Ah, Bitcoin (BTC), that elusive digital creature that has danced through three halving cycles like a particularly enthusiastic chicken at a disco. Each time, the supply would shrink, demand would surge, and the price would soar like a rocket powered by dreams and a bit of luck. But lo and behold, in this fourth halving cycle, it seems our dear Bitcoin has decided to take a detour through the land of the unexpected.

Data, that fickle friend, suggests that Bitcoin’s growth trajectory has taken a left turn at Albuquerque and is no longer following the well-trodden path of its historical cycles. Many so-called experts (who probably wear glasses and have a penchant for coffee) believe Bitcoin has entered a phase that can only be described as “completely different from before.”

What’s Different About Bitcoin’s Fourth Halving Cycle?

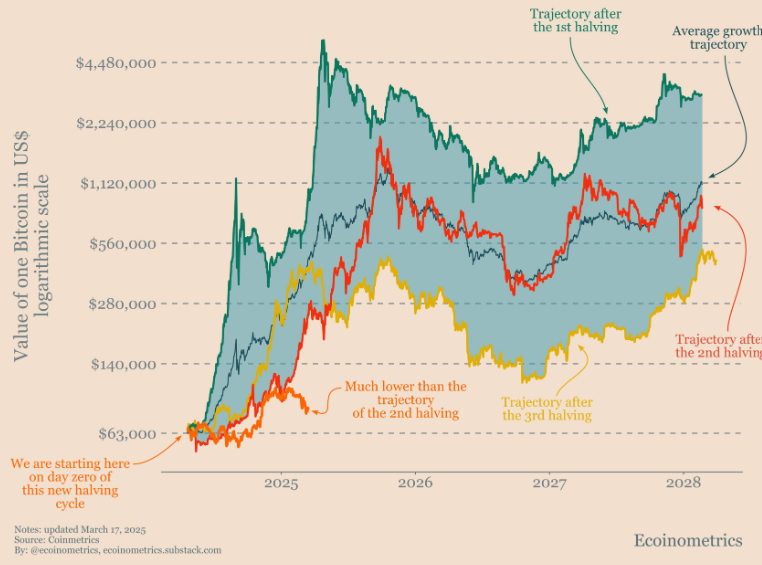

According to the wise sages at Ecoinometrics, Bitcoin’s growth rate in this cycle is about as exciting as watching paint dry—significantly lower than in previous escapades. It appears that the halving event, once the star of the show, is now more of a background character, like that one cousin who shows up at family gatherings but never really says anything.

If Bitcoin were to grow like it did in the glory days, we’d be looking at a price range of $140,000 to a staggering $4,500,000, starting from a humble $63,000. But alas, our beloved Bitcoin is currently lounging around the $80,000 mark, sipping a piña colada and contemplating its life choices.

“At this stage of the cycle, the lower bound of the historical range should be around $250,000,” commented the wise Ecoinometrics, probably while adjusting their spectacles.

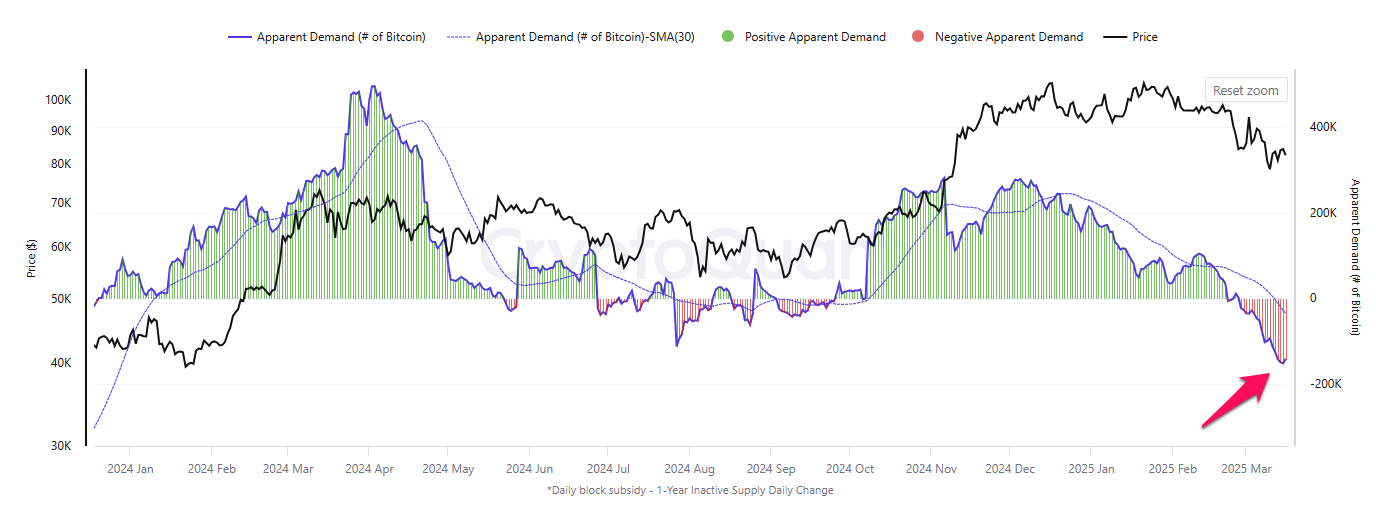

Another delightful twist in this tale is that Bitcoin demand has plummeted to its lowest level in over a year, according to the ever-reliable CryptoQuant data. The Bitcoin Apparent Demand metric, which sounds like something out of a sci-fi novel, compares new supply to inactive supply held for over a year, revealing the true demand—or lack thereof.

This means that even though the halving event reduces supply, Bitcoin’s price may struggle to rally without new capital inflows or a sudden surge of investor interest, which is about as likely as finding a unicorn in your backyard.

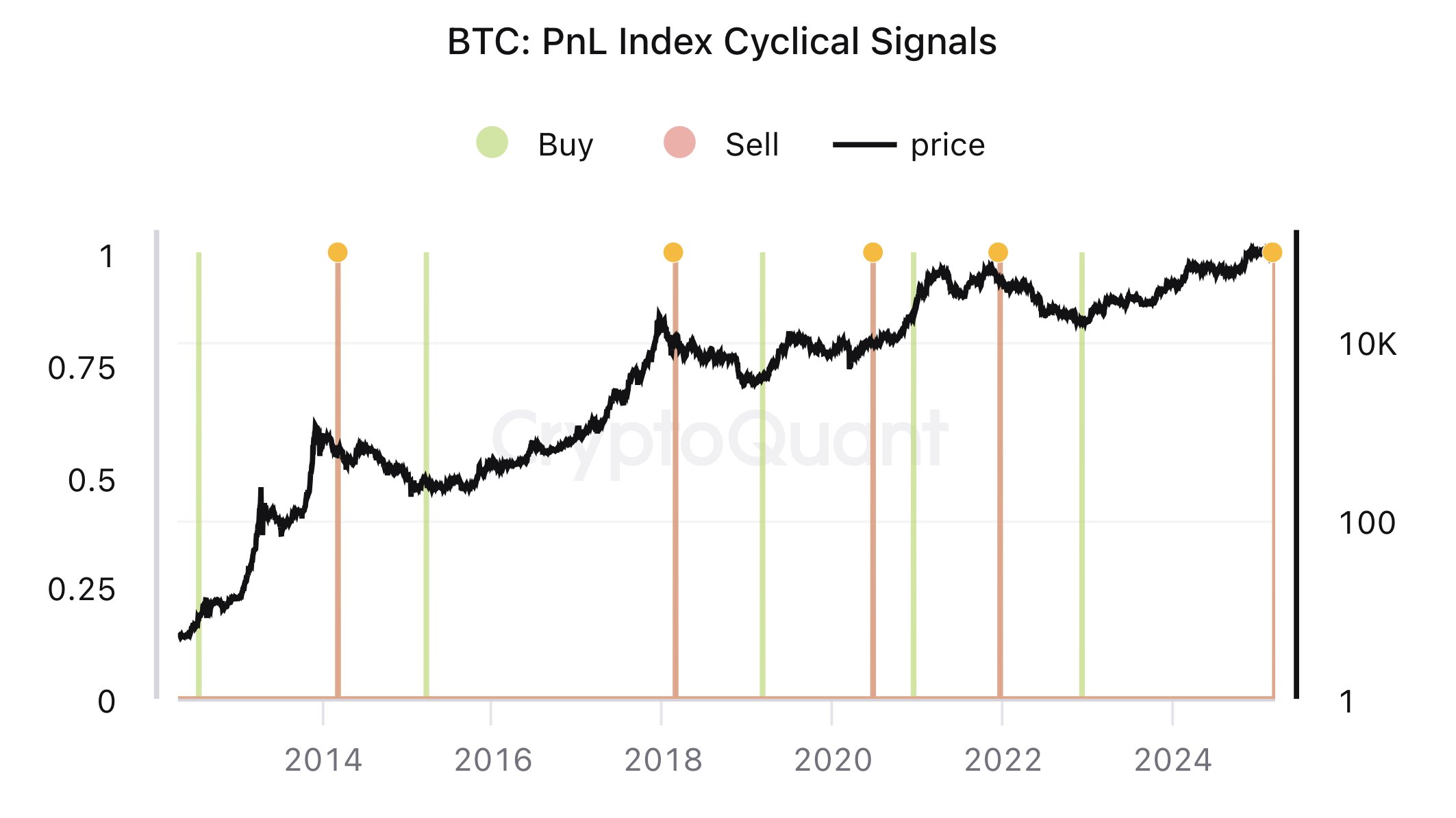

In addition to the Apparent Demand drama, Ki Young Ju, the founder of CryptoQuant and a person who probably has a crystal ball, analyzed the Bitcoin PnL Index Cyclical Signals. This metric applies a 365-day moving average to key on-chain data like MVRV, SOPR, and NUPL, signaling “Buy” or “Sell” at major turning points in a large cycle rather than short-term fluctuations. It’s like trying to read the tea leaves, but with numbers.

Based on this data, Ki Young Ju has boldly predicted that Bitcoin’s bull cycle has ended, which is about as cheerful as a rainy day.

“Bitcoin bull cycle is over, expecting 6–12 months of bearish or sideways price action,” Ki Young Ju predicted, probably while shaking his head in disbelief.

Charles Edwards, founder of Capriole Investments and a man who likely has a collection of lucky charms, pointed out another key difference in this Bitcoin cycle. Unlike the previous one, which thrived on the sweet nectar of expansionary monetary policies from central banks, this time, central banks are tightening their belts or maintaining a neutral stance, which is about as fun as a root canal.

During the last cycle, Bitcoin flourished as central banks injected liquidity into the economy, creating a veritable buffet for risk assets like crypto. However, the current monetary stance is more like a diet, making it harder for Bitcoin to sustain its upward momentum.

Despite this gloomy outlook, Charles Edwards remains somewhat optimistic, which is refreshing. He noted that US liquidity is showing technical signs of a potential recovery, like a phoenix rising from the ashes—or at least a slightly singed bird.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- SEGA Confirms Sonic and More for Nintendo Switch 2 Launch Day on June 5

- 30 Best Couple/Wife Swap Movies You Need to See

- Every Fish And Where To Find Them In Tainted Grail: The Fall Of Avalon

2025-03-18 12:23