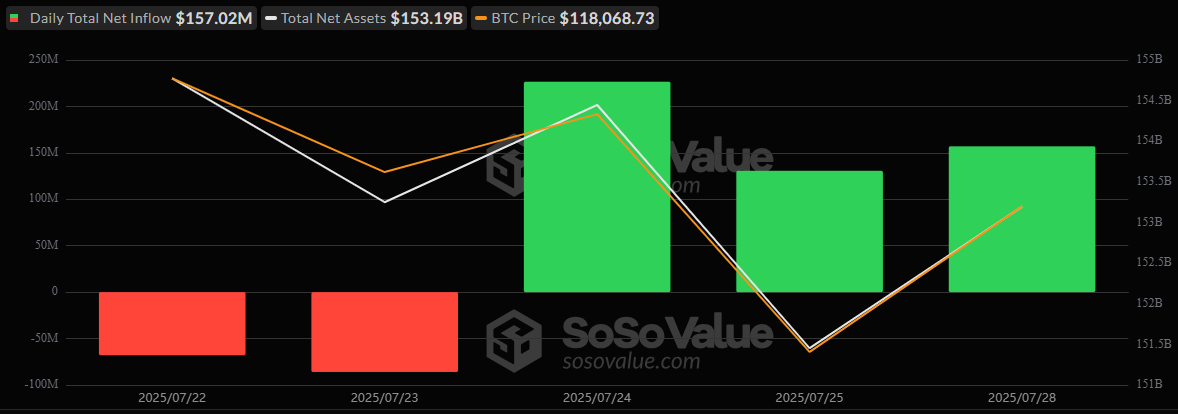

The week commenced with crypto-enthusiasts—those tireless fortune chasers—casting their rubles, or perhaps mere hopes, into the churning seas of Bitcoin ETFs, which, like a particularly moody landlord, decided to open its doors wide: $157 million swept in with the impetuousness of a young aristocrat returning home after a quarrel. Meanwhile, ether ETFs, unhindered by drama, merely nodded and proceeded upon their 17-day parade of inflows, quietly amassing yet another $65 million. All this, despite two funds losing money as if they’d confused their ledgers with potato sacks. 😏

Tale of Two ETFs: Ethereum Marches On, Bitcoin Dances in

Thus began another storied week in the land of crypto markets, where optimism springs eternal, and investors collectively decide to have faith (or delusions, depending on whom you ask). Bitcoin ETFs, which the previous week mulled their place in the universe, abruptly remembered their purpose and hurtled back with vigor, as if frightened of being upstaged by their Ethereum cousins. Bitcoin ETFs, not content with subtlety, chose to rally almost all their forces around Blackrock’s IBIT—the Napoleon of index funds—which single-handedly hoarded $147.36 million, presumably while humming “Ode to Joy.” Fidelity’s FBTC, perhaps nursing an existential crisis, managed a respectable $30.88 million, while Grayscale’s Bitcoin Mini Trust took the moniker “mini” to heart and contributed but $10.98 million.

But let us not descend into the fallacy that all was well beneath the digital sun. Two funds, Ark 21shares’ ARKB and Bitwise’s BITB, jettisoned money as if playing the world’s least satisfying version of “hot potato,” losing $17.45 million and $14.76 million respectively. In the end, however, the net result was $157.02 million rolling in, $3.34 billion swirling around like borscht at a Moscow banquet, and net assets reaching a stately $153.19 billion. Not bad for another day in blockchain’s great novel!

And what of Ether ETFs—the stoic peasants to Bitcoin’s impulsive gentry? Despite sabotage from within (thanks, Fidelity’s FETH and Grayscale’s ETHE, for hemorrhaging $49.23 million and $17.58 million, respectively), Blackrock’s ETHA, with the patience and resolve of a Russian matriarch, hauled in $131.95 million all by itself. Who needs friends when you can carry the whole wagon alone? 🤷♂️

Staggering minor betrayals, net inflows for Ether ETFs sauntered to a $65.14 million gain, pushing the sector’s net assets to a record $21.53 billion, while $1.91 billion changed hands—presumably with less hand-wringing than your average pre-revolutionary dinner party.

In conclusion—if finance even allows such a thing—Ether’s unwavering parade continues to steal the limelight. Don’t be surprised if it crosses the $22 billion mark soon, with investors and onlookers alike placing philosophical bets on which will falter first: human optimism or market exuberance. Catch you at the next chapter, should fate (or market volatility) permit! 😂📈

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- ETH PREDICTION. ETH cryptocurrency

- 9 Video Games That Reshaped Our Moral Lens

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

- The Weight of Choice: Chipotle and Dutch Bros

- Gay Actors Who Are Notoriously Private About Their Lives

2025-07-29 19:32