January’s been a real treat for Bitcoin – or should I say, a slap in the face. Volatile doesn’t even begin to cover it. The US and EU are at it again, tariffs flying around like there’s no tomorrow. And Bitcoin? It’s just shrugging and dropping nearly 2.5% to about $92,663. Yawn. Analysts are pointing to some pretty dramatic bear signals for 2026. Yeah, I said 2026. We’re geniuses over here.

1. Bearish Kumo Twist? Great, Now It’s Literally Twisting in the Wind

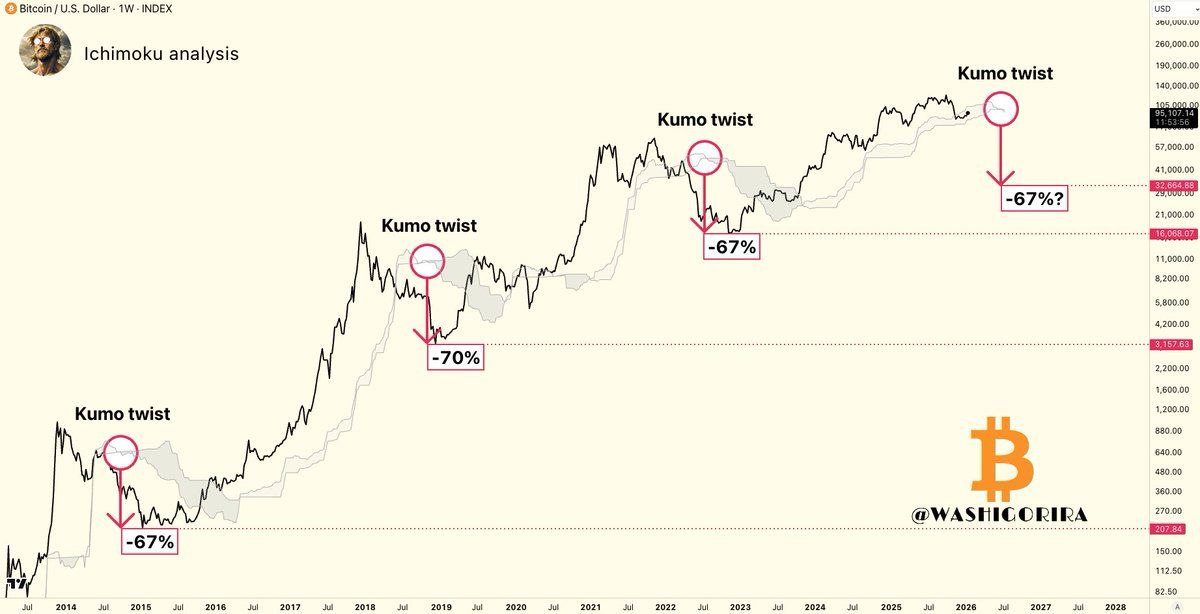

Twitter’s been blowing up over this “Kumo twist.” What’s that? Think of it as Bitcoin’s weather report, where the cloud-yep, the Ichimoku Cloud-decides whether it’s sunny or stormy. For the record, this twist looks like a bad hair day for Bitcoin. The crypto analyst Titan of Crypto says it’s bearish. Lovely.

Previous cycles show a similar twist means trouble-like a 67-70% drop. Nice. Just what we needed.

“When the Kumo turns bearish, Bitcoin enters a bear market. Not a warning, a full-blown, sit-down-and-cry session,” says Titan.

2. Bitcoin’s Having a Bad Day Below Key Barriers

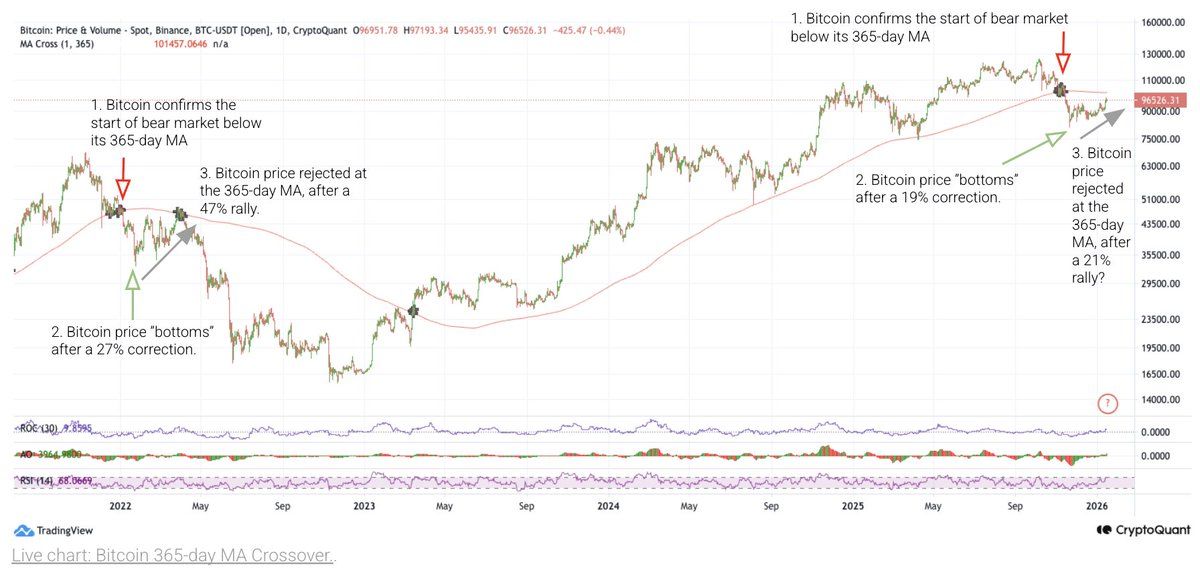

Bitcoin’s hanging out below its 365-day moving average – about $101,000. During 2022’s mess, that was the stop sign for any comeback. Now? Still a crater.

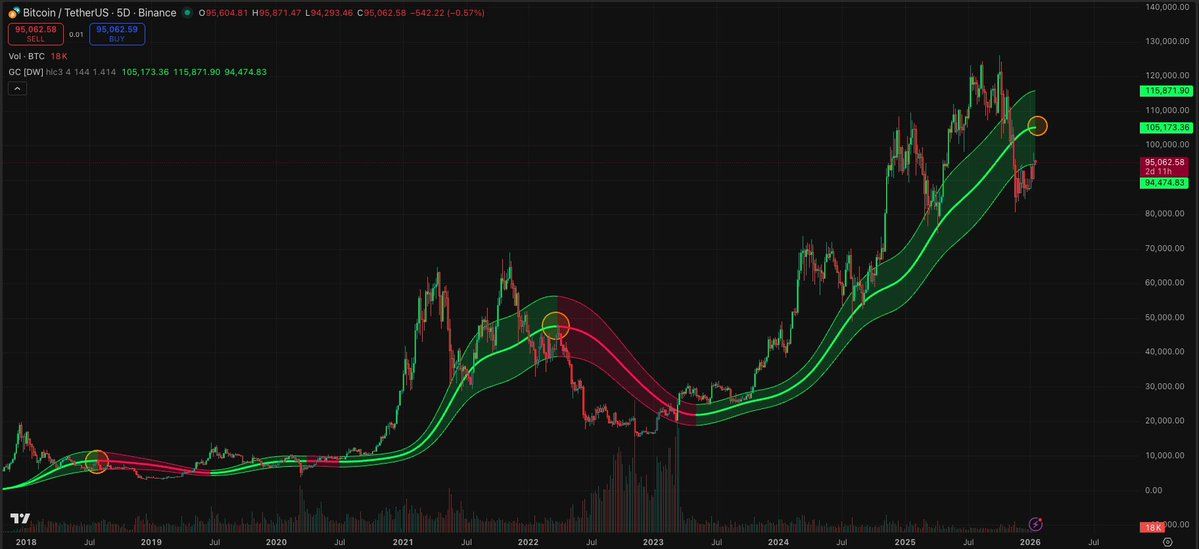

Coin Bureau says it’s bearish, and the Gaussian Channel on a five-day chart? Yep, that’s saying the same thing. Bitcoin’s lost its groove.

Crypto analyst Raven says we’re headed to $103k – a “liquidity hunt.” Or a dead cat bounce, more likely. Exciting stuff, huh?

3. Remember 2013 and 2017? Yeah, More Drop Potential

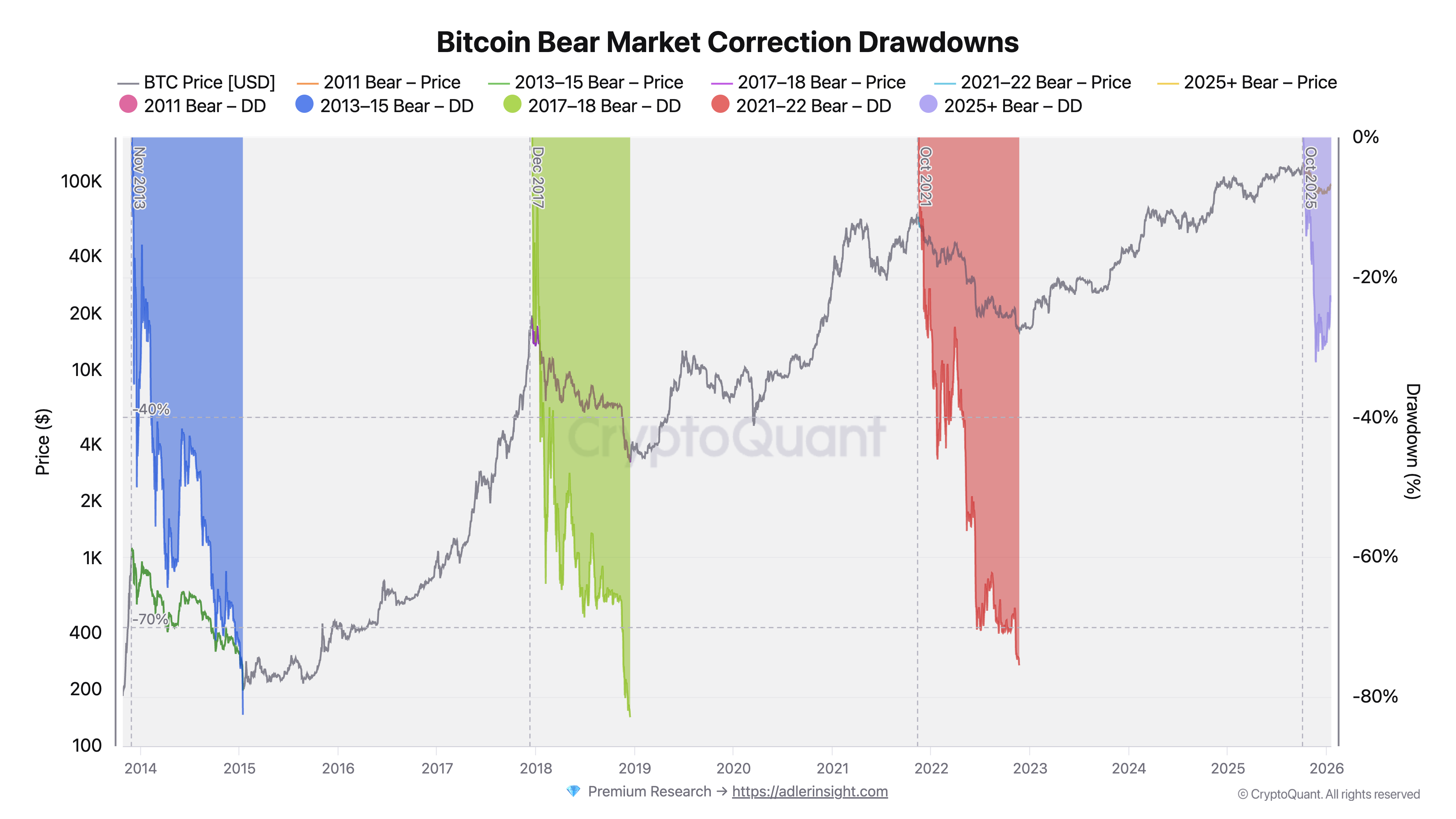

Bitcoin’s history is like a bad breakup-lots of highs, then down faster than you can say “divorce.” Past peaks? Boom-75%, 81%, 74% drops. Now? It’s only down about 30%. Do you think that’s the end?

This might just be the appetizer. The main course? More drops. Fun times.

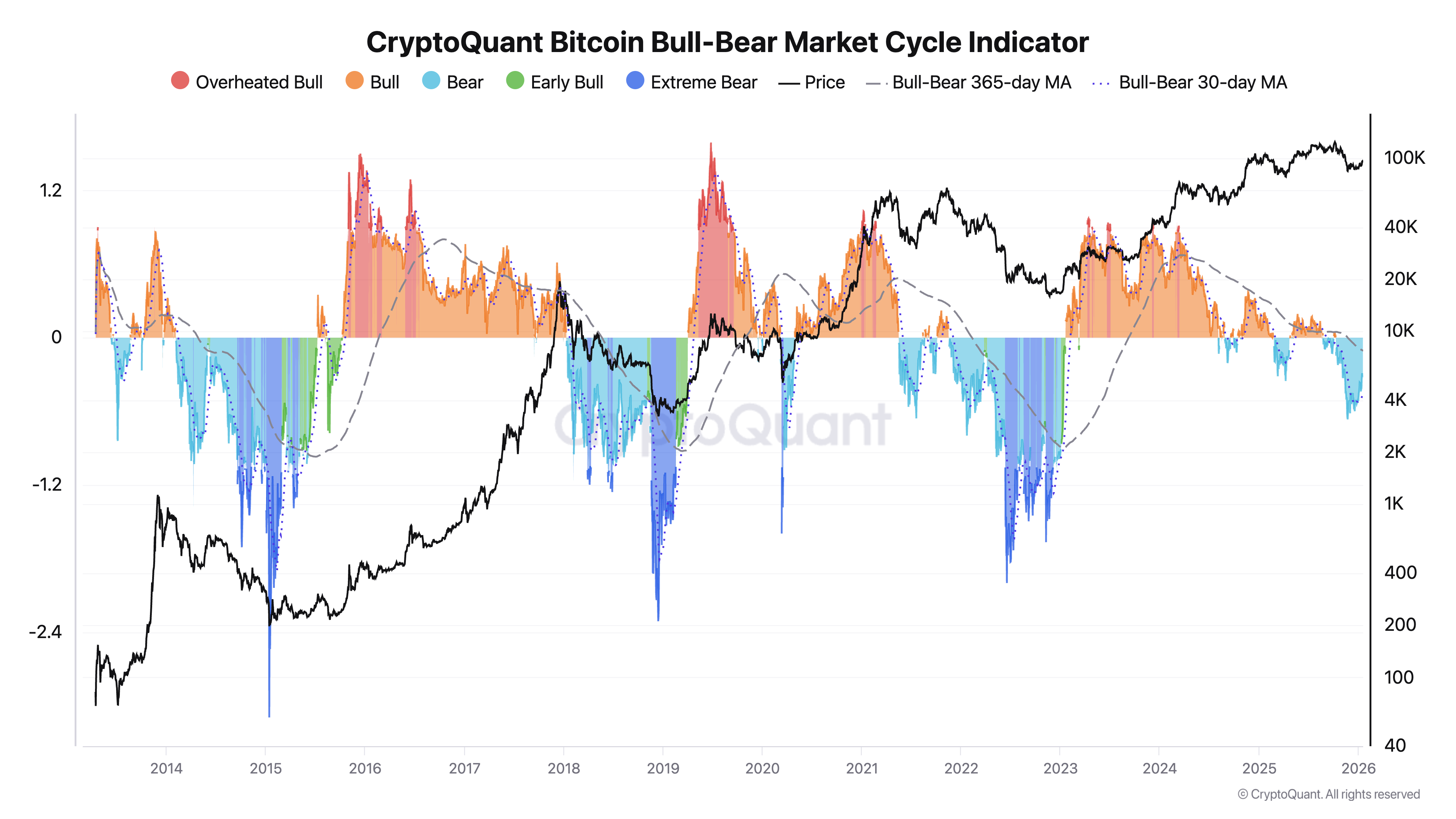

4. Cycle Indicator Says We’re Not Out of the Woods Yet

Looks like the broader market cycle is telling us, “Hey, this bear market? Not over.” Since October 2025, conditions have been bearish. But hey, it hasn’t gone full-blown apocalyptic so far.

“BTC’s in bear market territory. Expect lower lows. Or higher-if you’re into denial,” jokes some analyst.

5. Exchange Flows – The Tell-Tale Sign of Doom

Bitcoin’s flowing into exchanges like it’s going out of style. Mostly big holders, 10-100 BTC or even 1000+. They seem to be gearing up to sell, not horde.

Yeah, it’s a sign. The big players are getting ready for a dump. Nice. And we’re just here, biting our nails, wondering what comes next.

“Elevated exchange inflows? That’s a fancy way of saying, ‘They’re about to sell, and we’re doomed,’” someone wise said.

Bottom line: Multiple signals say the market’s on shaky ground. Will it drop like a rock or surprise us all? Stay tuned, or don’t. It’s not like it’ll make a difference.

Read More

- Gold Rate Forecast

- Top 15 Insanely Popular Android Games

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- EUR UAH PREDICTION

- Silver Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

2026-01-19 09:43