- Ah, the correlation between altcoins and Bitcoin, once a sturdy bridge, now crumbles like a stale biscuit, revealing the fragility beneath Bitcoin’s solitary ascent.

- Behold the whales, those titans of the deep, whose surge in dominance whispers caution rather than conviction; a snapback looms ominously near the heights of yore.

Bitcoin’s [BTC] latest surge is turning heads, but not for the usual reasons. As BTC ascends, the broader altcoin market stalls—oh, the irony! A rare divergence indeed, like a lone wolf howling at the moon while the pack sleeps.

With Bitcoin dominance rising and historical correlations breaking down, analysts are sounding alarms: this rally may be running on fumes, and the risk of a sudden reversal is growing. It’s like watching a tightrope walker without a safety net—thrilling yet terrifying!

Altcoin correlation crumbles as Bitcoin climbs

Bitcoin’s ascent is no longer lifting all boats; it’s more like a single boat drifting away while the others sink. 🛶💔

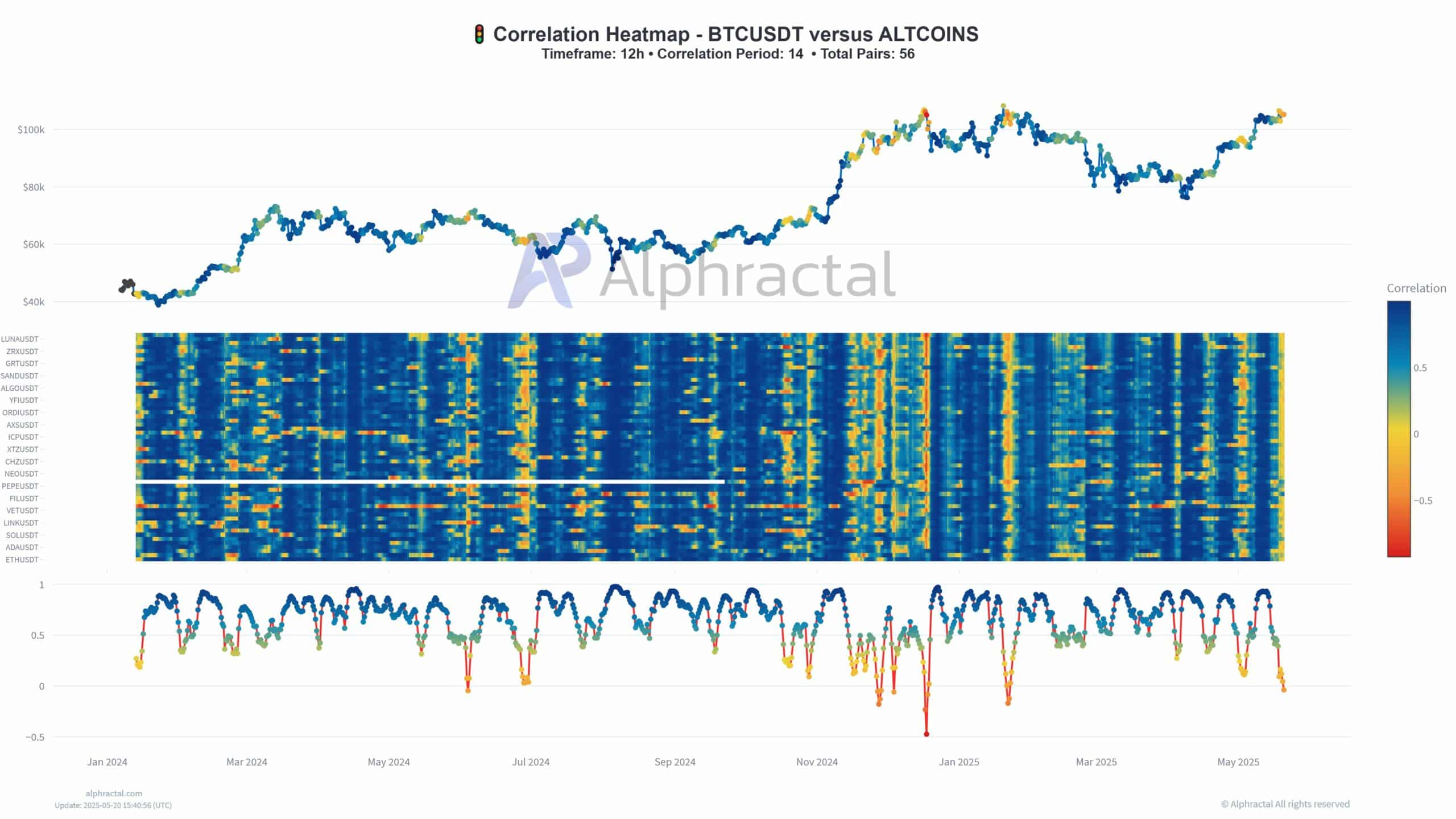

The 14-period rolling correlation between BTC and major altcoins has sharply declined since late April 2025, like friendships that fade in the light of success.

Unlike previous rallies where altcoins moved in sync with Bitcoin, the current trend shows fragmentation. Most altcoins now display near-zero or negative correlation on the 12-hour timeframe. It’s a sad tale of betrayal, really.

This disconnect, highlighted by cooler blue shades in the heatmap, signals a narrowing market. A Bitcoin-led rally often lacks long-term strength and can sometimes precede a broader risk-off shift in the market. It’s like a party where the host leaves early, and the guests are left wondering what to do.

Dominance reclaimed

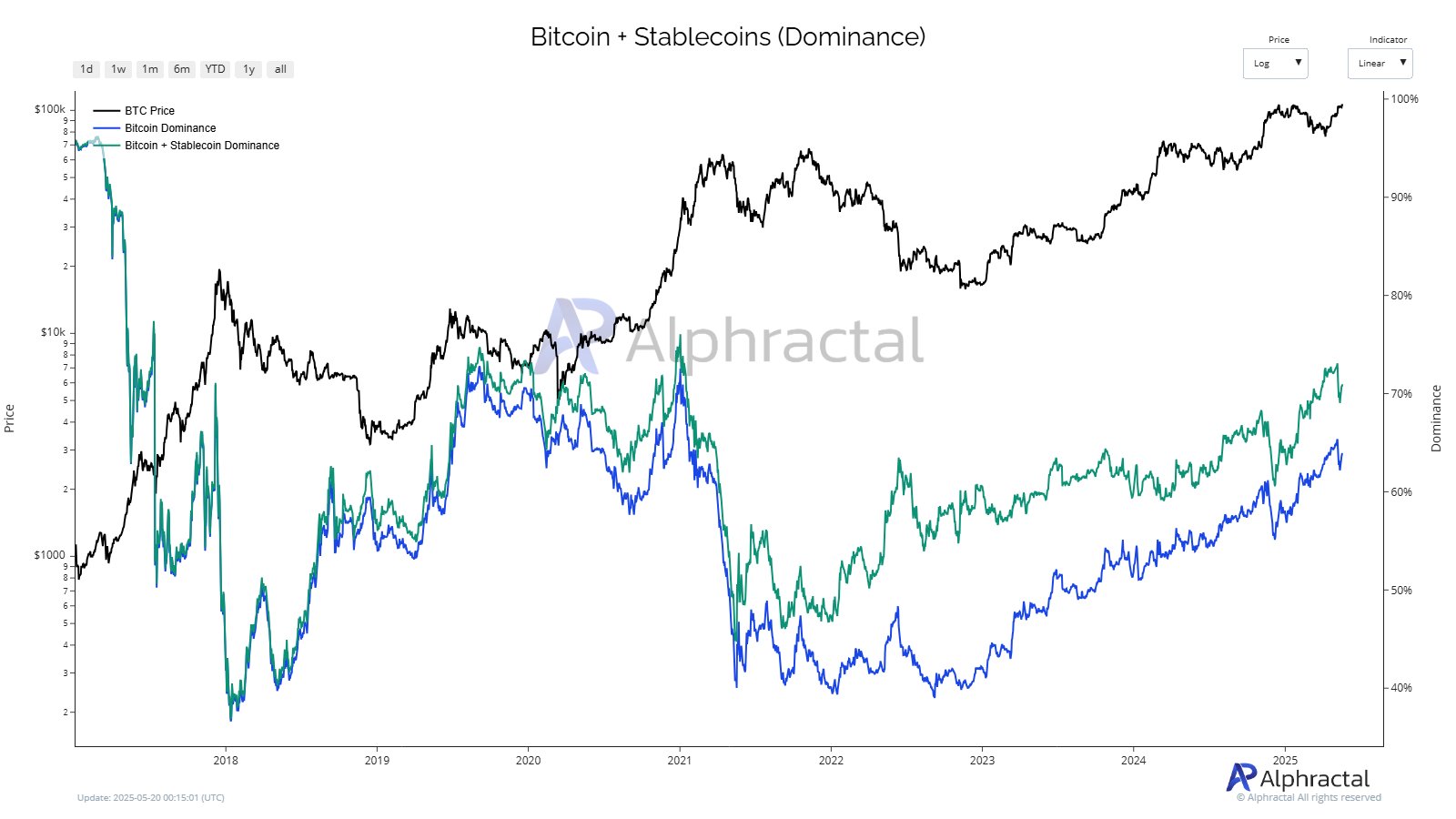

BTC’s price climb has been accompanied by a powerful resurgence in market dominance, not just for BTC alone, but when combined with stablecoins. It’s a reunion of sorts, but one that feels a bit forced.

The joint dominance borders on 70%, showing a return to risk-off behavior and consolidation of capital in “safer” crypto assets. Oh, the irony of seeking safety in a world of volatility!

While Bitcoin dominance alone remains below its 2021 peak, the inclusion of stablecoins shows that traders are waiting on the sidelines, like spectators at a circus, unsure whether to cheer or jeer.

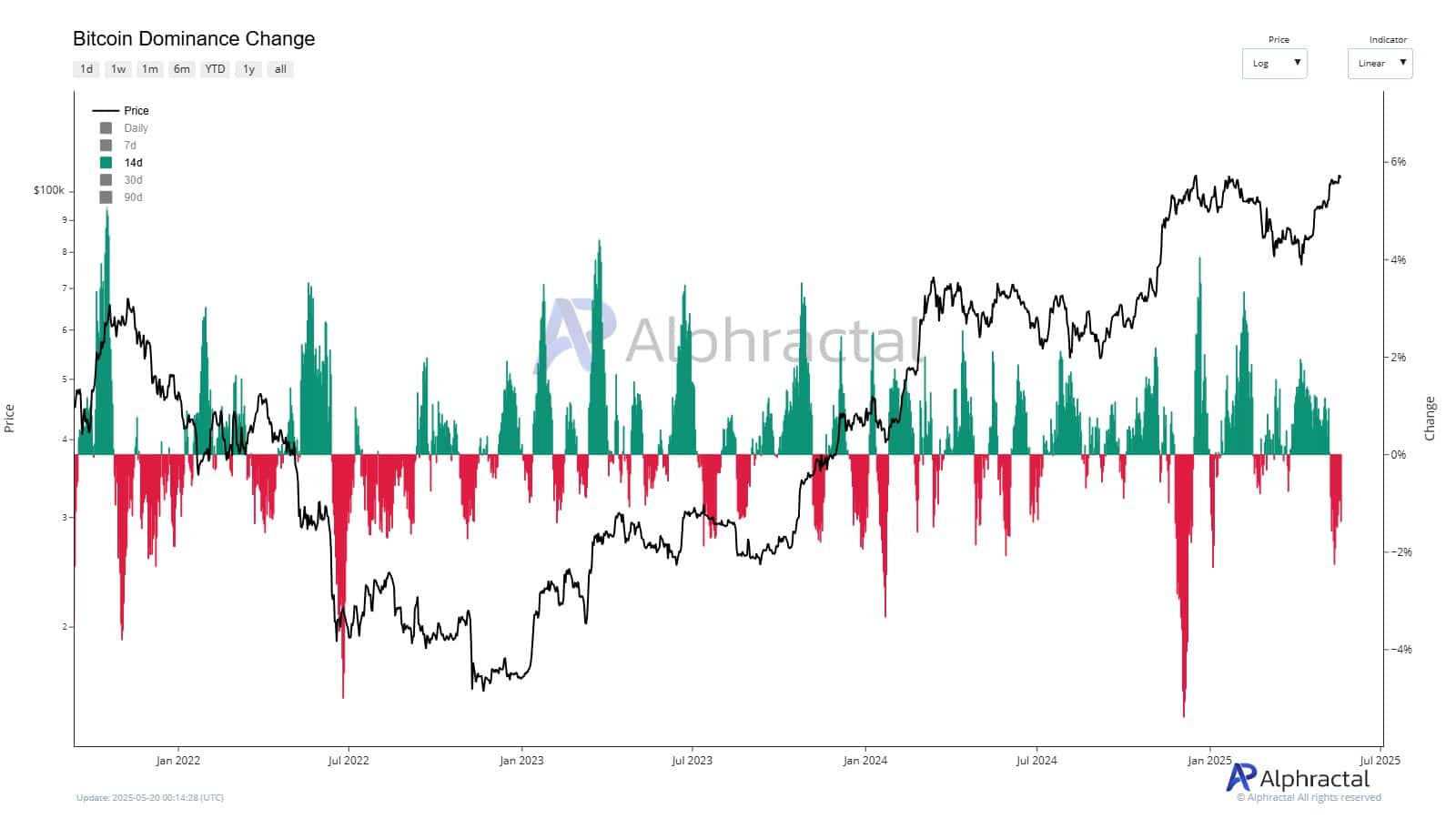

Despite price gains, BTC dominance change has frequently turned negative, highlighting continued capital rotation and market indecision beneath the surface strength. It’s a dance of uncertainty, where no one knows the next step.

Whales on thin ice

The latest rally appears to be driven by large players consolidating capital into BTC and stablecoins, not a broad market surge. With Bitcoin hovering near all-time highs, risk is elevated, especially as dominance gains appear to stall and momentum thins out. It’s like a game of Jenga, where one wrong move could send everything crashing down.

If institutional buying slows or external factors tighten, the market could quickly snap back. Thin liquidity, cautious retail participation, and dependence on whale-driven flows make the current setup fragile. It’s a house of cards, my friends!

Without fresh fuel, this rally risks fading just as quickly as it climbed. A tragic comedy, indeed! 🎭

Read More

- Gold Rate Forecast

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Are Billie Eilish and Nat Wolff Dating? Duo Flames Romance Rumors With Sizzling Kiss in Italy

- Tom Hiddleston and Wife Zawe Ashton Announce Second Pregnancy, Know Couple’s Relationship Timeline

- Is Justin Bieber Tired of ‘Transactional Relationship’ with Wife Hailey Bieber? Singer Goes on Another Rant Raising Concerns

- Justin Bieber Tells People to ‘Point at My Flaws’ Going on Another Rant, Raises Alarm With Concerning Behavior

- Resident Evil 9: Requiem Announced: Release Date, Trailer, and New Heroine Revealed

- Summer Game Fest 2025 schedule and streams: all event start times

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

2025-05-22 02:33